Imagine receiving a bill for thousands of dollars on a credit card you never authorized. Or patiently waiting for your tax refund only for it never to arrive. Or discovering that you’re registered as a wanted criminal in police databases. Sounds crazy, but it happens to millions of Americans every year.

In fact, the FTC’s Consumer Sentinel Network recorded over 5.7 million complaints in 2021, totaling more than $5.8 billion in losses. Of those reports, 1,434,676 were identity theft cases. In a separate survey conducted by Javelin Strategy & Research, as many as 42 million U.S. consumers were affected by identity fraud scams, resulting in $52 billion lost.

Fortunately, it’s not all bleak. By taking proactive measures, you can ensure your personal information is safe while protecting yourself against identity theft.

In this post, we share seven of the best identity theft protection services for 2023 so that you never have to worry about someone else enjoying a shopping spree on your dime or taking out an auto loan in your name.

TransUnion is one of three major credit bureaus in the U.S., so it’s no surprise that they offer one of the most comprehensive identity theft services available in the industry today under their IdentityForce brand. The company has won multiple awards, and their services often take top spot on customer review sites like Trustpilot.

Suitable for individuals, families, and organizations, their suite of tools combines advanced technology, real-time alerts, identity recovery, and 24/7 support to protect your financial well-being and reputation.

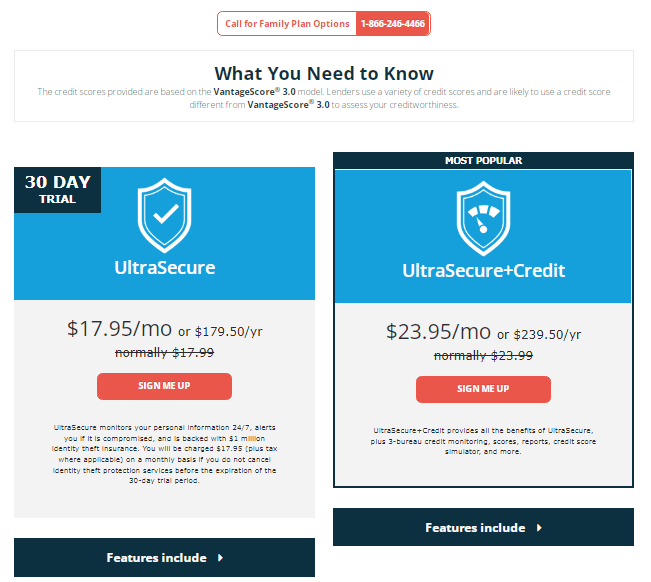

IdentityForce offers two basic pricing plans: UltraSecure and UltraSecure+Credit.

The UltraSecure plan gives you all the standard tools you need to protect your personal information, including comprehensive 24/7 monitoring, alerts, and identity theft insurance. This service is currently available for $17.95 per month or $179.50 per year.

The UltraSecure+Credit plan provides all the benefits of UltraSecure, plus credit monitoring of all three credit bureaus, credit scores, credit reports, credit freeze, a credit score tracker, a credit score simulator, and fraud assistance. For this upgraded package, you’ll currently pay $23.95 per month or $239.50 annually.

However, IdentityForce also offers ChildWatch for families wanting to add child coverage, as well as additional solutions for businesses wanting to offer the service to workers as an employee benefit.

Whether you want to protect your whole family or your business and its employees, you’ll find all the tools you’ll need with IdentityForce. Although it’s a little more costly than comparable providers, it’s an excellent choice overall. Consider trying their 30-day trial period to give IdentityForce a spin without the risk.

Norton is one of the biggest and most popular players in cybersecurity today, but the company doesn’t just provide award-winning antivirus software. It also offers some of the best identity theft protection tools on the market right now, which is why it makes our list and many others.

The service runs from very basic identity theft tools like credit bureau monitoring, identity and Social Security Number alerts, stolen wallet protection, and dark web monitoring to more complex monitoring of home titles, investment accounts, sex offender databases, social media, and more. Whether you’re an individual looking for identity theft protection or you want to protect your whole family, there’s an affordable option for you.

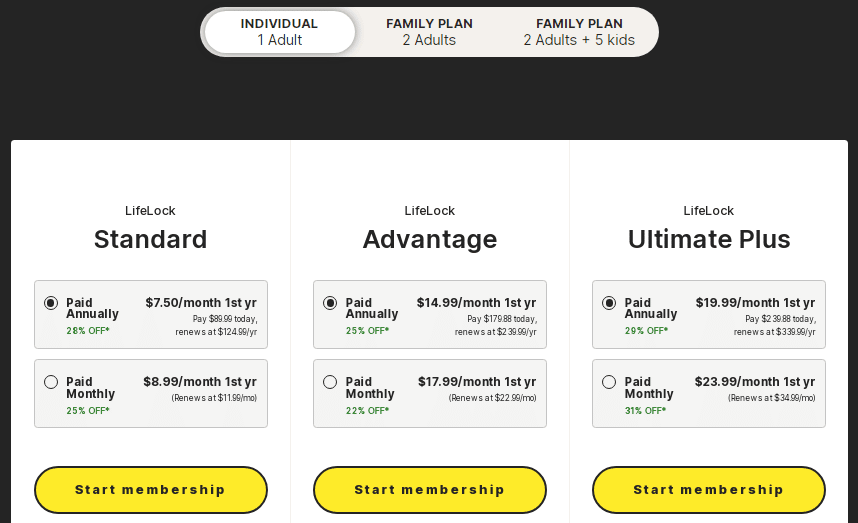

Norton’s LifeLock is available in three pricing tiers:

Although IdentityForce offers a credit simulator where LifeLock doesn’t, LifeLock is the way to go if multi-layered real-time virus threat protection for all of your devices is a priority. In addition to free trial periods based on which services you select, LifeLock often runs great discounts that can make trying it out cheaper, so give it a spin today!

Evolving from five privacy and security companies with decades of experience, Aura has quickly earned its reputation as a leader in identity theft protection. Offering all the technical features of the best identity theft prevention tools, the service also includes a VPN to keep your browsing safe and private, antivirus software to act against invasive malware, a password manager, Wi-Fi security, and safe browsing features. With Aura, you don’t just get solid ID theft protection. You also get complete network and device protection.

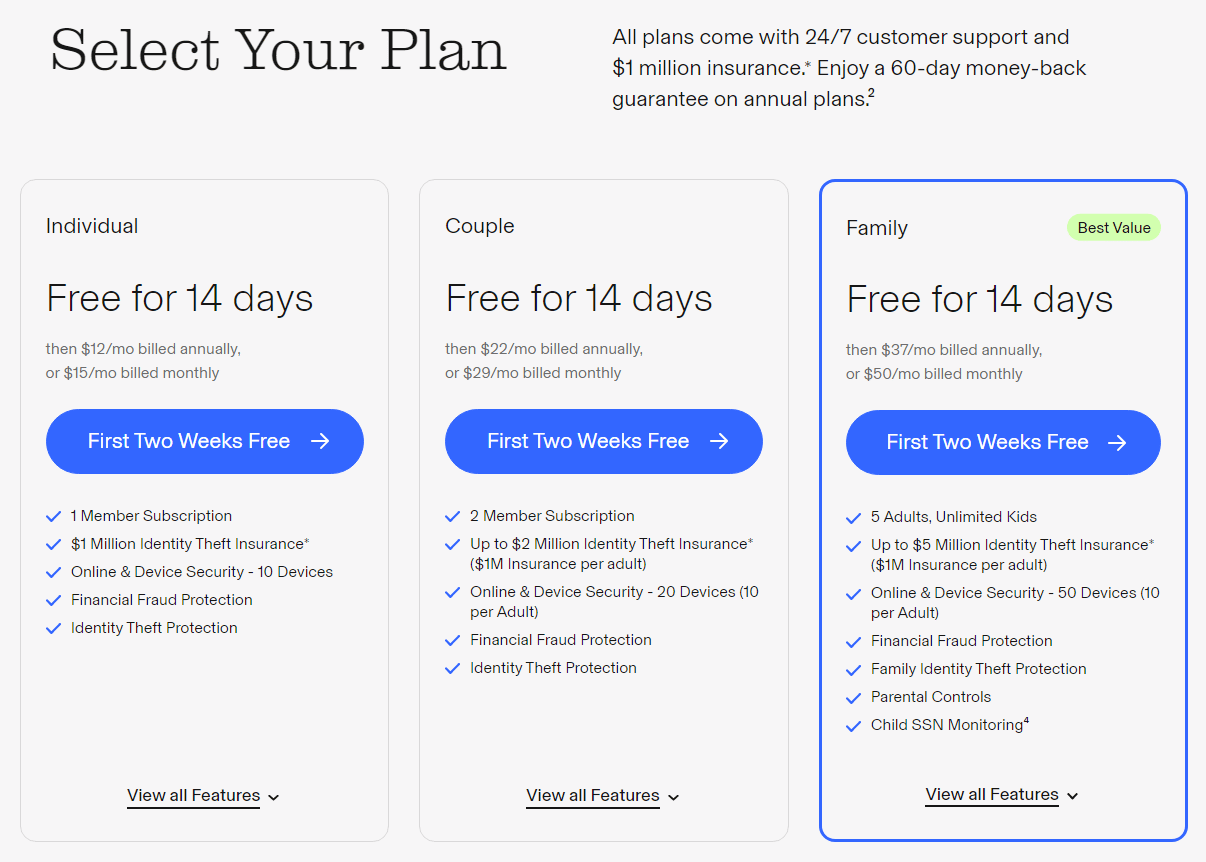

Aura offers three pricing options, including Individual, Couple, and Family packages.

The Individual package is billed at $15 per month or $144 annually (a $36 discount). This includes $1 million in identity theft insurance and covers 10 devices.

With the Couples package, the insurance policy is $2 million and covers 20 devices. The monthly fee is $29, while the annual fee is $264 (an $84 discount).

Their Family package runs $50 a month or $444 (a $156 discount) and covers five adults, unlimited children, and up to 50 devices. The insurance bumps up to $5 million (i.e., $1 million per adult).

One of Aura’s strengths is that it draws information from a wealth of sources, so if you want to ensure that you catch instances of criminals hijacking your data while keeping track of your financial well-being, you can’t go wrong with this product. Start with their risk-free 14-day trial to take it for a test run and see how easy Aura makes it to protect your money and reputation.

ID Watchdog is a top-tier identity theft protection service that comes courtesy of Equifax—another of the three big credit bureaus in the U.S. The company’s advanced software scours data points across a plethora of sources, including transaction records, public records, social media, and more, to identify potential instances of identity fraud.

ID Watchdog earns rave reviews from consumers and has been recognized by the Consumer Federation of America as one of the best in the identity theft protection business.

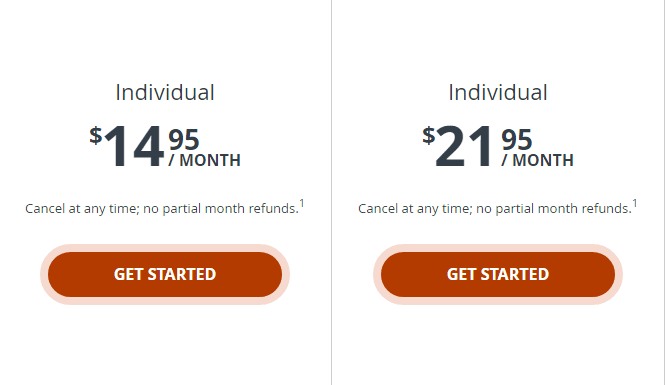

ID Watchdog offers two pricing tiers that are available to both individuals and families.

For individuals, the Select package is $14.95 monthly or $150 annually, while the Premium package is $21.95 per month or $220 annually.

For families, the Select package rate is $23.95 per month and $240 per year. The Premium package is $34.95 monthly and $350 annually.

If you want award-winning, full-service identity theft protection software backed by a credit-reporting agency, give ID Watchdog a try. Although there’s no free trial, you can cancel your subscription at any time, so the risk is minimal.

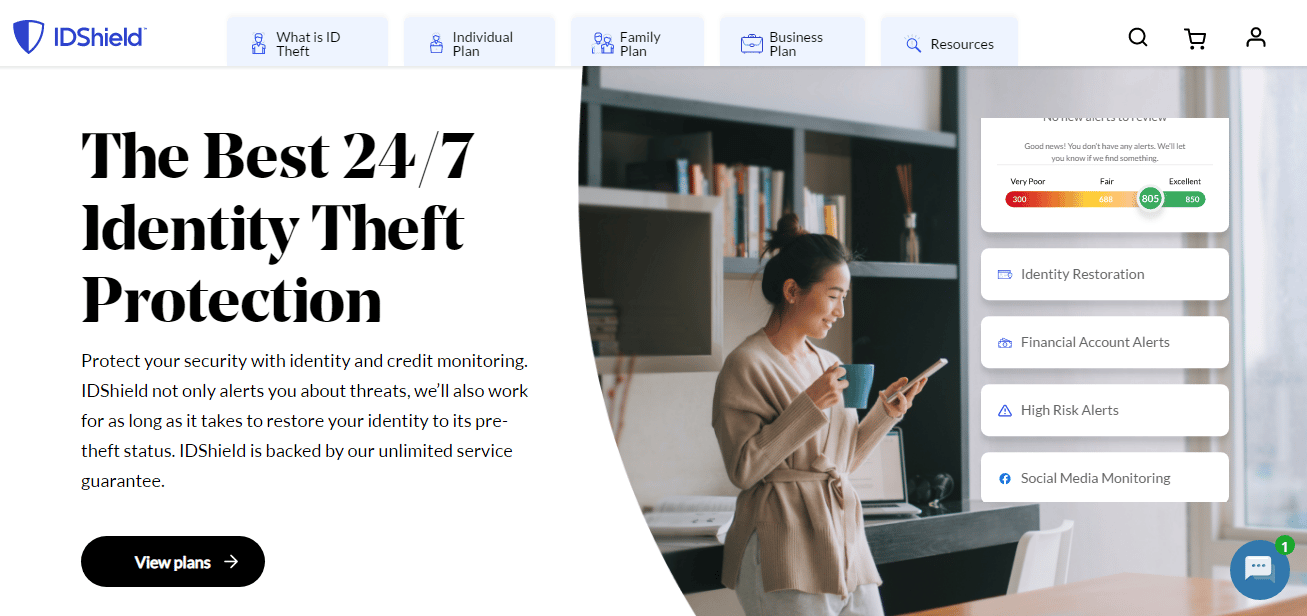

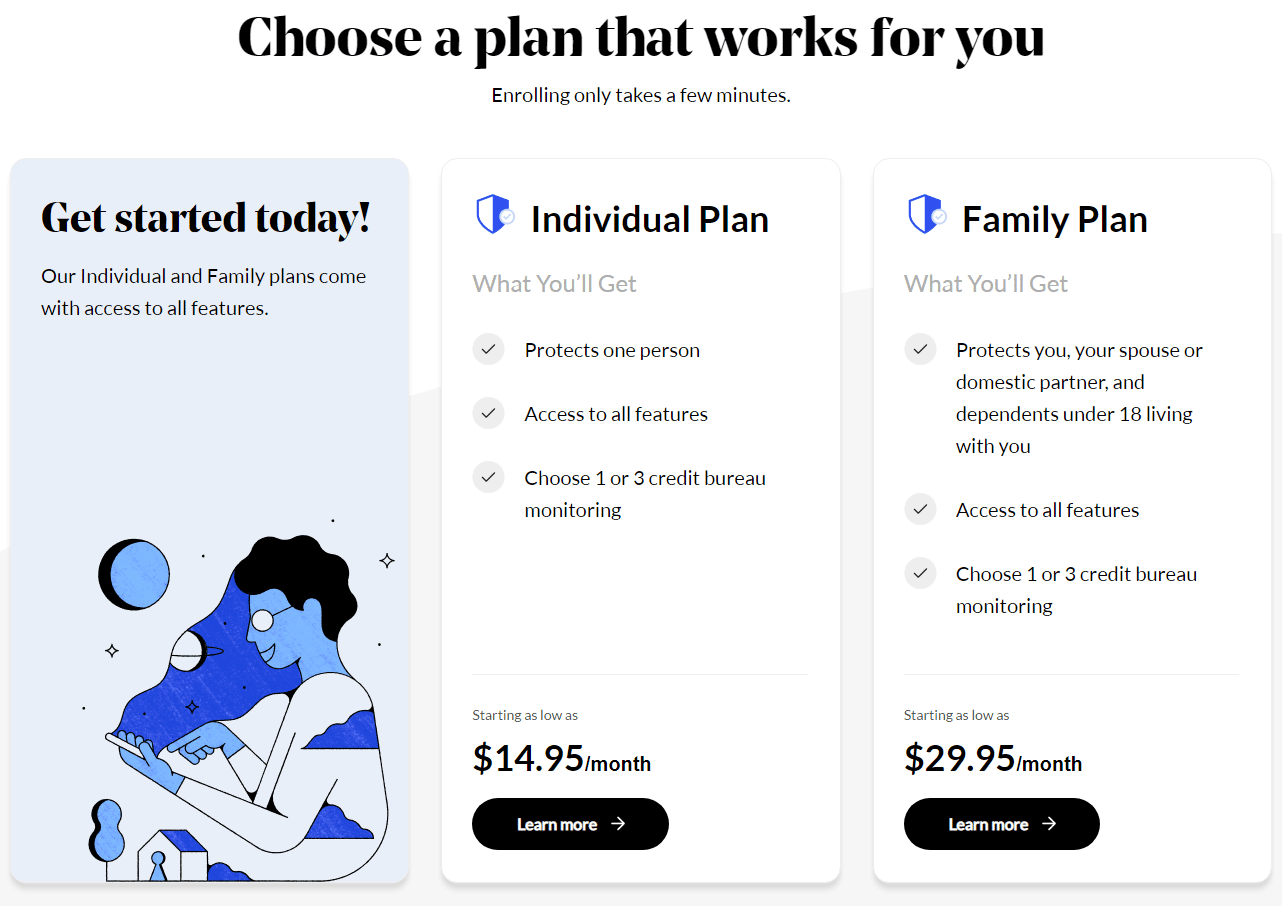

A product of Pre-Paid Legal Services, Inc., IDShield offers extensive identity theft coverage for individuals, families, and organizations. Besides standard identity protection, financial protection, and monitoring services, the company provides social media monitoring, reputation management, and a variety of cybersecurity and device protection tools.

With IDShield, you not only get a full suite of identity theft protection features. You also get unlimited consultations, which is what truly sets this service apart from many of its competitors.

IDShield offers three types of plans for each of its consumer markets: individuals, families, and businesses.

The Individual Plan costs $14.95 per month for monitoring one credit bureau and $19.95 per month for monitoring three, while the Family Plan is $29.95 per month for monitoring one credit bureau and $34.95 per month for monitoring three. Both plans offer the same features.

For businesses, IDShield offers IDShield for Business Essentials, which protects up to 6 IP addresses or URLs and runs $79.95 per month. However, you can upgrade your package to IDShield for Business Plus, which costs $149 a month and covers 12 IP addresses or URLs.

IDShield is a reliable company with a solid identity theft protection product. Its service is comparable to IdentityForce at a slightly lower price. However, it lacks certain non-essential features like junk mail removal. If these features aren’t important to you, give IDShield a try today.

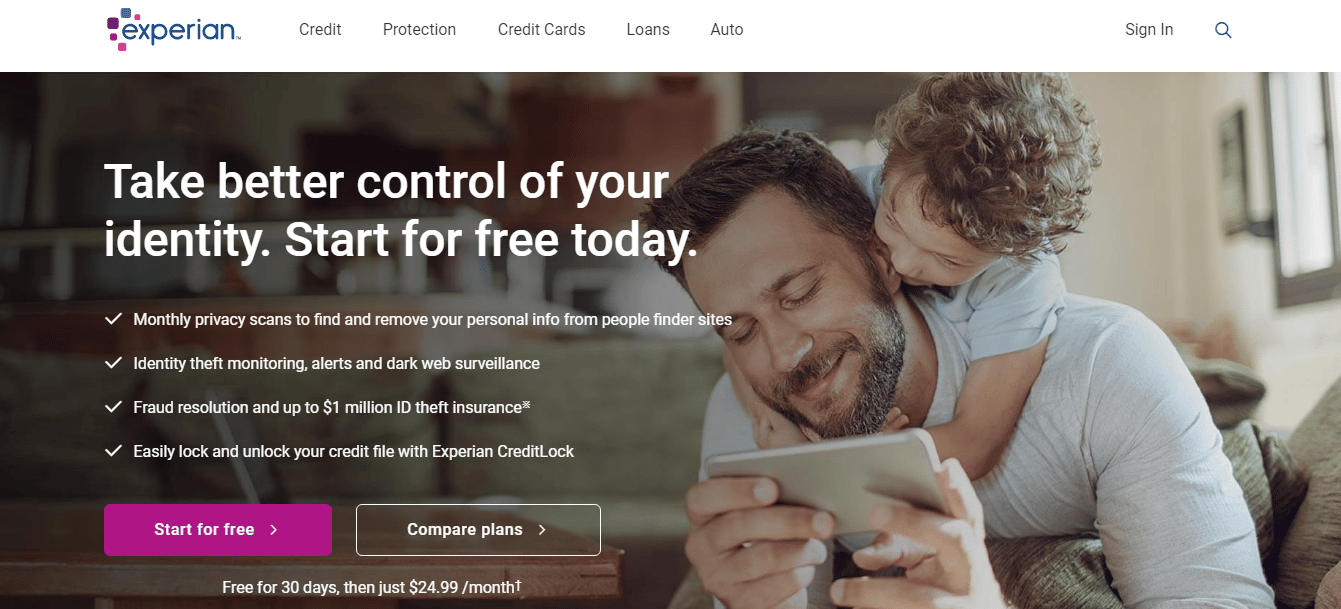

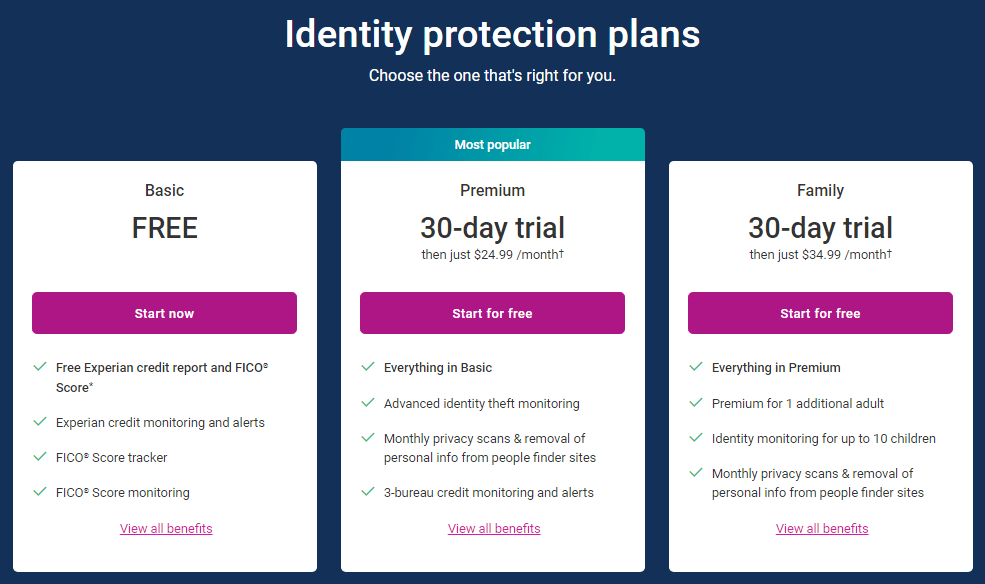

Grabbing a spot on our list is IdentityWorks, an identity theft protection service from Experian—another of the big three credit bureaus in the U.S. The service offers a reliable set of identity theft monitoring tools to protect consumers against violations of personal information, including credit monitoring, dark web monitoring, and social security monitoring.

However, what makes IdentityWorks a no-brainer is its broad range of additional services—many of them for free. This includes free credit tracking, monthly credit reports, and more. Armed with modern technology and insider knowledge, IdentityWorks is truly a force to be reckoned with.

IdentityWorks offers three simple pricing plans.

Basic: Completely free, this tier level offers some great tools like dark web surveillance, Experian credit monitoring, FICO Score monitoring, personal privacy scanning, and more.

Premium: This fully-loaded tier comes with a complete suite of identity theft features and up to $1 million in identity theft insurance coverage for just $24.99 a month.

Family: Offering everything in the Premium package for one additional adult and up to 10 children, the Family plan only costs $34.99 per month (just $10 bucks more!).

Since IdentityWorks is a product of a major credit bureau, it stands to reason that it was designed to be one of the most comprehensive identity theft tools for consumers. And with a 30-day free trial available, you can put its power to the test and try it risk-free.

With Credit Protection, Identity Protection, and Total Protection options, PrivacyGuard is one of the most flexible options on our list.

Besides being an easy-to-use and overall reliable solution in the identity theft protection game, the service combines both basic and advanced ID theft protection with outstanding customer service—one of the reasons it comes so highly recommended by many of the big players in the financial industry today.

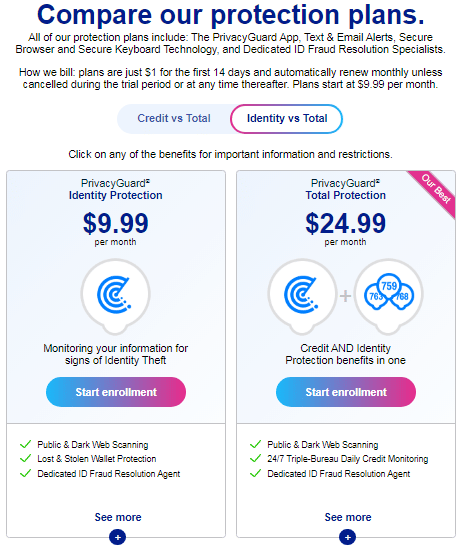

As mentioned, PrivacyGuard is one of the most flexible solutions when it comes to pricing plans. The company separates its tools into three packages.

Although PrivacyGuard lacks certain features like social media monitoring, it offers enough for you to feel confident your personal information is being protected. Throw in credit protection features and you can sleep soundly knowing you’re covered from every angle. While there’s no free trial, you only pay $1 for the first 14 days—an absolute bargain!

Identity theft is a crime involving the use of a consumer’s personal information by another individual to achieve illicit financial gain or commit some other type of fraud. Criminals will usually use information such as a bank account number, Social Security Number, or other personal details like names and addresses to accomplish their goal.

Activities often include opening accounts, making purchases, obtaining loans or lines of credit in the consumer’s name, filing fraudulent tax returns on the consumer’s behalf, diverting payments meant for the consumer, and even taking ownership of property the consumer owns by altering deeds and titles.

On average, identity theft victims lose around $500 per incident. However, losses can be far more severe and almost impossible to recoup—even in small amounts.

Sadly, financial losses aren’t the only consequence. Identity theft can destroy credit scores, retirement accounts, college funds, medical records, reputations, and more. It can take a massive amount of effort and time to undo the damage—sometimes even years.

While it may not seem like a silver lining, more often than not, identity theft tends to be a crime of opportunity rather than a targeted attack. Therefore, you can do several things to minimize your risk and make yourself less of a target.

Besides tracking what bills you owe and when they’re due, reviewing your bills for unauthorized charges, checking your bank account and credit card statements, and evaluating your credit reports for accounts you don’t recognize, you should sign up for one of the best identity theft protection services mentioned above.

With our increasingly modern and connected lives, it can be difficult to keep track of every transaction and every account, especially if you don’t regularly review your statements. However, there are certain activities that are a dead giveaway you may be a victim of identity theft.

The good news is that the time it takes to detect identity theft is shortening thanks to identity theft protection services and tools. In fact, according to a 2016 report by the IRTC, it took an average of three months for identity theft victims to recognize that anything was wrong. Today, 21% of complainants detect unauthorized activity within 24 hours, while 16% discover an identity theft crime has occurred just one week after the fact.

When most people think about identity theft, they tend to associate it with financial fraud. Although money is a huge motivator for identity thieves, these criminals can also use your name, Social Security Number, and other financial information for reasons beyond trips to the mall. And if you thought poor credit or no credit will save you from being a victim, think again.

Here are the most common types of identity theft to watch out for today:

Financial identity theft: Perhaps the most common type of ID theft, financial fraud is when someone uses your information to buy goods and services in your name or on your bank cards. The expense may be as small as gassing up their Mitsubishi Mirage (though that can be quite a significant amount these days) to buying a home or even military-grade weapons. It’s for this reason most insurance for identity theft covers up to $1 million in losses.

Criminal identity theft: Essentially an ID thief’s “get out of jail free” card, this type of crime happens when someone uses your credentials to avoid arrest. This most often happens during traffic stops. Instead of a harsher penalty, they receive a ticket in your name—one that they’ll never pay. This can put you at risk of false incarceration if you’re ever pulled over for a traffic violation since you’ll be noted as a criminal in police databases. Poof, there goes your squeaky clean record, which can have a tremendously negative impact on other areas of your life where background checks may be involved.

Medical identity theft: With this type of ID theft, another person obtains medicines or other healthcare services using your data. Besides potentially receiving a jaw-dropping bill for someone’s hernia or shoulder surgery, another related problem is that it can raise your insurance premiums if the criminal’s medical history is intertwined with your records. It may even create issues with your own healthcare treatment. Therefore, carefully reviewing your healthcare statements can go a long way to ensuring you don’t get hit with unwanted medical bills or other errors.

Elderly identity theft: Seniors tend to be soft targets, especially for financial and medical identity theft. Statistically, this demographic is less likely to track and review their accounts for fraud. They’re also more easily persuaded by fraudulent websites and emails used in phishing scams.

Child identity theft: Another group of the most vulnerable to cases of identity theft in our society is children. One of the main reasons kids make easy targets for this type of fraud is because the crime often goes undetected for years, with many only discovering a problem when they apply for credit, go for a job interview, or get pulled over for the first time. Identity thieves will most often use a child’s Social Security Number to abuse credit, obtain payday loans, or even get a driver’s license. Fortunately, many identity theft protection services now offer solutions for families with little ones. While these services won’t prevent the crime, they can help stop the damage in its tracks.

Cloning: This type of identity theft is when someone lives their daily life pretending to be someone else. In many cases, it’s because the individual has a criminal record, poor credit, or an eviction attached to their name. It’s also prevalent in immigration fraud cases where undocumented individuals try to attain employment or housing. One form of identity cloning that’s on the rise involves the use of social media accounts. Since people make their information and images so readily available on sites like Facebook and Instagram, it has never been easier to duplicate an account and use it for nefarious reasons, such as catfishing or scamming people out of their hard-earned cash.

Tax identity theft: A common practice for identity thieves is to divert tax refunds meant for other people. And believe it or not, you don’t even need to be employed. These criminals will submit a fake income using your name and Social Security Number and then change your listed address with the IRS to receive the reimbursement. That’s why it’s so important to request an IRS tax PIN to safeguard your account, as well as have an identity theft service monitoring your information for a change of address.

Employment identity theft: If someone isn’t legally eligible for employment in the U.S., they may use falsified documents in another person’s name to find work. The problem with this is that the victim of the identity theft may be stuck with tax-related payments when tax season rolls around.

Auto loan fraud: With the car industry being so competitive, you’ll often find auto dealers who are over-eager to sell. The problem is that they don’t always thoroughly cross-check the applicant’s details. Additionally, fraudsters can overcome certain safeguards by falsifying required documents like employment verification.

The reality is that criminals can obtain information about you in a variety of ways: stealing your wallet, phishing through emails, over-the-phone or in-person scams, the dark web, and more. But most commonly, this information is gathered through data breaches. Much of it is also publicly available online. It’s for this reason you need to protect yourself from all angles to mitigate the risk and extent of the damage. Keep manually checking your bills, statements, and credit reports, but also make sure you have a trustworthy ID theft service monitoring activity.

Although each service has its own step-by-step process, you’ll typically be asked to enter all relevant personal information after signing up. This usually includes your name, address, phone numbers, email address, Social Security Number, bank account information, and driver’s license number. Keep in mind that the more information you provide, the more they can monitor. You’ll then set up alerts so that you’re notified every time the service’s A.I. software detects irregular use of your data both online and offline.

If you receive a notification, you can check within your dashboard to see what data was used and where to determine if it is a case of identity theft. If needed, you can then speak to an identity theft restoration expert who will help you remedy the situation and claim damages for any lost money.

No one is safe from identity theft—not even kids. It can destroy your finances, credit, reputation, and more, which is why it’s so important to be proactive rather than reactive. Although no tool can prevent identity theft, the best identity theft services will monitor your information, flag incidences where your information is being irregularly used, and provide 24/7 support to help walk you through the recovery process. With the top services offering identity theft insurance and reimbursement policies, you can rest assured you’ll recoup any losses.