If you have bad credit or no credit, you may want to get the best secured credit card. You can get approved for these credit cards more easily, and they can help you build your credit score. This way, you can qualify for an unsecured card. But which secured credit card is the best, and how do you choose?

We’ve gathered the top options to help you find the ideal secured credit card for your needs.

Choosing the best secured credit card will require you to consider several factors. You will notice many of the considerations are similar to those when selecting an unsecured card, but there are also some notable differences.

Credit score requirements

Most people searching for a secured credit card do so because they either have a bad credit score or no credit history. While secured cards tend to have fewer requirements in terms of credit scores, some will still have minimums. Always check the requirements to see if you are likely to be approved. Remember that the hard inquiry required to apply for a credit card will temporarily lower your credit score. You don’t want that drop to be for nothing if you are unlikely to be approved.

No history, bad credit, or bankruptcy

Some secured credit cards are designed for a specific type of person. For example, some accept people with recent bankruptcies, while others don’t. Some are designed for people with bad credit who want to rebuild their scores, while others are for people with no credit who need to build a history.

Interest rate

As with any type of credit card, the best secured credit card bad credit customers can get will have a lower interest rate. That being said, most secured cards tend to have higher interest rates because of the people they are marketed to. Card issuers know you have minimal options, so they can charge more. Additionally, lending to you is a higher risk if your credit history isn’t great, and charging more lets them compensate for that.

Annual fees

You also want to look at the annual fees, if there are any. You can easily find a secured card without an annual fee, but always check, as many have fees. Some cards give you extra benefits in exchange for paying a fee, such as cash back. But others simply charge the fee without any benefits for you, so be cautious.

Other fees

While you are looking at the interest rate and fees for a given card, look at other fees as well. Check the fees and interest for cash advances and balance transfers. See what you are charged for late payments or returned payments. Confirm there are no other hidden fees. If you plan to ever travel with the card, look at foreign transaction fees as well.

Minimum and maximum deposit

With most secured cards, your deposit becomes your credit limit. Depositing more appeals to those who can tie up their funds and want a high-limit secured credit card. Meanwhile, those with low minimum deposits appeal to people on a tight budget who don’t want their funds locked in a deposit. Think about your financial needs, and then look for a deposit that makes sense for you.

Credit bureau reporting

Most people looking for a secured card need to work on their credit scores. Your credit score is likely either low, or you have no credit history. In either case, using your secured card responsibly can build your score and history. But for that to happen, the card issuer must report to the major credit bureaus. The best card issuers report to all three major bureaus, Experian, TransUnion, and Equifax. At the very least, make sure to choose an issuer that reports to at least two of the bureaus.

Upgrade path and deposit return

As you improve your credit score, you should become eligible for an unsecured credit card. You could simply apply for another credit card, but the best issuers will give you an upgrade path from your secured card. In other words, they will reevaluate your finances and credit score. If your score improves or you pay on time for a certain amount of time, you will be eligible to upgrade to an unsecured card. This is the easiest way to transition from a secured card, as it may not require an additional application.

Timing for upgrade path and deposit return

Most of the cards on our list will start reviewing your account after six or seven months. At this point, you may qualify for an upgrade or the return of your deposit. Keep in mind, however, that some require you to wait longer. The Citi Secured Mastercard, for example, requires you to wait 18 months. But that card still made our list of top secured cards for other reasons.

Rewards

Very few secured cards offer rewards such as cash back, but some do. Consider if this is important for you. Just remember to weigh the benefits of rewards like cash back against negatives like annual fees.

Mobile app

All modern credit cards will let you manage your account online. You should be able to see transactions, contact support, and more. Most also have mobile apps, but not all mobile apps are of the same quality. Some will have additional features, such as the ability to check your credit score.

Credit score monitoring

As mentioned, some credit cards will have credit monitoring or reporting in their mobile apps. Some will even include your credit score on your monthly statement to make it easier to track.

Other monitoring and protection

Some credit card issuers also offer other types of monitoring. They may check the dark web for your personal information or social security number. These services can help prevent identity theft or let you catch identity theft early.

Keeping these considerations in mind can help you choose the best secured credit card for your needs.

The Capital One Quicksilver Secured Card is an excellent option if you want to earn rewards and prefer an easy path to upgrades. It is not only one of the few secured cards that offers upgrades, but it also doesn’t have an annual fee. You also get benefits like $0 fraud liability and automatic consideration for a higher line of credit in just six months.

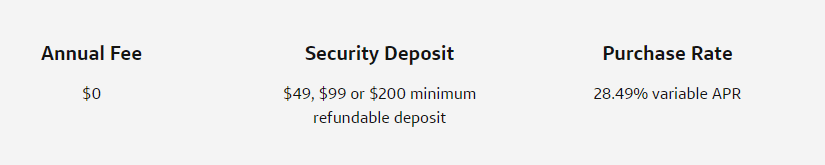

There is no annual fee for the Capital One Quicksilver Secured Card. The APR is fairly high, at 28.49% variable. There are no hidden fees, including no fees for authorized users and no foreign transaction fees.

The fee for balance transfers is 3%. There is a cash advance fee of 3% or $10, whichever is larger. Be aware of late payment fees of up to $40.

The Quicksilver Secured Card from Capital One is an excellent option for those who want to earn rewards with their secured card without any annual fees. You also get all of the benefits associated with Capital One, such as account alerts, CreditWise, and Capital One Travel. Additionally, there is a convenient path to upgrade, and you may get an increased credit limit within just six months of responsible card use.

Image: https://ibb.co/QPRtp7w

The Citi Secured MasterCard has no annual fee and doesn’t require you to have any credit history. The APR is expectedly high, but this card also comes with a clear path for upgrades, including your choice of other Citi cards. It is especially appealing to Citibank members, who can earn Citi ThankYou Points for certain activities. Those can then be moved to a Citi rewards card account.

Images: https://ibb.co/WpBfR0v

There is no annual fee with the Citi Secured Mastercard. While the 25.49% variable APR is high for credit cards overall, it is fairly competitive among secured cards and those for people with no credit history or bad credit.

It’s worth noting that there are two types of Citi Flex Plans. Those that pay an APR will have the 25.49% variable APR. Those with a Plan Fee will have a monthly fee of up to 1.72% and the APR for transactions.

Cash advances have a variable APR of 28.24%. Making a late payment or having a payment returned leads to a variable penalty APR as high as 29.99%. Any interest charged will be at least $0.50.

Foreign transactions have a fee of 3%. Cash advances have a fee of 5% or $10, whichever is larger. There is a balance transfer fee of 5% or $5, whichever is larger.

The Citi Secured Mastercard is a solid option for people who want to be able to easily upgrade to a Citi unsecured credit card in the future. The lack of an annual fee helps make it appealing. But you should be aware of the penalty APR rate and the fact that some other secured cards charge lower fees for cash advances and balance transfers.

You should also be aware that you must wait longer to have your account reviewed for a deposit refund and upgrade than you would with some of the other cards on this list. It is also worth noting that you won’t be approved if you filed for bankruptcy within the last two years.

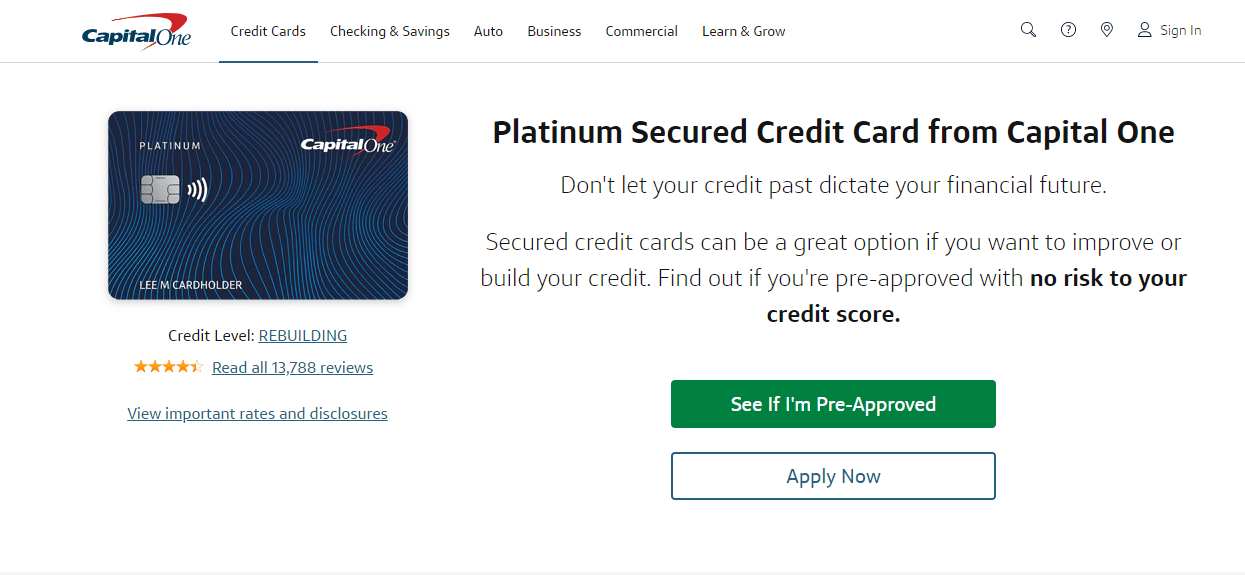

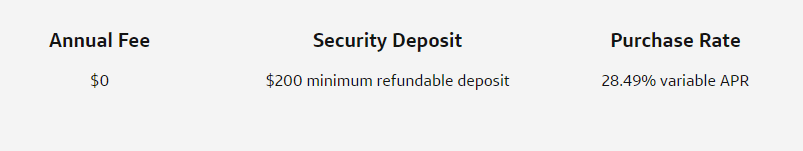

The Capital One Platinum Secured Credit Card is yet another top option from Capital One. Like the Quicksilver Secured card, you get a simple path to upgrading and no annual fee. But this card doesn’t include the cashback benefits of the Quicksilver card. This makes the Platinum Card a good choice for those getting their first card or who need to boost their score. One unique feature of this card is that you may be eligible to deposit less than your credit limit, a rarity among secured cards.

Like most of the other options on this list, the Capital One Platinum Secured Credit Card doesn’t have an annual fee. The variable APR is 28.49%. There are no fees for replacement cards, foreign transactions, or authorized users.

Cash advances have a fee of $10 or 3%, whichever is greater. Transfers have a fee of 3%. The late payment fee is up to $40.

The Capital One Platinum Secured Card is a solid option if you need to build your credit score but your finances are otherwise solid. It is not appropriate if you have a non-discharged bankruptcy, most of your income goes to your rent, or you don’t have a bank account. Those who qualify can take advantage of the fact that you may get a credit limit of $200 by just depositing $49.

Qualifying for this secured card entitles you to an account review in as little as six months. At that point, you may get a credit increase or be upgraded to an unsecured account.

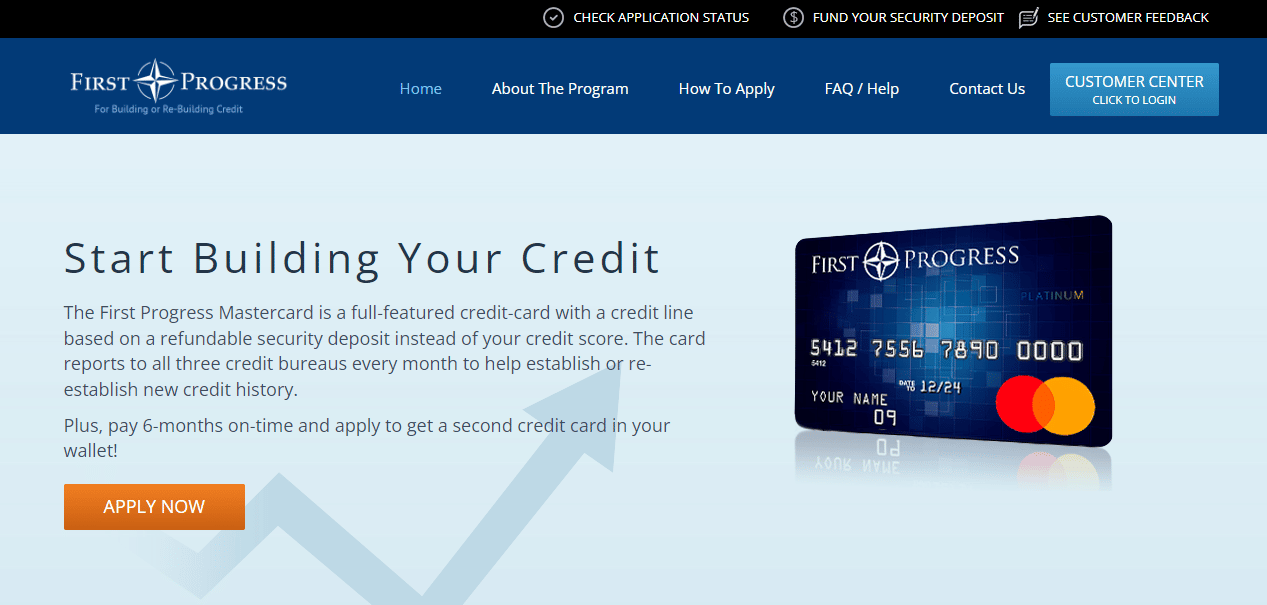

This credit card doesn’t require users to have a credit history and has no minimum credit score requirement as well. Conveniently, this is one of the rare cards that won’t automatically disqualify you from filing for bankruptcy. If this credit card doesn’t quite fit your preferences, you can also consider the Platinum Prestige Mastercard or the Platinum Elite Mastercard. All three secured cards

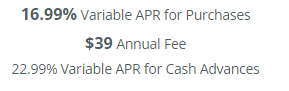

The APR for this credit card is just 16.99%, which is among the lowest rates for a secured card. There is an annual fee of $39, which is subtracted from your available credit limit for the first month.

Cash advances have a 22.99% variable APR. The cash advance fee is 3% or $10, whichever is greater. Foreign transaction fees are 3%. There are late payment fees of up to $41 and returned payment fees of up to $30.

If you are considering one of the other First Progress secured cards, it’s worth noting that the Platinum Prestige has a variable APR of 12.99% for purchases and 21.99% for cash advances. Its annual fee is $49.

The Platinum Elite Mastercard has a variable APR of 22.99% and a 27.99% variable APR for cash advances. Its annual fee is $10. The other fees are identical to the First Progress Platinum Select Mastercard. We chose to include the Platinum Select instead of the others because of its balance of APR and annual fee.

The First Progress Platinum Elite Mastercard is an appealing secured card for anyone with a recent bankruptcy, as this is one of the few card issuers that may still approve your application. While we chose to highlight the Platinum Elite Mastercard, there are also two other secured cards from the brand available. One has a lower annual fee and higher APR, while the other has a lower APR and higher annual fee.

If you prefer a different combination of APR and fee, your chances of being approved for one of the other secured First Progress cards are identical. Like many other options on this list, this card has an upgrade path and evaluates you for a deposit refund in about six months.

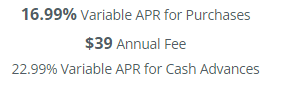

Like the other credit cards on this list, the Discover It Secured Credit Card comes with an upgrade path after you use your credit card responsibly for a set amount of time. Like the Quicksilver card from Capital One, this Discover It card also offers rewards in the form of cash back. The cash back program, combined with the lack of annual fees, makes it very appealing to a wide range of people. Just keep in mind that there is a cap to the cash back you can earn.

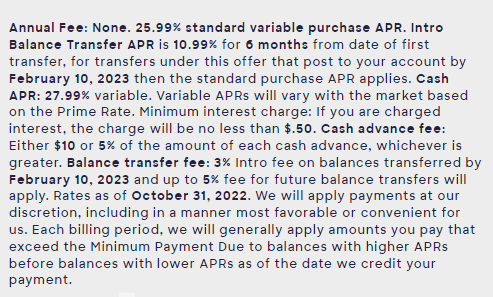

The Discover It Secured Credit Card doesn’t charge an annual fee. The standard purchase APR is a variable rate of 25.99%. There is an introductory balance transfer APR of 10.99% for six months. After this, the 25.99% rate applies. Any interest charged will be at least $0.50.

The cash advance APR is 27.99%. Cash advances also have a fee of 5% or $10, whichever is greater. Initial balance transfer fees are 3% (before February 10, 2023). After that date, the fee is 5%.

There is no late payment fee with your first late payment. Additional late payments can come with a fee of up to $41. Returned payment fees can be up to $41. Take advantage of free overnight card replacement.

The Discover It Secured Card will appeal to people who prefer Discover’s offerings of unsecured cards or those who want to earn rewards. It is also a very strong option if you want to transfer a balance, as this is the only card on our list that has an introductory APR for balance transfers. Like our other recommendations, this is also a good choice if you want a simple path to upgrading to an unsecured card.

To get the best secured credit card, you need to make sure you understand what this means. A secured card is one that requires a deposit. Once you make the deposit, the amount you deposit becomes your limit. It is “secured” because your deposit is there in case you miss a payment.

The idea behind the Primor secured credit card, Unity Visa secured credit card, or any of the cards listed above is the same. The deposit “secures” your line of credit, reducing the risk that the card issuer faces when they lend to you. That is why secured cards are such a common option for people with no or poor credit. Your lack of credit history or poor credit history increases the risk that lenders face when they give you a credit card. But by requiring a deposit, they mitigate this risk.

The big difference between a secured and unsecured card is whether you have to make a deposit. As mentioned, that deposit “secures” your card. This is why unsecured cards are larger risks for card issuers.

As such, unsecured or traditional credit cards typically require a higher credit score. You are also much more likely to receive benefits and rewards with unsecured cards. Card issuers can offer those perks because their risk is lower.

From the merchant’s perspective, a secured credit card works exactly the same as an unsecured one. As such, you can use a secured card anywhere you can use an unsecured one.

One reason to get a secured credit card is to have a credit card even if you don’t have a good credit score or have no credit history. But having a secured card can also help you build your credit if you use it responsibly.

That is important, as your credit score is used for things like applying for jobs and renting apartments in addition to loans.

It builds your credit history length

One of the many factors affecting your credit score is the average length of your credit history. This makes up 15% of your FICO score. This benefit of a secured card is mostly for those who don’t have a credit history yet. It lets you start accumulating lines of credit on your credit report, extending the average length of the history.

Make the most of this benefit by keeping your secured credit card open after you no longer need it, assuming it doesn’t have an annual fee. Closing the card when you get an unsecured card will remove it from your average credit history length, hurting your score.

It lets you build a solid payment history

Your payment history affects 35% of your FICO score. The most relevant part of this is whether you pay your balance on time. So, when you get a secured credit card and pay off your balance every billing period, this will boost your score.

It lowers your credit utilization ratio

This ratio makes up 30% of your FICO score and compares how much credit you have available to the amount you use. A lower rate is better, and you want it to be under 30%.

Opening a secured credit card can help your credit utilization ratio by increasing the amount of credit that you have available. If you keep your expenditures low as your overall available credit increases, your utilization ratio will drop, boosting your score.

It may improve your credit mix

Your credit mix accounts for 10% of your credit score. This refers to whether you have a combination of types of credit, such as student loans, car loans, mortgages, and credit cards. If you currently only have lines of credit, such as car loans or student loans, opening a secured credit card can improve your credit mix.

However, be wary of new credit. While getting a secured credit card can improve your score in the above ways, it can temporarily drop the 10% of your score that comes from new credit. This depends on the number of hard inquiries made, as hard inquiries indicate you are looking for more loans or lines of credit.

We noted that some of the top secured credit cards have a pre-approval or pre-qualification process that doesn’t check your credit. This is a very helpful tool to minimize the impact on your credit score. By getting pre-approved, you can confirm that the temporary drop in your credit score from the hard inquiry will be worth it, as you are likely to be approved for the card.

There are two important caveats that come with the ability of secured cards to build your credit score. First, your card issuer needs to report your activity. And you must use your credit card responsibly.

To address the first point, most of the cards on our list report to all three of the major bureaus. Without this reporting, your score may not improve with responsible card use.

In terms of using your card responsibly, keep the following tips in mind:

There is no single answer to what is the best secured credit card. The best choice will depend on your financial history, preferences, and goals. For example, the best secured credit card for no credit may not approve people who have filed for bankruptcy. Instead, they would turn to the best secured credit card to build credit.

The bottom line is that any of the secured cards on our list would be an excellent choice. They all offer paths to upgrading to an unsecured card, although how long you must wait to do so varies. You simply have to compare features like annual fees, APR, and potential rewards to see which of the above choices best meets your needs.