If you're looking to get your finances in order, the 50/20/30 method for budgeting might be a good place to start. This rule can help you create a budget that is realistic and achievable. In this blog post, we will explain how the 50/20/30 plan works, and give you some tips on how to use it to your advantage.

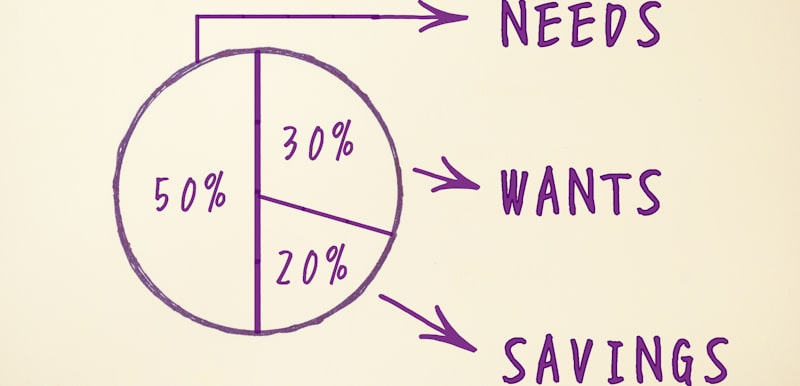

The 50/20/30 rule for budgeting is a simple way to budget your money. The rule is this: 50% of your income should go towards necessities, 20% should go towards savings and debt repayment, and 30% should be spent on discretionary expenses.

We'll explore more on how this budgeting rule works, why you should consider the 50/20/30 budgeting approach, and how you can get started using this budgeting method to tackle your needs, wants, and savings.

While it isn't the only budgeting option available, the 50/20/30 plan can be a helpful way to budget your money, especially if you're looking for a simple and straightforward method that includes just three categories.

As we noted above, the 50/20/30 budgeting approach breaks your spending into 3 categories: 50% for essentials, 20% for savings and debt repayment, and 30% for discretionary expenses.

So, grab a calculator, and let's take a closer look at each of these categories for this proposed rule, and what should be included in each:

Your 50% goes towards covering your essential expenses, which include things like:

As you can see, this 50% category covers all of your necessary living expenses from your take-home pay first. These are the bills you have to pay every month, and it's important to make sure they are always covered first.

It may seem like a lot, but these types of things are important. Without your health insurance premiums, you could be one serious illness away from ruin. And if you don't have transportation, how will you get to work?

The 50% category also includes your minimum debt payments. This is important because you want to make sure you are always paying at least the minimum on your debts each month.

If you only make the minimum payments, it will take you much longer to pay off your debts, and you will end up paying more in interest. But, if you don't pay the minimums at all, then you could be in even bigger trouble.

20% of your monthly income should go towards savings and additional debt repayment.

This includes items such as:

It's important to make sure you are always saving for the future and not just living for today. You never know when you might need to tap into your emergency fund, and you want to make sure you are prepared.

Saving may seem like it is not important right now, but it is crucial to your financial health down the road. Plus, additional investing, and of course, getting out of debt are important to focus on as well, so adjust your budget accordingly to make room for these important pieces of the puzzle.

The key is to save some of your income each month, then once your bank account has enough saved for an emergency fund, you can then work to build up multiples of your monthly take-home pay to help weather future financial storms.

Focusing on your retirement, but setting aside some of your income in tax-advantaged accounts will help you save money for retirement because your retirement contributions will grow with compounding interest over the years.

When you retire, you'll want to have enough saved to cover your living expenses. The general rule of thumb is that you'll need about 80% of your current income to maintain your standard of living in retirement.

So, if you're currently bringing home $5,000 per month, you'll need roughly $4,000 per month in retirement. Of course, this will vary depending on your lifestyle and other factors, but setting aside some funds now will serve you well in the long-run.

But the point is that you'll need to have a plan for how much money you'll need in retirement and save accordingly.

And finally, the last 30% of your budget is for discretionary expenses and is your disposable income.

These are the fun things in life that you can enjoy spending your income on, like going out to eat, going to the movies, or buying new clothes.

It is important to have some fun money in your monthly budget so you don't feel like you are depriving yourself all the time, so that is why we dedicate 30% of your income to these types of expenses, allowing you to focus on spending your money how you want, within reason.

Just make sure you don't overspend in this category and stay within the 30% rule so that you don't take away from the other important categories. Find those things you may be able to live without for a few months, then re-evaluate how you want to allocate your funds, and what you may include or exclude each month.

If you have any questions about how to budget your money, please don't hesitate to contact us. We are here to help you every step of the way!

If you're looking for a simple way to budget your money, the 50/20/30 budgeting approach is a great place to start to properly sort out your monthly income.

This budgeting method is easy to follow and can help you get your finances in order quickly. Plus, it can be customized to fit your unique financial situation.

If you're struggling with debt, the 50/20/30 plan can also help you get out of debt faster.

By focusing on paying off your debts such as an auto loan or a high-interest credit card first, you can free up more money each month to put toward your other financial goals.

By allotting a specific amount to allow you to put toward debt, you'll be able to save a lot of money in the long run by paying off debt and accruing less interest on your current debts than you would otherwise.

If you find that you're not able to save as much money each month as you'd like, or if you're struggling with high-interest debt, the 50/20/30 rule can help.

By allocating a larger portion of your income to expenses such as housing and transportation, you can free up more money each month to put toward your other financial goals.

And by focusing on paying off high-interest debt first, you can save a lot of money in the long run by accruing less interest on your current debts than you would otherwise.

If you're wanting to get your finances on track, give the 50/20/30 budget a try. You may be surprised at how much easier it is to stick to than you thought.

It isn't the end-all, be-all approach to personal finance, but it is a simple approach to starting a new budget, and taking care of all of the important pieces, before moving on to the rest of the discretionary spending and "fun stuff".

As we've stated, this isn't the only budgeting rule on the block, but having some budgeting plan is better than having no budget at all. This particular approach is based on the guideline that 50% of your income should be spent on needs, 20% on savings and debt repayment, and 30% on wants, but at the end of the day, it's important to follow a budget, so this is a simple one to start with.

The 50/20/30 budget rule is a simple way to budget your money and get your finances in order quickly. This budgeting method is easy to follow and can help you save money each month, ensuring all of the important budget categories are taken care of first.

Some people may refer to it as the 50/20/30 rule, or even the 50/30/20 rule, no matter what the case is, it's the same approach: 50% toward needs, 30% toward wants and 20% toward savings.

The 50/20/30 budget method is a great starting point for anyone who is looking to get their finances in order but doesn't know where to start.

It's time for you to start a budget, so start mapping out your 50/20/30 rule (or 50/30/20 rule) budget today! Pay off those debts, tackle your necessities, and reign in your spending habits for better financial health.

Start properly allocating your take-home pay, find where you can adjust your budget, and work toward making sure each category is as close to the proper percentage. Then, you can spend less time worrying about finances, and more time making your personal finances work for you.