If you are struggling with debt, then you may want to consider a debt consolidation loan. The best debt consolidation loans can reduce the overall amount that you owe and streamline the process of paying off lenders.

There are many debt consolidation loans available, but not all of them offer the same features and benefits. Some will take advantage of you with high interest rates or not help you pay off your debts as much as you claim. To make it easier to find a loan that fits your financial needs from a reputable company, we’ve gathered the top debt consolidation lenders. You simply have to study each lender’s offers to ensure you make a good choice.

To find the best debt consolidation loans, you should consider the following factors:

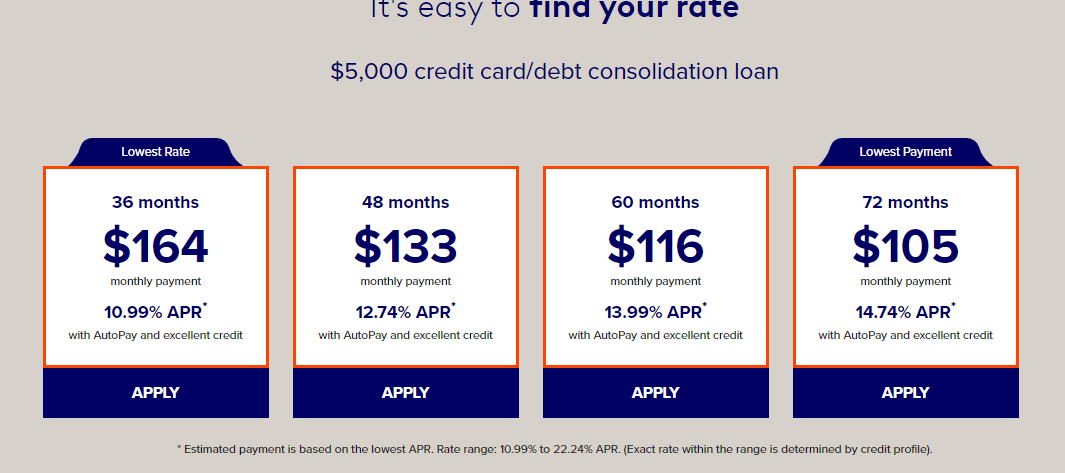

LightStream stands out with its lack of fees and low interest rates. The fact that you can also get a discount on your rate if you set up AutoPay is yet another plus. There are also some options for longer loan terms, which come in handy if you want to reduce your monthly payments. The only caveats are that you can’t pre-qualify, and LightStream doesn’t directly pay your lenders.

Your interest rate depends on your credit score, with an additional discount available for AutoPay. The rate also depends on your loan term. The rate ranges from 10.99% to 22.24%. With AutoPay, the rate ranges from 7.99% to 22.49%. To get the AutoPay discount, you must sign up for it before your loan is funded. There is a convenient payment calculator on the LightStream website, so you can check your potential monthly payments.

There are no hidden fees, including no prepayment or late fees and no origination fees.

LightStream offers a good option for people with good or excellent credit in search of low rates and their choice of term length. With term lengths between two and seven years, you can choose a longer term for lower monthly payments or a shorter term and higher monthly payments. The lender’s rates are also highly competitive, and it has a Rate Beat Program that guarantees you get the best possible rate.

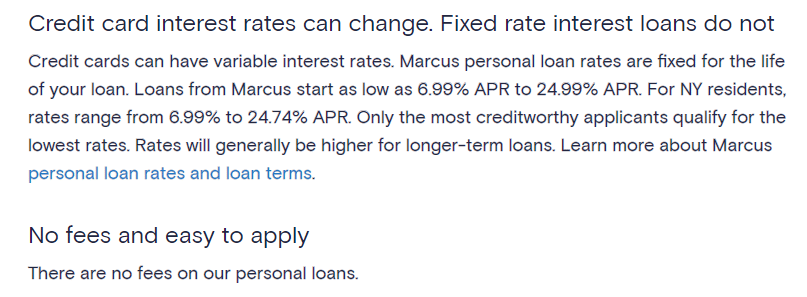

Marcus by Goldman Sachs is a popular option for those with excellent credit scores. You can borrow between $3,500 and $40,000 to consolidate your debts. A credit score of 660 is recommended, although some sources say 740 will get you a better chance of approval. But you can pre-qualify with just a soft credit check. Additionally, Marcus will directly pay your creditors for you.

Debt consolidation loans from Marcus have APRs of 6.99% to 24.99%. For residents of New York, the rates vary from 6.99% to 24.74%. Marcus typically offers higher rates for loans with longer terms. The rates are fixed, unlike credit card interest rates, which can change.

There are no hidden fees associated with getting a loan from Marcus.

For those with excellent credit scores, Marcus by Goldman Sachs is well worth consideration. It offers competitive rates without any fees. Additionally, the requirements are minimal. The only caveat is that you need a strong credit score of at least 660, with some sources saying you are unlikely to be approved without a score of at least 740.

Happy Money used to be called Payoff, so any reviews you see for either company name apply to this lender. Happy Money specializes in debt consolidation to pay off credit card debt. You can choose loan terms of two to five years and loan amounts between $5,000 and $40,000. The lending process is designed to be simple and transparent.

You can check your rate by filling out a quick form. You will get a response within minutes, and checking your rate doesn’t affect your credit score.

Happy Money’s loan rates vary from 7.99% to 29.99%. There is a loan origination fee of 0% to 5%, and it will be charged when Happy Money issues your loan.

There are no early payment fees, application fees, late fees, returned check fees, annual fees, or check processing fees.

Happy Money offers a simple method of consolidating your debt via a personal loan. You can pre-qualify without affecting your credit score, and it is open to people with a credit score of at least 640. The potentially low interest rates are highly appealing but remember to account for the loan origination fee. Those are the only fees. Happy Money also adds convenience by directly paying your creditors.

Best Egg loans are a strong choice for those with a credit score of 600 and up, which is a lower minimum requirement than many others on this list. The lender stands out by directly paying your creditors. There are also secured loans available if you own your home.

Best Egg has a personal loan calculator that you can use to estimate your rates without having to enter your email address or any identifying information. Just enter the loan amount, the loan term, and your credit score range to get an estimate of your fees.

For example, if you opt for a 60-month loan and choose “Don’t Know” for your credit score, your APR can be 5.99% to 29.99%.

Keep in mind that there is also a loan origination fee that can be up to 5.99%. This gets deducted from the loan proceeds.

Best Egg has a strong reputation and stands out with its lower-than-average credit score requirement and income requirement. That being said, you will always have to show Best Egg that you make enough to pay back your loan. This lender also stands out with its range of loan options, letting you choose from $2,000 to $50,000. And thanks to the online loan payment calculator, you can estimate your rates before you even contact Best Egg.

Discover is a unique option on our list of debt consolidation loans, thanks to the fact that it is also a credit card company. As such, it also offers balance transfers in addition to debt consolidation loans. Another unique point of Discover is that there are debt consolidation loans available for student debt, something that is not usually an option with other lenders.

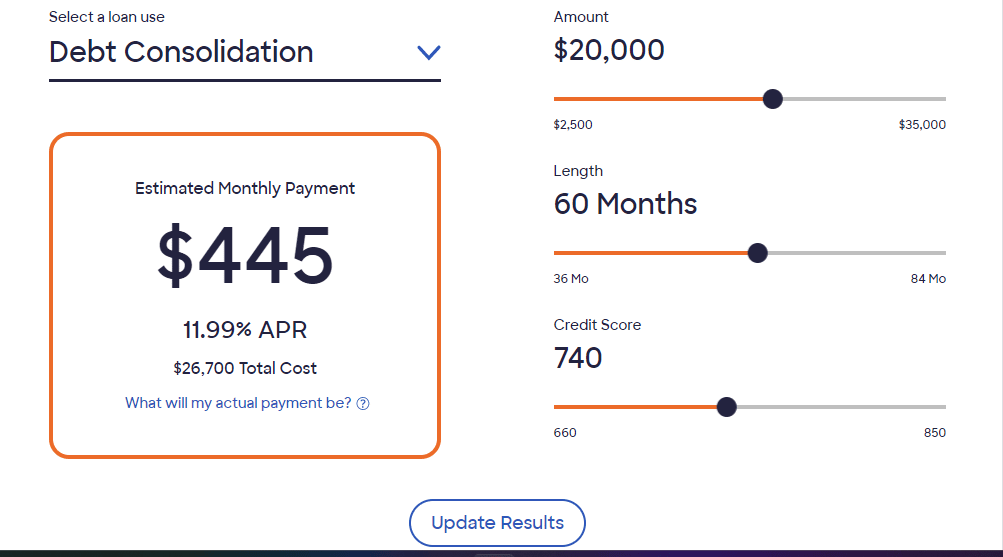

You can use Discover’s online calculator to estimate your payments for a debt consolidation loan or another type of loan from Discover. Just enter the type of loan (debt consolidation), amount, term length, and your credit score. Remember that this is an estimate only. You can also fill out a form and contact Discover to check your rate for free. This will also confirm that you qualify and will not affect your credit score. The process only takes minutes.

Interest rates vary from 6.99% to 24.99%. There is no loan origination fee. Late fees are $39.

While Discover has a high credit score requirement, especially compared to some loans on this list, it has a low household income requirement. Additionally, Discover offers more debt consolidation options than others, including a way to (separately) consolidate your student debts and the ability to transfer a credit card balance. Like many others on this list, you can see your likely rates for free without any effect on your credit score.

You can get a credit card consolidation loan from SoFi for anywhere from $5,000 to $100,000. You can see your interest rate in about 60 seconds and receive the funds the same day you are approved.

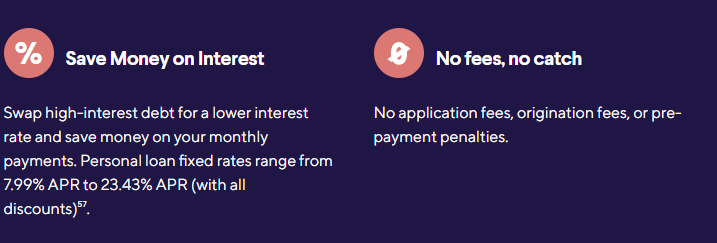

Interest rates from SoFi are between 7.99% to 23.43% APR once you account for all of the discounts. One available discount is for Direct Pay. This is when SoFi pays your lenders directly, giving you a 0.25% APR discount and adding convenience. As expected, you can check your rate without any effect on your credit score.

There are no application fees, no origination fees, no late fees, and no prepayment penalties.

SoFi is an appealing option for people who don’t want to worry about hidden fees when applying for a debt consolidation loan. It is also one of the few lenders that not only has the option to directly pay your creditors but offers you a discount to do so. The ability to check your rate without a hard credit inquiry also makes SoFi worth considering.

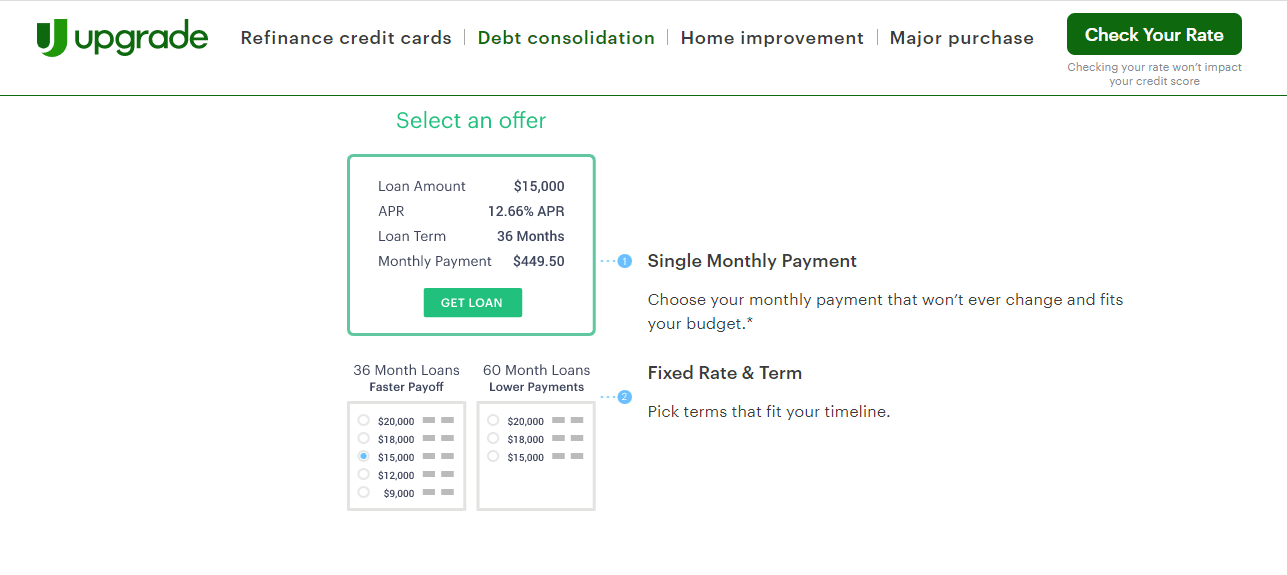

Upgrade is an online lender that is especially appealing to those with lower credit scores who won’t qualify for other debt consolidation loans. The minimum credit score is just 560, which is much lower than most others on this list. Additionally, Upgrade offers direct payment to creditors.

Upgrade’s APRs range from 7.96% to 35.97%. You can check your rates without affecting your credit score, getting results within minutes.

Keep in mind that there is an origination fee of 1.85% to 8.99%. There is also a late fee of $10 and a failed payment fee of $10.

Upgrade is a particularly appealing option if you don’t meet the requirements for other debt consolidation loans. It has a low minimum credit score requirement, a high maximum debt-to-income ratio, and no income requirement. This lender will also directly pay your creditors and offer several other types of loans. With Upgrade’s high rating, low requirements, and competitive rates, it is worth checking your rates from this loan option.

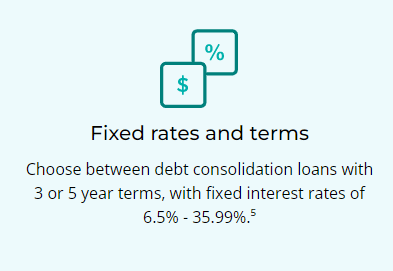

Upstart is a good option if you have a regular income but your credit history isn’t great. This comes thanks to its flexible credit requirements. Additionally, you just need a minimum annual income of $12,000.

Upstart’s debt consolidation loans have APRs of 6.5% to 35.99%. There are no prepayment fees. You should also be aware of the loan origination fees, which can be up to 8%.

Past-due amounts have a fee of $25 or 5%, whichever is greater. Paper copies have a one-time fee of $10. There is also a $15 returned check fee.

Between its low income requirement and the fact that Upstart considers more than just your credit score, it is a popular option for people with less-than-stellar credit scores. You can check your rates without a hard pull, so it doesn’t affect your credit score. Just keep in mind that Upstart does charge loan origination fees, and they can be high. So, factor those in when comparing rates.

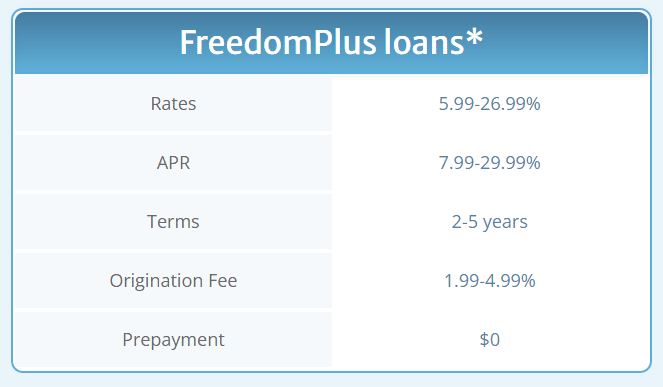

You can borrow between $5,000 and $50,000 from Freedom Plus with an APR of 7.99% to 29.99%. The minimum credit score is just 600, making it more accessible than some other loans. You also have the option of joint or co-sign loans, which not all lenders offer.

Freedom Plus has rates of 5.99% to 26.99%. The APR is 7.99% to 29.99%. There is also an origination fee of 1.99% to 4.99%. There are no prepayment fees.

Freedom Plus has lower minimum requirements than some consolidation loans, with a minimum credit score of 600 and no minimum income. The rates can also be competitive at times, but you also need to account for the loan origination fee. As with others, you can get your rate without affecting your credit score.

Debt consolidation loans refer to loans that provide funds that borrowers can use to pay off other debts. In the process, you consolidate several debts into a single debt. The best debt consolidation loans will also lower your monthly payments or interest rate.

You can use debt consolidation loans to pay off a variety of loan types. They are commonly used for credit card balances, car loans, and other types of personal loans.

There are a few reasons to get debt consolidation loans. In most cases, it will reduce your monthly payment or your interest rate. Sometimes, you may end up owing less overall, although this is not always the case.

Having a single debt consolidation loan is also much more convenient than having several individual loans. You only have to remember to pay a single loan each month and track a single due date. You also only have to maintain a single loan account or have one loan app on your phone.

You apply for a debt consolidation loan just like you would apply for any other loan. Then, it can work in one of two ways. In some cases, the lender will directly pay the debts you owe to lenders. In other cases, you will have to take the money from the new loan and use it to pay the lenders yourself. The results are the same, but the latter includes an extra step for you.

When you first apply for a debt consolidation loan, this will require a hard credit check. That check will temporarily lower your credit score.

Other than that, debt consolidation loans affect your credit score just like any other loan. If you make late payments, your score can drop. If you make on-time payments (and don’t have a history of on-time payments), your score can increase.

If the debt consolidation loan helps you pay off your debt, this will help your score. That is because your credit utilization ratio will drop.

If you don’t qualify for a debt consolidation loan or aren’t sure if it is right for you, you can also consider some other options.

We already mentioned balance transfers when talking about Discover’s offerings. If you have good or excellent credit, you may be eligible for a credit card with a 0% introductory APR. If you are confident that you can pay off the transferred balance during the introductory period, this can be a great alternative.

If you don’t think you can pay off the balance transfer by the end of the introductory period, this is not necessarily a good option. It will depend on the interest rate and other fees the credit card in question charges.

Depending on your situation, you may also want to consider another type of loan to pay off your debt. For example, if you own a home with enough equity, you can get a home equity line of credit or home equity loan. You could also get a 401(k) loan, but be aware of potential penalties and fees for doing so.

The alternative to debt consolidation is to continue to pay off your debts individually. You may want to consider various tips, tricks, and strategies for this.

For example, the debt snowball method focuses on gaining momentum. You start by paying off the smallest debt. Once it is paid off, you move to the next debt. You can repeat this cycle until you pay off all your loans.

Another common method is the avalanche method. With this, you focus on paying off the debt that has the highest interest rate. Once it is paid off, focus on the next-highest interest rate.

Either of those strategies can speed up the process of paying off your debt.

You can turn to credit counseling from a non-profit organization. These services will help you develop strategies to pay off your debt. They may also help you consolidate your debt or negotiate it.

Now that you know the features and benefits offered by the best debt consolidation loans, all that’s left is to choose one from our list. Any of the lenders listed above is a reputable choice that will help you streamline the process of paying off your debts. You just need to decide which one is right for your needs based on the requirements and terms mentioned in our reviews. Soon, you will be on the way to making your debt more manageable.