If you aren’t earning rewards as you shop, you need to look for a new credit card. One of the most popular types of rewards is cash back, as you have the freedom to spend it however you want. But with so many options on the market, how do you know which one to choose?

We’ve gathered the best cash back credit cards available. Our list includes options for every type of credit score, so you just have to find one that fits your financial needs and has your preferred reward structure.

In choosing the best cash back credit cards, keep the following in mind:

The Chase Freedom Unlimited Card has no annual fees and offers benefits like a reasonably high cashback rate and an introductory offer. It is best for those with a good or excellent credit score. It has numerous benefits, from extended warranties to insurance to the ability to tap to pay.

This card comes with an introductory APR of 0% for the first 15 months. After that, your variable APR will be between 18.74% and 27.49%. The same APR, including the 0% introductory period, applies to balance transfers.

The penalty APR is 29.99%. It applies if you don’t make a minimum payment on time or make a payment that gets returned unpaid. Balance transfers come with a fee of $5 or 5%, whichever is larger. Within the first 60 days of opening your account, it is $5 or 3%, whichever is larger. Cash advances have a fee of $10 or 5%. Foreign transaction fees are 3%. There is a $40 fee for a late or returned payment. There are no fees for going over the credit limit or a return check.

You can create a My Chase Plan for a monthly fee of 0% while you are still in the 0% APR introductory period. After this, the monthly fee is 1.72%.

You can also earn $100 cash back for referring friends to a Chase Freedom card, up to $500 a year.

If you have a good or excellent credit score, the Chase Freedom Unlimited card is an excellent way to earn cash back and numerous other benefits. The absence of an annual fee is very nice, but you should be wary of the APR after the introductory period. That said, the introductory APR for both balance transfers and transactions makes this card very appealing. The bonus cash and higher cash rewards for new cardholders are also appealing.

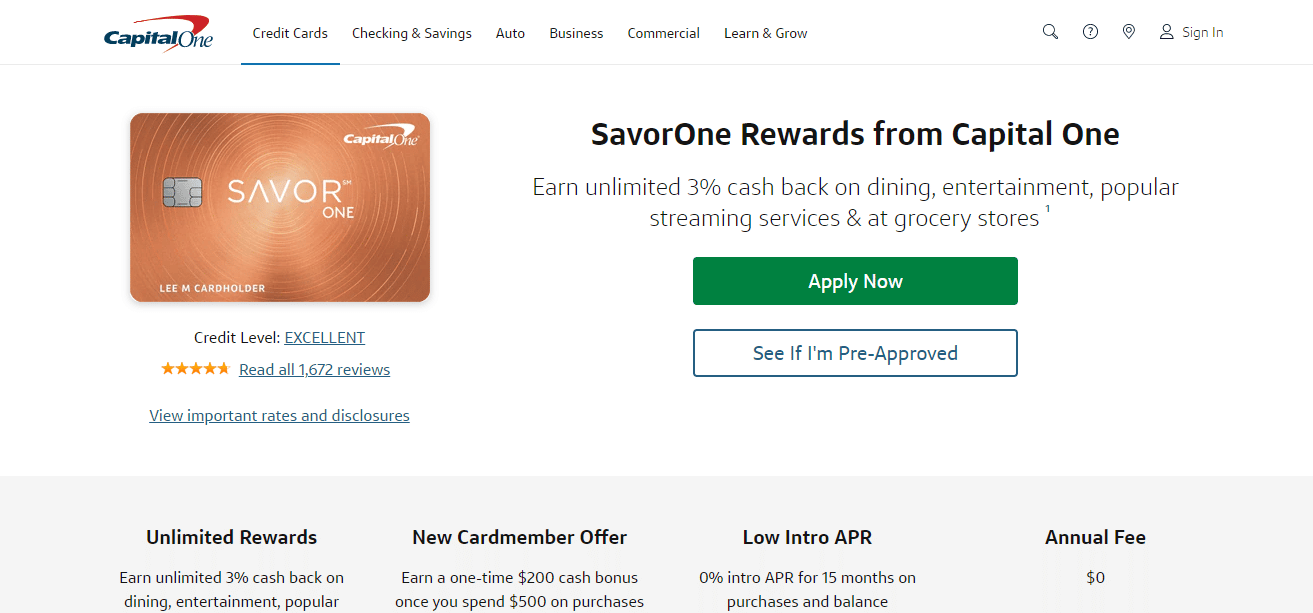

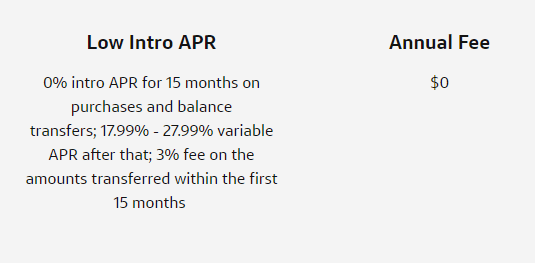

The SavorOne credit card is an appealing choice for people with excellent credit scores and who want to prioritize cash back on food and entertainment. The card offers a high cash back rate for streaming services, grocery stores, entertainment, and dining. It also has no annual fee and a 0% introductory APR.

This card comes with a 0% introductory APR that lasts for 15 months on both balance transfers and purchases. After that, the rate varies from 17.99% to 27.99%. The APR for cash advances is 27.99%. There is a cash advance fee of $3 or 3%.

There is no annual fee and no foreign transaction fee. There is a late payment fee of $40. The balance transfer fee for the first 15 months is just 3%.

The SavorOne card is especially appealing to those who frequently eat out or enjoy entertainment. The card lets you earn highly competitive cash back rates on those purchases and gives you exclusive access to events, experiences, and travel prices, thanks to Capital One. The 0% introductory APR and cash back make this credit card highly appealing.

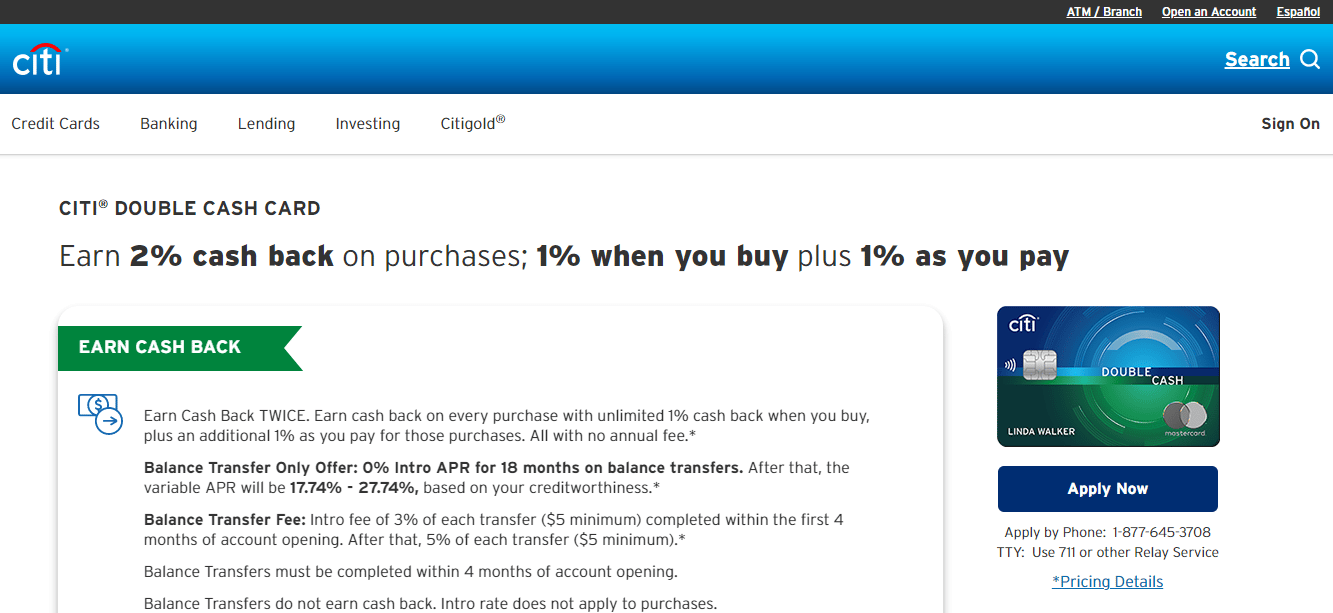

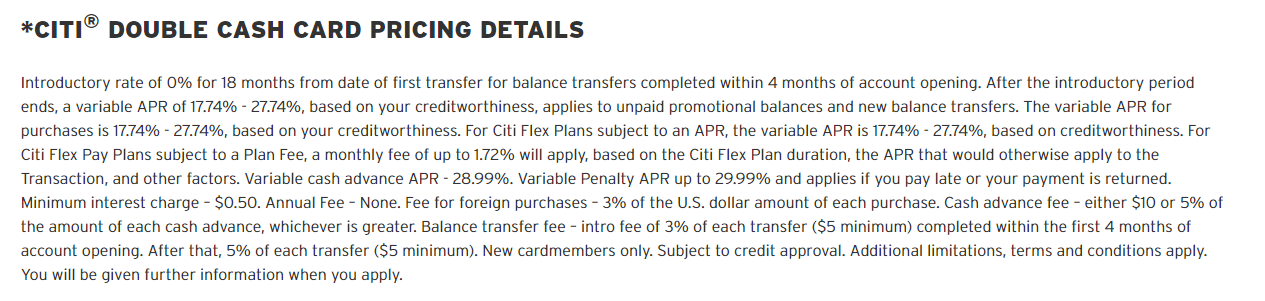

The Citi Double Cash Card gets its name from the fact that you earn cash back twice. You earn it first when you buy and again when you pay. Together, this adds up to a 2% total cash back. This makes it an appealing choice for those with good credit who want to earn consistent cash back on all their purchases.

There is no annual fee. This card comes with an APR of 17.74% to 27.74%. There is a penalty APR of up to 29.99%. It may apply if your payment is returned or you make a late payment. The APR for cash advances is 28.99%. Cash advance fees are $10 or 5%.

There is an introductory APR of 0% on balance transfers. This is good for the first 18 months. After that, your balance transfers have a variable APR of 17.74% to 27.74%. For the first four months of opening your account, there is a balance transfer fee of 3% or $5. After those four months, the balance transfer fee is 5% or $5. Importantly, balance transfers don’t earn cash back.

There is a 3% foreign transaction fee. If you get a Citi Flex Plan, there is a fixed finance charge of 1.72%. The fee for a late or returned payment is up to $41 each.

The Citi Double Cash card is a great choice for people who don’t want to worry about different cash back rates for various categories. It is worth noting that other cards offer higher cash back rates, but those tend to limit the higher rate to specific categories, making it harder to track. The introductory balance transfer APR also makes this card appealing to those carrying a balance on their current card.

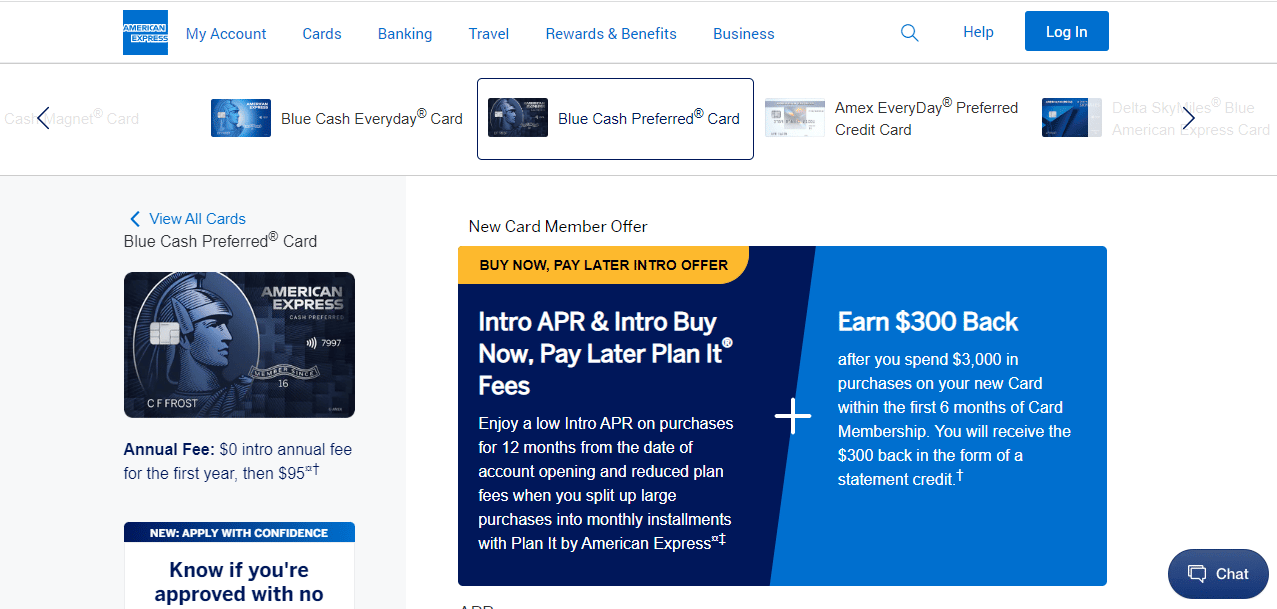

If you are willing to pay an annual fee to get even higher cash back rates, the Blue Cash Preferred Card is a solid option. The high cash back rate means that anyone who spends a lot, especially in certain categories, can easily earn back the monthly fee. As a bonus, you can check if you are approved without any impact on your credit score.

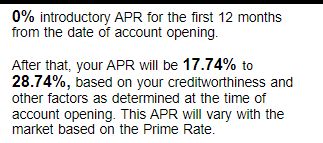

The annual fee is $0 for the first year and $95 after that. This card has an introductory APR of 0% that lasts for 12 months. After this, the variable rate becomes 17.74% to 28.74%. This is for both purchases and balance transfers. The penalty APR is 29.99% and can apply if you make a late payment or your payment is returned.

Plan It by American Express lets you divide large purchases into smaller monthly installments. You pay $0 for the first 12 months of opening your account. After that, your fixed monthly fee is up to 1.33%.

Cash advances have a 28.99% APR. There is also a cash advance fee of 5% or $10. The balance transfer fee is 3% or $5. The foreign transaction fee is 2.7%. Late or returned payments have a fee of up to $40.

The Blue Cash Preferred Card is an appealing option for those who put a fair amount of money on their credit cards, as the high cash back rate means you will easily earn back your annual fee. The introductory offers, including the $0 annual fee and 0% APR for a year, make the card more appealing. So do the numerous benefits you get from having an American Express card, including exclusive access to experiences. The ability to check if you would be approved without affecting your credit score is also very nice.

The Discover It Cash Back Credit Card stands out with its cash back rate of up to 5% in categories that you are actually likely to use. It has no annual fee. Just keep in mind that you will have to activate the bonus categories. As a bonus, there is a secured version of this card available with a path to upgrade to this unsecured version. There is also a student version that students should consider.

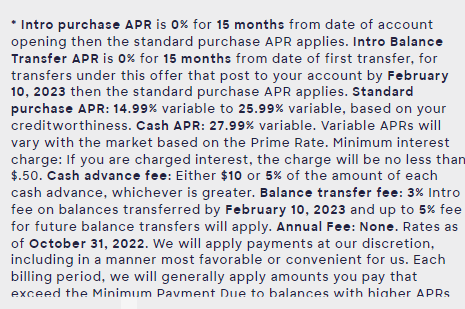

The Discover It Cash Back Credit Card doesn’t have an annual fee. There is an introductory 0% APR that lasts for a competitive 15 months. This introductory APR applies to balance transfers and purchases. After that introductory period, the APR varies from 14.99% to 25.99%. There is no penalty APR.

Cash back carries a fee of 5% or $10. The cash back APR is 27.99% variable. Any interest charged is at least $0.50. There is a balance transfer fee of 3% on balances transferred before February 10 and up to 5% after that.

There is no late fee for the first late payment. The late payment fee is $41 after that. The returned payment fee is also $41.

The Discover It Cash Back card appeals to those who want to take advantage of the absence of an annual fee and the 5% cash back rate in rotating categories. You just have to remember to opt in to get the 5% cash back. The card also comes with additional features, such as free alerts for your SSN and protection for your online privacy, rare features for a credit card.

The Wells Fargo Active Cash Card stands out with its unlimited 2% cash back rewards, absence of an annual fee, and various offers for new cardholders. You can get an introductory APR and a cash bonus reward when you sign up.

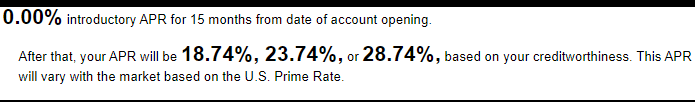

Enjoy a 0% introductory APR for 15 months. After the introductory period, the APR is 18.74%, 23.74%, or 28.74% variable. The same APR, including the introductory period, applies to balance transfers. Cash advances and overdraft protection advances have a 29.74% variable APR. The minimum interest payment is at least $1.00.

Balance transfers have an introductory fee of $5 or 3% for the first 120 days after opening your account. After this, the fee is 5% or $5. Cash advance fees are $10 or 5%. Currency conversion fees are 3%. Late payment fees are up to $40.

New cardholders can take advantage of the 0% introductory APR rate and the bonus cash. This card appeals to people who want to earn 2% cash back on everything without hassles or having to worry about categories. That makes it a good option for people who don’t typically spend in the categories that other cards offer rewards.

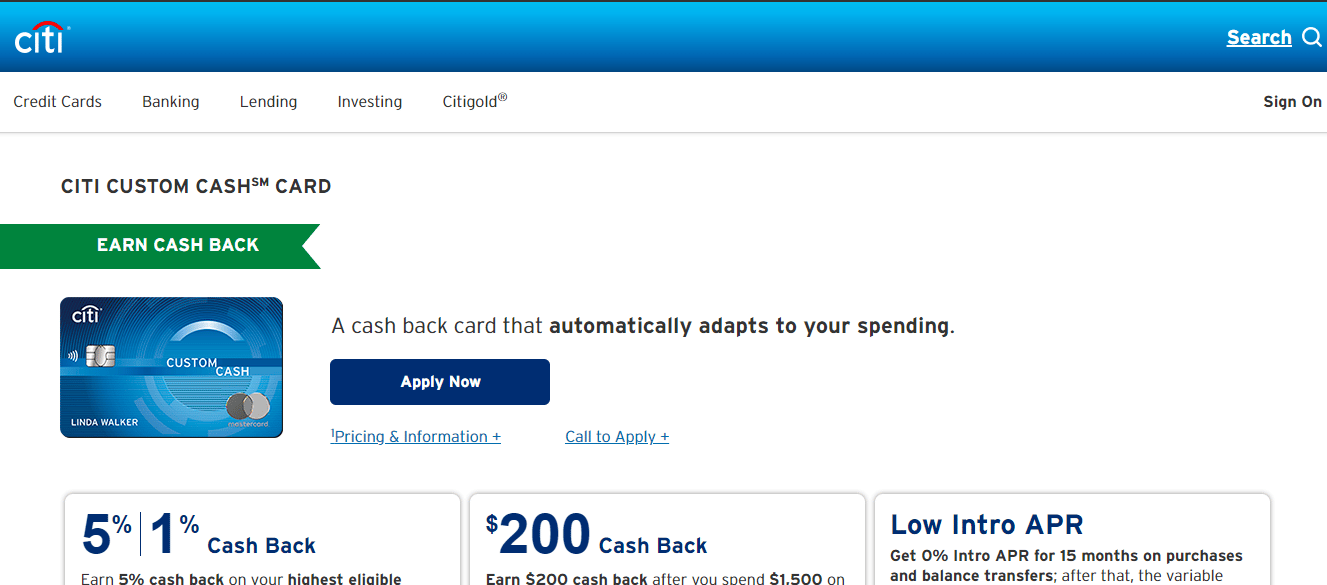

This is a unique cash back credit card as it adjusts to give you the highest cash back rate in whichever category you spend the most. This means you don’t have to worry about your purchases fitting into a specific category, as you still get a competitively high cash back rate. The Citi Custom Cash Card also has great introductory offers.

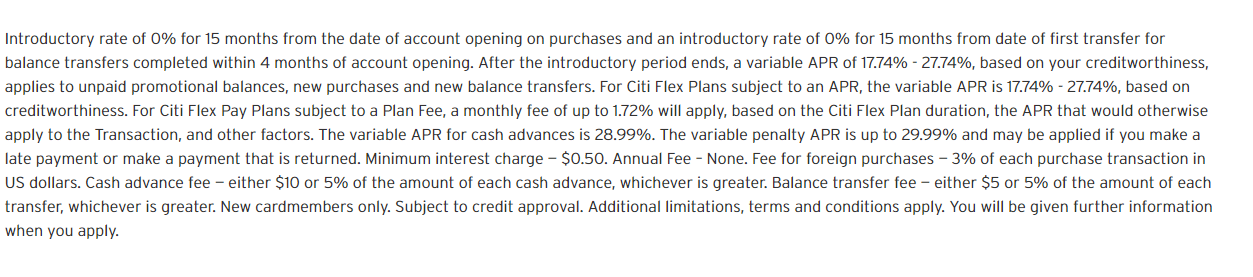

There is no annual fee for this card. The Citi Custom Cash Card has an introductory APR of 0% for the first 15 months. After that, the APR is 17.74% to 27.74% variable. This APR is for both purchases and balance transfers, but for balance transfers to qualify, you must complete them within four months of opening your account. The penalty APR is 29.99% and can apply if your payment is returned or you make a late payment. The minimum interest payment is $0.50. The balance transfer fee is 5% or $5, whichever is larger.

The cash advance APR is 28.99%. The fee is $10 or 5%. The APR for the Citi Flex Plan is 17.74% to 27.74%. There is also a Citi Flex Plan fee of 1.72%. Foreign transaction fees are 3%. There are late and returned payment fees of up to $41 each.

The Citi Custom Cash Card appeals to those who want to take advantage of the 5% cash back rate in whatever category they spend the most. The fact that this is automatic and adjusts to your spending makes it highly appealing. The only caveat is that the 5% cash back rate only applies to up to $500 of expenses per month before the 1% rate kicks in. But given the absence of a monthly fee, this is still an excellent option for cash back.

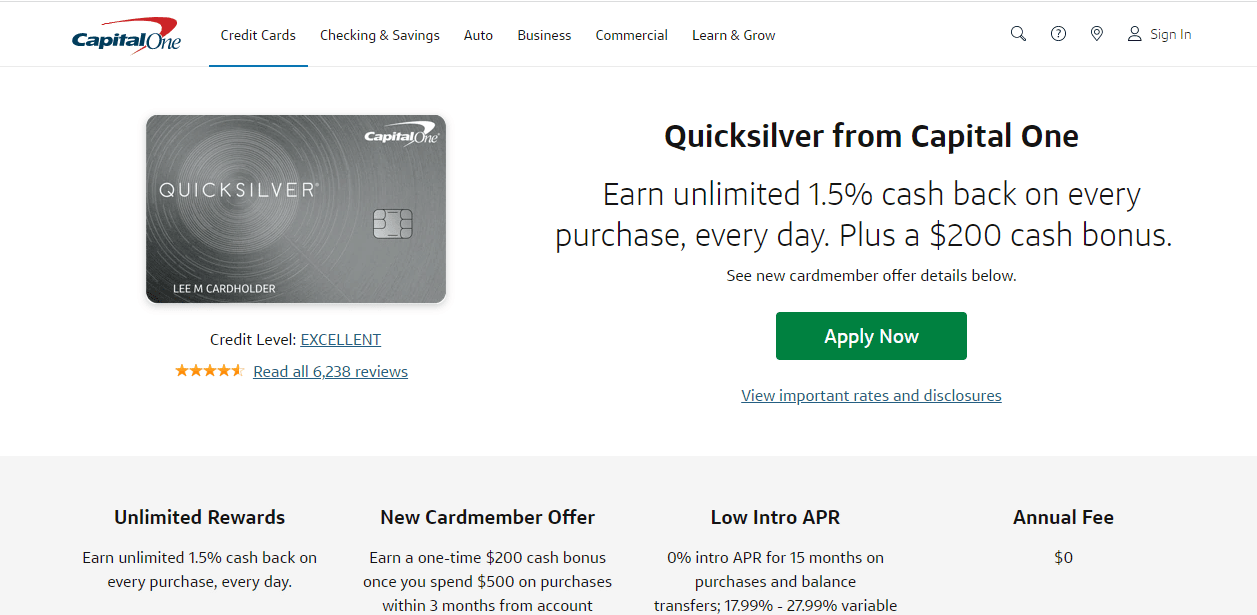

The Capital One Quicksilver card is a popular option for earning cash back among those with excellent credit. If you have poor credit, look into the secured version of this card, which offers similar cash back benefits (without the cash bonus) and an upgrade path. The Quicksilver card from Capital One lets you earn unlimited cash back with a simple yet competitive flat rate of 1.5%.

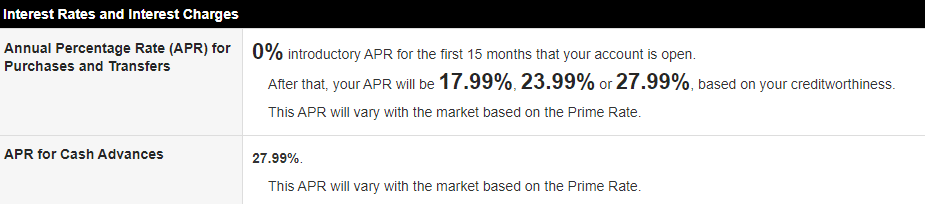

Like other cards on this list, the Capital One Quicksilver Card has a 0% introductory APR for 15 months on both purchases and balance transfers. There is also no annual fee. After those 15 months, the variable APR becomes 17.99% to 27.99%. That same 15-month introductory period also includes a reduced fee of just 3% for amounts transferred.

There are no foreign transaction fees. The cash advance fee is 3% or $3. There is a late payment fee of up to $40.

The Capital One Quicksilver card is a strong option for cash back if you don’t want to worry about fitting your spending into categories. The 1.5% cash back rate is fairly competitive, and you can earn 5% cash back on Capital One Travel. As a Capital One card, you also get exclusive access to Capital One Travel, Entertainment, and Dining, adding value to this $0 annual fee card. The introductory APR and balance transfer fees also make this card appealing.

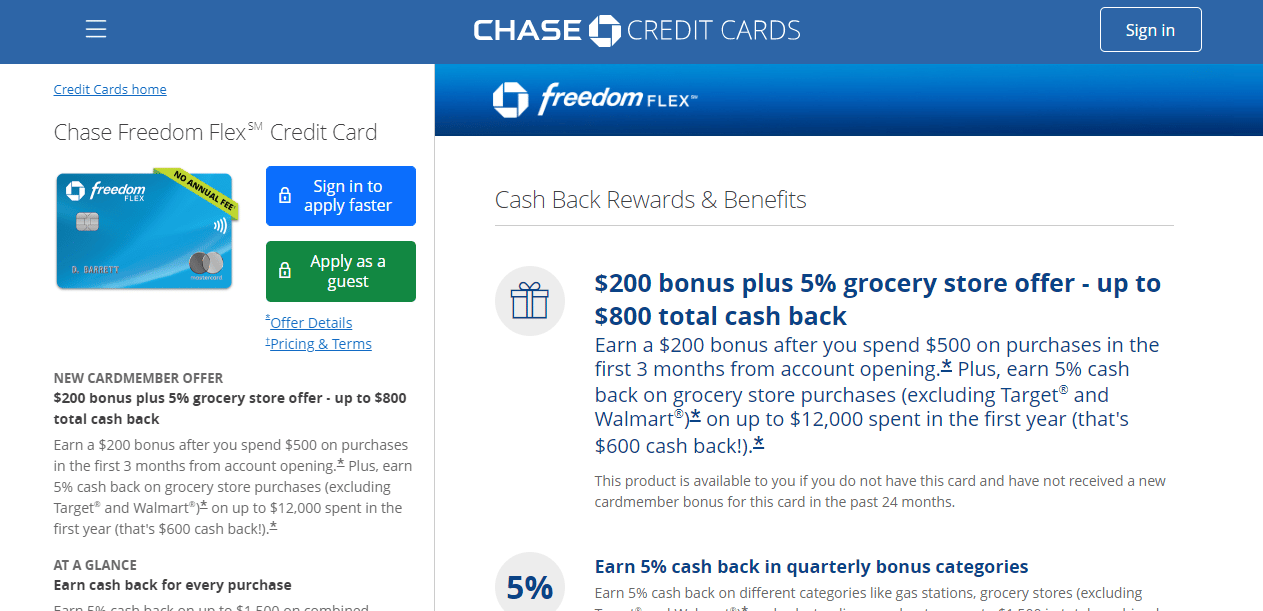

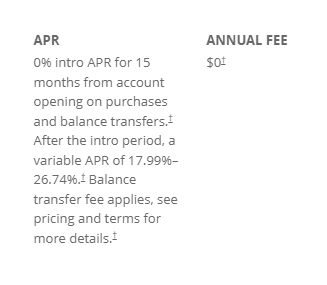

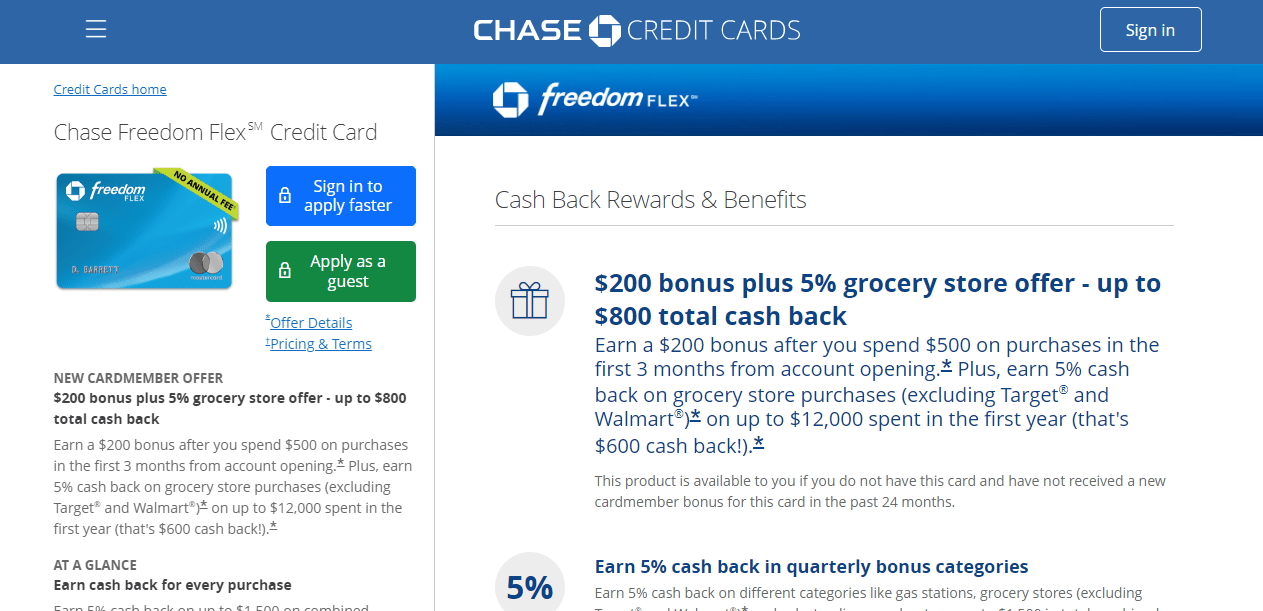

With the Chase Freedom Flex card, you earn 5% cash back on changing quarterly categories. You can earn up to 5% or 3% cash back on other categories and at least 1% cash back on everything else. Your cash back rewards don’t expire while your account is open, and new cardholders also get to take advantage of a 0% introductory APR.

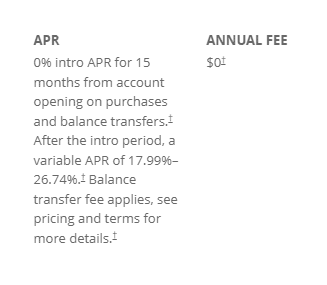

There is no annual fee for the Chase Freedom Flex card. There is an introductory APR of 0% on balance transfers and purchases for the first 15 months. After this, the APR becomes a variable rate between 18.74% and 27.49%. Not making a minimum payment or having a payment returned leads to a penalty APR of 29.99%.

If you take advantage of a My Chase Loan, the APR is also 18.74% to 27.49%. Using the My Chase Plan comes with a fixed finance charge of 0% during the first 15 months of having your card or 1.72% after this.

Balance transfers have a fee of 3% or $5 within 60 days of opening your account. After this, the fee is $5 or 5%. Cash advance fees are $10 or 5%. Foreign transaction fees are 3%. There is no return check fee. There is a late payment fee of $40. The return payment fee is also $40.

The Chase Freedom Flex credit card is a good choice for those who are willing to opt into cash back to get a high rate. The key is that you must remember to enroll for each quarter to earn the 5% cash back in the relevant category. This card also comes with numerous appealing offers for new cardholders, from the 0% APR to the cash back bonus to the 5% cash back on groceries for the first year.

As the name implies, cash back credit cards let you earn cash back as you spend them. The best cash back credit cards will have higher rates of cash back and let you earn cash back in multiple categories. Depending on the card, you may get the cash back in the form of a statement credit, or you may be able to exchange it for a check or gift card.

Having one of the best cash back credit cards lets you earn rewards with every purchase. Any of our recommendations would be an excellent choice. You just have to decide what purchases you want to prioritize earning cash back on and confirm you meet the requirements for your chosen card. Thanks to our list of top picks, you can easily find the card that’s right for you.