Financially savvy individuals keep track of their credit scores. The easiest way to do this is by using any of the best credit report sites. Multiple sites will give you access to your credit score for free, and there are plenty of paid options as well. We’ve gathered a list of the top sites, including options for every budget. Choose any of our recommendations, and you will be on your way to knowing your credit score and what’s in your report.

There are plenty of sites that let you access your credit score or report, but the best ones will have additional features and reports from all three bureaus. As you look for the best credit report sites, consider the following:

AnnualCreditReport.com offers the most basic and free service when it comes to requesting copies of your credit reports. This official website exists because federal law entitles you to request a copy of your reports every 12 months. The website offers specific information about the law, as well as the ability to request your score.

It is completely free to request your credit reports via AnnualCreditReport.com. You can use the website to request free reports once per year.

If you prefer to get your credit reports through an official website, this is a solid option. It also educates and has links to various official government websites. Conveniently, the website gives you all three of your reports at the same time. The only caveat is that you can only use it to get free reports once every 12 months.

Overview

Credit Karma gives you free copies of all three of your credit reports. It also provides educational resources to help you read and understand your report. The website has numerous other useful features and tools, such as the ability to check your credit score for free and comparisons of credit cards.

Credit Karma provides credit reports for free, without any hidden charges.

If you don’t want to pay for credit reports and are fine getting reports from only two of the three bureaus, you can consider Credit Karma. If you want reports from all three, including Experian, choose another site on this list. Credit Karma is also a great choice if you need help understanding your credit score and want access to other tools with the same free account.

Overview

Credit Sesame is a unique option when it comes to free credit reports. Instead of giving you an official credit report, you get a unique Credit Sesame report. Credit Sesame’s free report relies on information from TransUnion, or you can pay for a report that includes information from all three bureaus.

Like many of the other sites on this list, Credit Sesame provides your credit report for free. A premium plan is available for access to information from all three bureaus.

If you want to know the information on your report and don’t care whether you get an official copy of the report, then consider Credit Sesame. If you want reporting from more than just TransUnion or a copy of the official credit report, consider a different option on our list.

Overview

Like many of the other sites on this list, Wallet Hub gives you a copy of your credit reports for free. However, this website will also give you a summary of the important changes to your report. You can get updates to your reports and credit score.

It is free to use Wallet Hub to get your credit reports, view your credit scores, and more.

Consider using Wallet Hub if you want access to all three of your credit reports in full, as well as information about your credit scores and credit monitoring services. Wallet Hub stands out with its tools and educational resources to help you manage your finances and understand and improve your credit score.

NerdWallet is best known for its educational articles about finances, but it also offers a free credit report. Importantly, you will only get a copy of your TransUnion report from NerdWallet, not the other bureaus.

Getting a TransUnion credit report from NerdWallet is completely free. You won’t pay anything for the additional features, such as tips and education.

If you want to see your TransUnion credit report, NerdWallet is worth considering. You will also get personalized tips that make this a useful resource. However, if you want all three reports, choose another site from our list.

Overview

Most of the best credit report sites on this list focus on providing your credit report, but that is just one of several features found in Identity Guard. This website is primarily a service to protect your identity and prevent identity theft. It just happens to offer credit reports within its plans as a member perk.

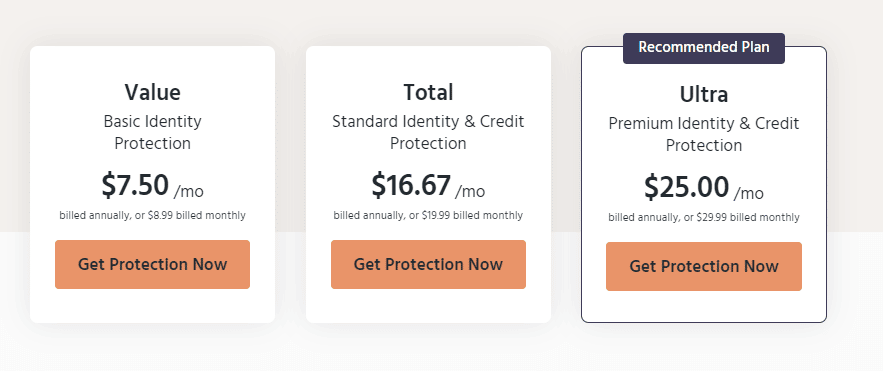

The Value Plan from Identity Guard costs $7.50 a month when billed annually or $8.99 when billed monthly. The Total Plan costs $16.67 a month when billed annually or $19.99 when billed monthly. The Ultra Plan costs $25.00 a month when billed annually or $29.99 when billed monthly. Choosing an annual plan gives you a 60-day money-back guarantee.

There are also family plans available if you want protection for up to five adults and unlimited kids. The Value Plan for families is $12.50 a month billed annually or $14.99 when billed monthly. The Total Plan for families is $25.00 a month billed annually or $29.99 billed monthly. The Ultra Plan for families is $33.33 per month billed annually or $39.99 billed monthly.

You need at least the Total Plan to get any credit-related services. With that plan, you will receive 3-bureau credit monitoring and a monthly credit score. If you want a 3-bureau credit report annually or Experian Credit Lock, you need the Ultra Plan.

If your desire to see your credit report is part of an overall goal of protecting your identity, then Identity Guard is a good choice. While you will have a monthly fee, you get constant monitoring for identity theft and your credit. You will receive annual credit reports and have a million-dollar identity theft insurance policy.

Identity Force is another strong choice for those who want more than just access to their credit reports. You will get your credit scores as reports and a credit score tracker. Also, you get various tools to protect your identity.

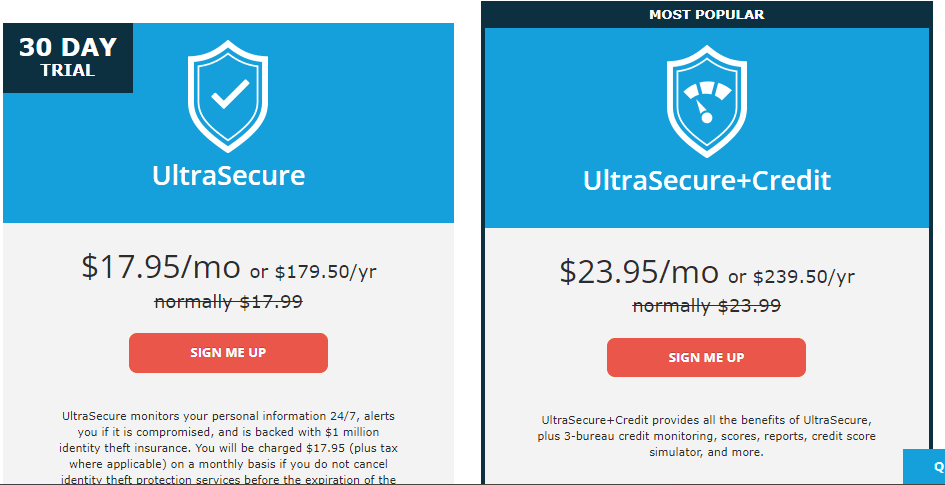

You can choose from two plans with Identity Force: UltraSecure or UltraSecure+Credit. The UltraSecure plan costs $17.95 a month or $179.50 a year. Importantly, this plan has only the identity protection features, including identity theft insurance.

If you want credit reports and related services, you need to choose the UltraSecure+Credit plan. This costs $23.95 a month or $239.50 a year.

Identity Force is another option that appeals to those who think of their credit reports as one way to protect their identity. You will have a reasonable monthly fee, especially when compared with those offering free credit reports. However, you get a long list of features that will protect you and your identity, spot potential problems immediately, and let you correct identity theft or fraud.

The best credit report sites will give you access to your free credit reports. You are legally entitled to get a free copy of your report each year. This includes one free copy from each bureau, including Equifax, Experian, and TransUnion. Because of the pandemic and the financial hardships caused by it, the government increased the frequency of your free credit reports. You can get one each week until December 2023.

Some credit report sites give you reports from all three bureaus separately. Other reports compile the information into a single report, and some provide information from only one or two of the bureaus.

Many of these websites provide additional credit-related features. For example, you may be able to view your credit score, track changes to your score, and get personalized advice or access educational resources to help you manage your score.

Many of the paid credit report sites provide identity protection as well. This is a natural connection, as reviewing your credit report regularly is a good way to spot potential identity theft. But the various paid services can spot it even sooner. These will include premium services such as identity theft insurance, protecting you from financial concerns related to identity theft.

As mentioned, there is a federal law allowing you access to a free copy of your credit report from each of the major bureaus once a year. The reasons for this include helping you stay on top of your finances and protect yourself from unmanageable financial liabilities.

The best credit report sites give you free access to your credit reports from all three bureaus. They will also provide educational information to ensure you understand your report. Many sites provide information on your credit score and tools like credit tracking or monitoring with alerts. If you want a paid service, you can also expect to get identity protection features.