A certificate of deposit (CD) is an excellent way to earn a higher interest rate than you would with a checking or savings account, but without the risk that comes with investing in stocks. But traditional CDs charge you a penalty if you withdraw your funds early.

No-penalty CDs offer an alternative to this, letting you withdraw your funds early without having to pay a penalty. But with so many companies offering CDs, how do you find the best no-penalty CD rates? We’ve done the hard work for you by gathering information on the banks, credit unions, and financial institutions with the best rates on no-penalty CDs.

When it comes to determining the best no-penalty CD rates, the rate itself will obviously be the most important factor. Still, you must consider a few other things. Keep the following factors in mind as you compare no-penalty CDs:

USALLIANCE is a unique option for CDs or other financial services because it is a full-service not-for-profit financial institution. As most people know, the vast majority of banks are for-profit. In addition to the no-penalty CD, USALLIANCE also offers various regular CDs, including options with higher rates but longer terms. As a credit union, you can access 30,000 surcharge-free ATMs and 6,000 branches in the United States.

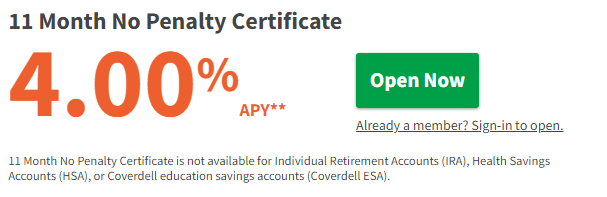

The 11-month no-penalty CD from USALLIANCE has an APY of 4.00%.

If you want to get the absolute best rate on a no-penalty CD, USALLIANCE is a strong option. With the bank’s current offers, a no-penalty CD will actually earn you more than a regular CD with a longer term. You can also get a checking account, savings account, or credit card from USALLIANCE.

America First Credit Union offers a no-penalty CD called a Flexible Certificate Account. This is offered in addition to regular CDs, checking accounts, savings accounts, IRAs, loans, and more.

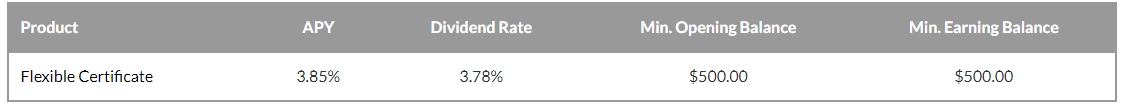

The no-penalty CD from America First Credit Union has an APY of 3.85% and a dividend rate of 3.78%.

Those who prefer banking with credit unions and are looking for high interest rates will appreciate America First Credit Union. Just keep in mind that you only get one penalty-free withdrawal per quarter, not unlimited withdrawals without penalties.

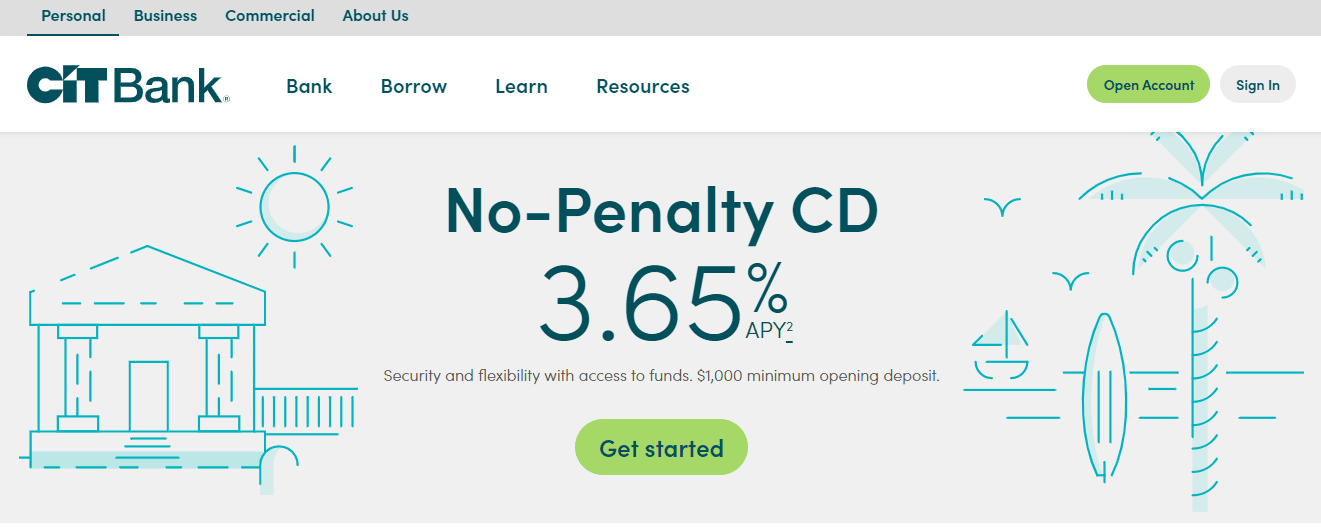

CIT Bank’s no-penalty CD has a slightly higher minimum deposit than others on this list, but at $1,000, it is still accessible. The CD is 11 months long, and you can also choose traditional term CDs, jumbo or RampUp CDs. This bank is a subsidiary of First Citizens Bank as of January 2022.

The APY for CIT Bank’s no-penalty CD is 3.65%.

CIT Bank offers a competitive interest rate of 3.65% on its 11-month no-penalty CD. If you prefer, you can also choose a traditional CD or a jumbo CD. The bank also offers checking accounts, savings accounts, and loans.

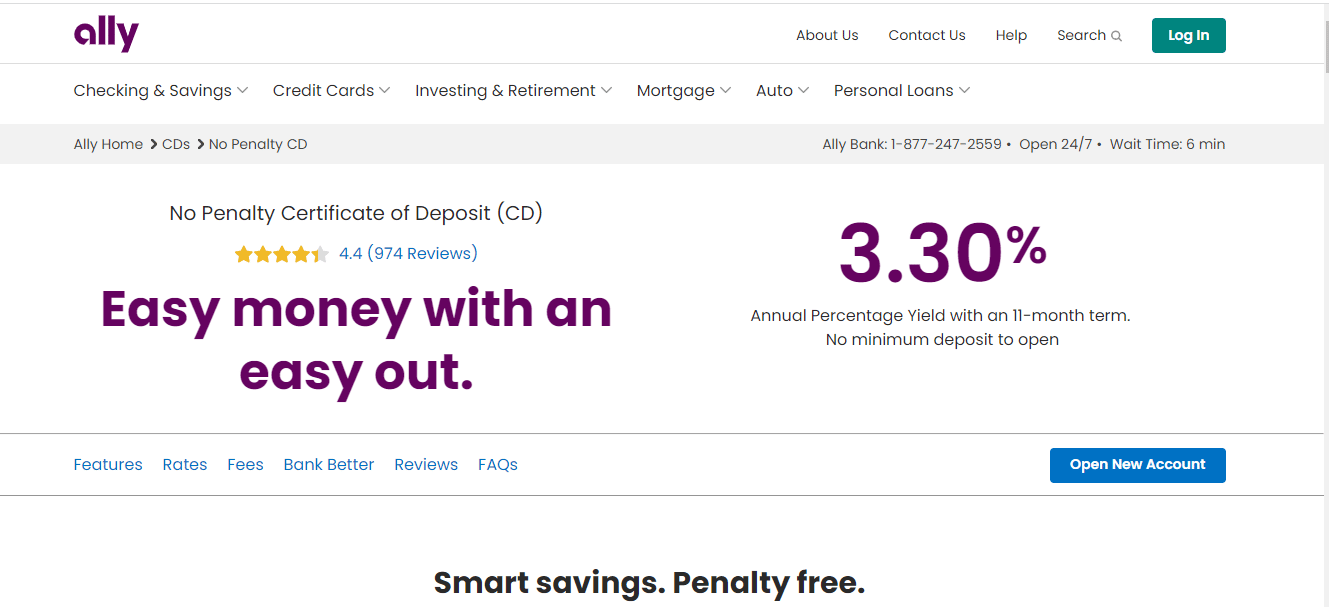

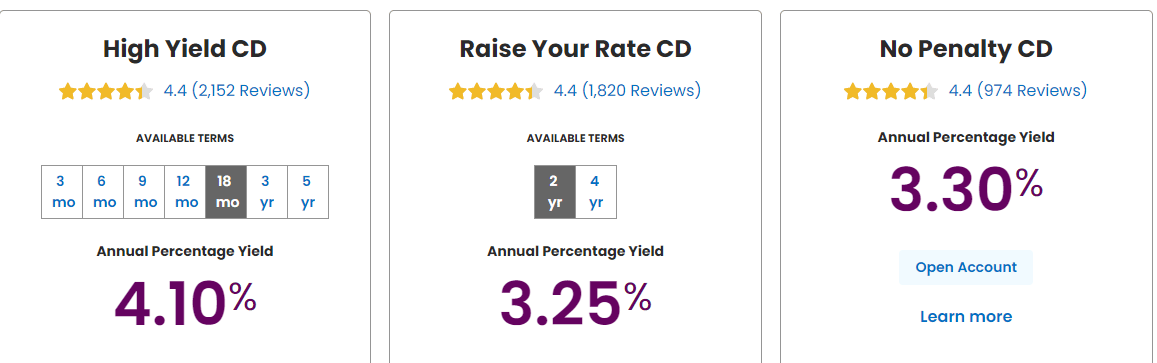

Ally Bank is an online bank without physical locations. Its 11-month no-penalty CD is offered in addition to its regular CD options. One stand-out feature of Ally Bank’s no-penalty CD is that there is no minimum deposit, making it easier for anyone to access CDs.

Ally Bank’s rate for its no-penalty 11-month CD is 3.30%.

Ally Bank’s no-penalty CD will appeal to people who don’t want to commit to a minimum opening deposit, even if it is just $500. The ability to get a CD with just $1, $100, or whatever fits your budget makes this type of financial product more accessible to everyone. You can also open a checking or savings account with Ally Bank, get a loan, invest, or apply for a credit card.

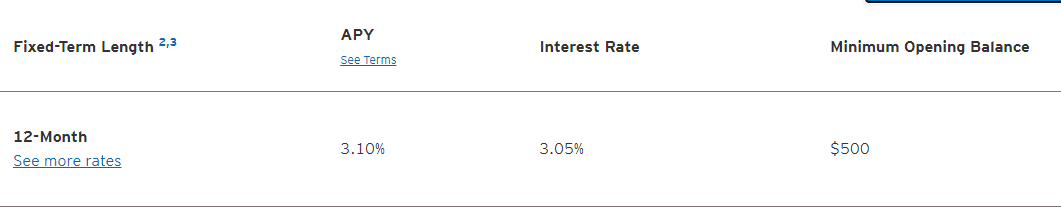

Choosing Citibank for your no-penalty CD gives you the confidence and convenience that comes with using one of the biggest banks in the United States. Keep in mind that Citibank’s no-penalty CD is 12 months.

The 12-month no-penalty CD from Citibank has an APY of 3.10%.

Those who prefer to bank with an easily recognizable name will want to consider the no-penalty CD from Citibank. You get confidence from the brand’s reputation and FDIC insurance. The bank also has some unique offerings, like the step-up CD. It’s worth noting that while the APY for the no-penalty CD is highly competitive, some of the fixed-rate CDs have lower-than-average returns. So, always compare rates before choosing a regular CD from Citibank.

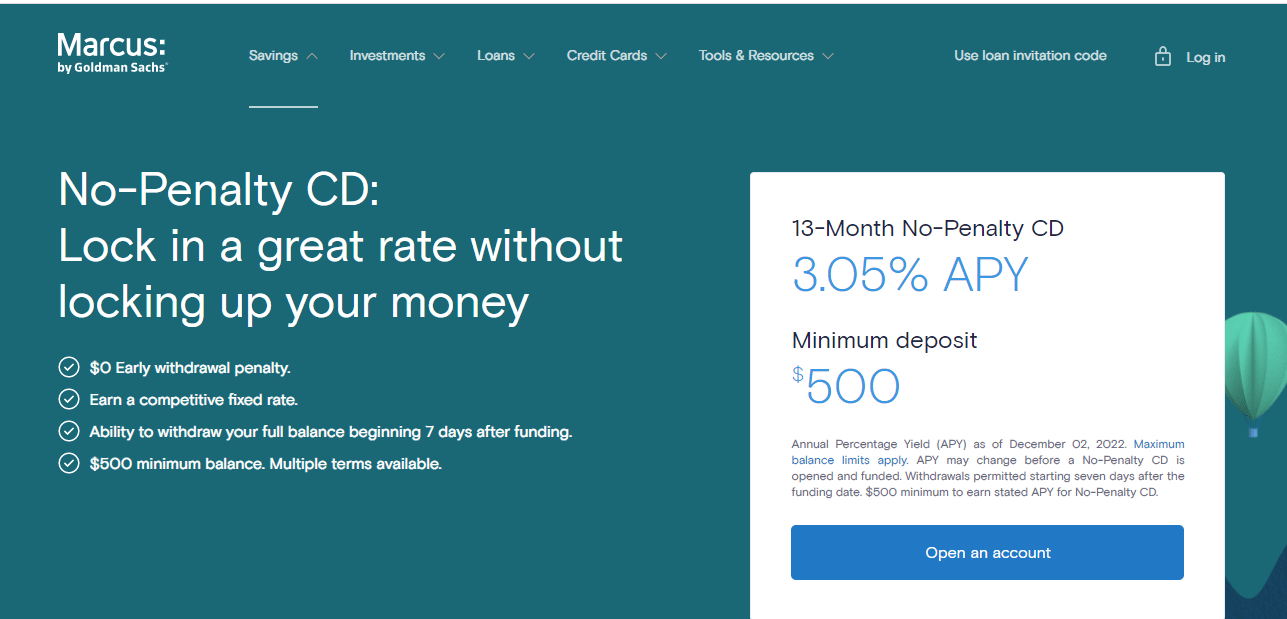

At a glance, Marcus by Goldman Sachs is a good choice if you want to be able to choose from several no-penalty CDs, as the bank offers three options. However, only the 13-month version earns a spot on this list, and the rates for the shorter terms may be too steep and not worth considering for most people. Still, choosing Marcus for your CD gives you the confidence of the Goldman Sachs name, a factor that reassures many investors.

The no-penalty CD APY from Marcus is up to 3.05%, but that rate is just for the 13-month CD. Keep in mind that the APYs for the other no-penalty CDs are significantly lower and far from competitive. The 7-month no-penalty CD earns just 0.45%, while the 11-month CD earns just 0.35%.

Choosing Marcus for your no-penalty CD gives you the confidence of the Goldman Sachs name. The company also offers a nice variety of other financial products, including various savings accounts, investments, loans, and credit cards. The minimum deposit of $500 is on-par with most other options, making it fairly accessible.

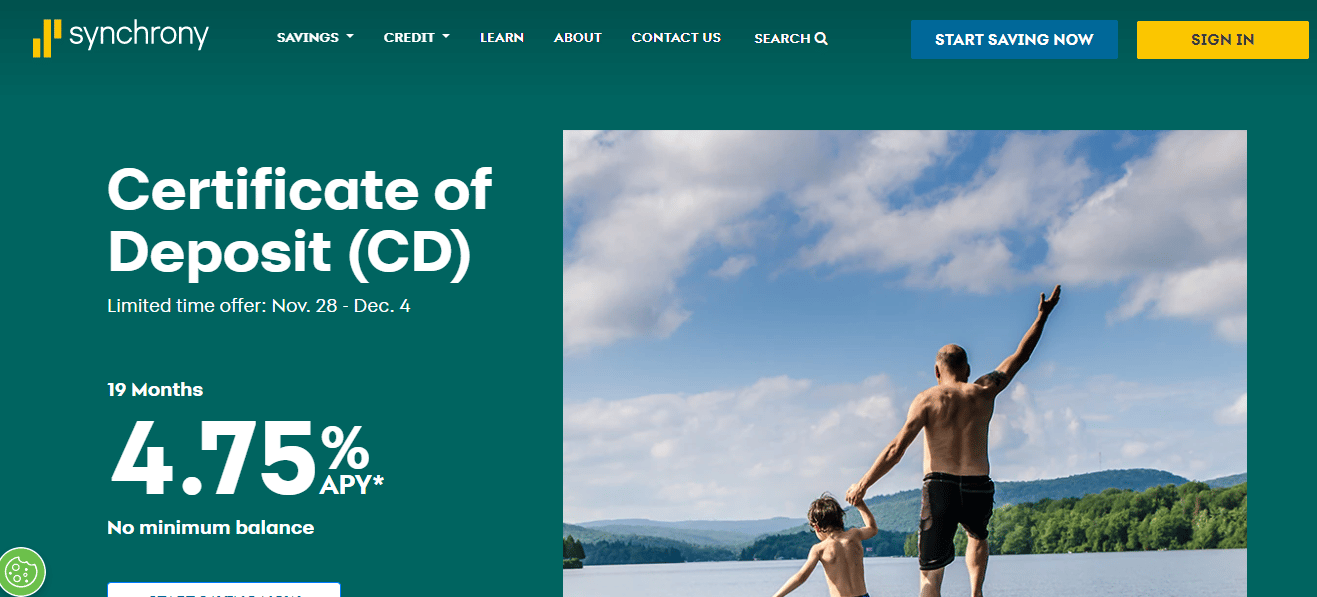

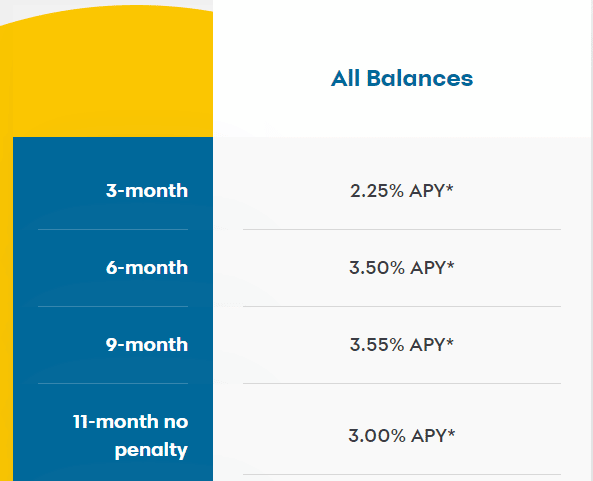

Synchrony Bank is one of the few options on this list without a minimum deposit requirement, making it accessible to everyone. The bank’s savings account is also competitive, and it offers various traditional CDs, as well as a bump-up CD.

The no-penalty CD from Synchrony earns 3.00% APY.

Synchrony Bank offers reasonably competitive rates for its no-penalty CD and other types of CDs. It also has unique offerings, like a tax-advantaged IRA CD. If you still aren’t sure whether to get a no-penalty CD, the Synchrony Bank high-yield savings account offers an alternative thanks to its high interest rate.

With a certificate of deposit, you lock your funds in the bank in exchange for earning a higher interest rate. With a no-penalty CD, you won’t be charged a penalty if you withdraw your funds before the agreed-upon time, which contrasts with traditional CDs, as most will charge a penalty for doing so.

For most no-penalty CDs, you will find terms of about a year. You can also withdraw your full balance without penalty as soon as seven days after funding the CD. For reference, most regular CDs would charge you at least several months’ interest for early withdrawal.

Keep in mind that in exchange for the flexibility that no-penalty CDs give you, you will get a slightly lower interest rate than you would for a regular CD. So, if you know you don’t need to access the funds before the maturity date, it’s better to go with a regular CD. If you want the flexibility to withdraw your funds, choose a no-penalty CD.

As no-penalty CDs are one of many banking products available, you may want to consider their pros and cons before choosing this type of investment over other available options.

The biggest advantage of a no-penalty CD is the fact that you won’t pay an early withdrawal penalty, except perhaps in the first week.

Because there are no penalties for early withdrawal, you can take advantage of increases in rates. You can easily opt to withdraw from your no-penalty CD and put your funds into a new one.

Compared to certain other account types, such as most savings accounts, no-penalty CDs have higher interest rates.

While no-penalty CDs tend to have higher interest rates than savings accounts, their earnings tend to be lower than those of regular CDs.

Depending on the CDs and savings accounts in question, savings accounts may have better APYs than no-penalty CDs. This is why you should always compare your options before opening an account.

Your APY with a no-penalty CD is fixed, unlike a savings account. This lets you take advantage of high rates when you open your account.

People used to traditional CDs may expect a wide range of term lengths, from just a few months to several years or even more. But no-penalty CDs tend to have terms of about a year, give or take a few months. You won’t find many options that are longer or shorter than this. Of course, if you want a longer term, you can always simply renew the CD.

Depending on the bank, you may have to withdraw your entire CD’s balance without the option of a partial withdrawal. That said, this varies by bank, with some still allowing partial withdrawals. For example, the second on our list, America First Credit Union, allows partial withdrawal of your funds.

As is standard for any type of CD, no-penalty CDs typically allow only a single initial deposit. If you want to earn the APY on additional deposits, you will have to open a new CD.

Overall, no-penalty CDs are an appealing option for anyone who wants to build their savings with a high interest rate but without the risk of being unable to access their money. No-penalty CDs give you the flexibility to respond to emergencies and unexpected expenses.

If you have any doubt at all that you may need to access the funds before their maturity date, choose a no-penalty CD over another type of CD. But you may also want to compare rates for high-yield savings accounts.

Choosing one of the best no-penalty CD rates gives you the higher interest rate of a certificate of deposit and the flexibility to withdraw your funds when needed. For many, it is the perfect balance of liquidity and earnings. The above list shows the top no-penalty CD rates available, so you can choose the highest rate that fits your needs.