A life insurance policy is a must-have for any parent and anyone who has someone in their life that they want to take care of in the future. But with so many options, how would you know which are the best life insurance companies for your specific needs?

We’ve evaluated all of the major life insurance providers to determine the best. Take advantage of our research to find the right life insurance company for you. Any of the following companies would be a good choice, but you need to consider your preferences as you make your decision.

The best online life insurance companies are those that will cater to your specific needs. When choosing a company, you want to consider some general factors, as well as personal preferences.

Keep the following information in mind as you choose one of our recommendations:

Financial strength ratings to ensure they will be in business for decades to come

If you prefer term or permanent life insurance

If you want permanent life insurance, universal, whole life, or variable life insurance

Whether you want no-exam life insurance

The cost of the policy and the payout

How much insurance coverage you need

What the policy excludes

What riders are available (including accelerated death benefits/living benefits, term conversion, accidental death and dismemberment, and waiver of premium, among others)

Customer satisfaction ratings

Complaints filed with regulators (check the National Association of Insurance Commissioners)

Northwestern Mutual is a popular option for life insurance because of the company’s financial stability. It is also an excellent choice for whole life insurance in particular, in addition to life insurance in general. You can also customize your policy to a greater degree than some of our other picks, but the tradeoff is that you have to work with a financial advisor.

Choose from term, universal, variable universal, and whole life policies. You can even convert term policies to whole life policies.

You can customize your premium and death benefits with the universal policy.

Northwestern Mutual has a life insurance calculator to help you decide on the size of policy you need.

The company has an exclusive underwriting process that can get your life insurance approved within just two days. Eligibility for this process varies.

If you opt for a whole life policy, you will receive dividends. Northwestern Mutual has consistently paid them since 1872, showing financial stability.

Unfortunately, Northwestern Mutual does not have clear pricing for its life insurance. This is because the company customizes its plans based on your needs. You will have to talk to a financial advisor to get a quote. But Northwestern Mutual matches you with a financial advisor in around three minutes, so getting a quote won’t take long.

If you are okay with having to wait to get pricing information, Northwestern Mutual is an excellent option for most people in search of life insurance. The fact that you have to get a quote through a financial advisor means that you can customize your policy. Additionally, Northwestern Mutual has a very long history, giving you peace of mind that it will deliver on the promised benefits of your policy.

Haven Life stands out for its great user experience. You can get an estimate on your monthly premiums in a matter of minutes by filling out a simple online questionnaire. Just keep in mind that Haven Life only offers term life insurance, so if you want another type of insurance, choose a different company on this list.

Haven Simple offers coverage of up to $500,000 with a term of five to 20 years. There is no medical exam required. You must be 20 to 55 years old.

Haven Term offers up to $3 million in coverage with a term of 10 to 30 years. You must be 64 or younger.

You can add Haven Life Plus for financial planning, estate planning, and discounts at places like CVS MinuteClinic.

Both types of policies include paperless processing, level premiums, a no-obligation free-look period, and accelerated death benefit.

You can pay Haven Simple with your credit card.

Haven Life also offers disability income insurance and annuities.

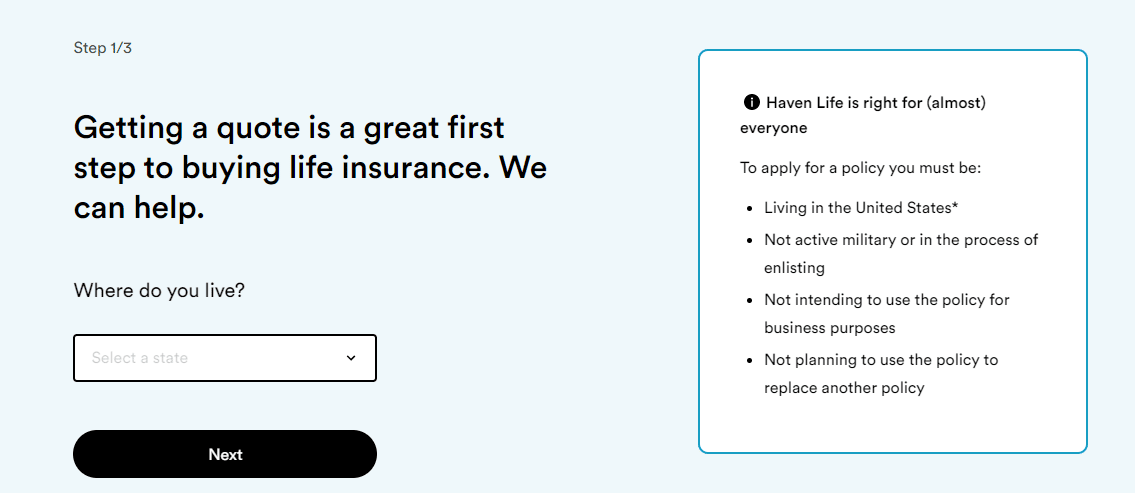

You can get an online quote for your Haven Life policy in a matter of minutes by using the quote tool. You will be asked to enter your state, sex, birthdate, health class, and whether you use tobacco products. From there, you will choose your ideal term length and coverage amount.

Haven Life is an appealing option for those in search of a good user experience and customer support from their life insurance. You can get a quote in minutes and choose from two types of term life policies. As a bonus, those who opt for Haven Simple won’t have to wait for a medical exam to apply for insurance.

In addition to offering life insurance, Prudential offers policyholders excellent educational resources. It also stands out with its senior offerings and the ability to choose from term or universal life insurance, including a long list of universal life policies.

Choose from three term life policies. These include options with set prices or policies that change with your life stage.

Choose from universal life, indexed universal life, survivorship universal life, indexed variable universal life, variable universal life, or survivorship variable universal life.

Access a vast library of resources to educate yourself about life insurance and more.

Enjoy riders that offer living benefits for nursing home care and terminal illnesses. Disability, cash value, and estate planning riders are also available.

You can get a quote from Prudential online or over the phone in a matter of minutes. You will just have to answer a few simple questions.

Prudential is a strong choice for those who want their choice of life insurance policies, as the wide range of policies makes it easy to find one that fits your needs. Between the long list of universal life insurance policies and riders, plenty of customization is available. The company also stands out with its ability to get a fast quote online or over the phone, as some companies now offer only online quotes.

State Farm has excellent customer satisfaction and lets you easily combine your life insurance with other types of insurance. Choose from term life, whole life, or universal life insurance coverage. You also get the confidence that comes from State Farm’s superior financial ability.

You can opt for a whole life policy and earn dividends.

Universal life policies can include survivorship universal life and joint universal life.

Whole life insurance can involve a single premium, paying premiums for a limited time, or final expense coverage.

You can choose a return-of-premium life insurance policy, a somewhat rare offering.

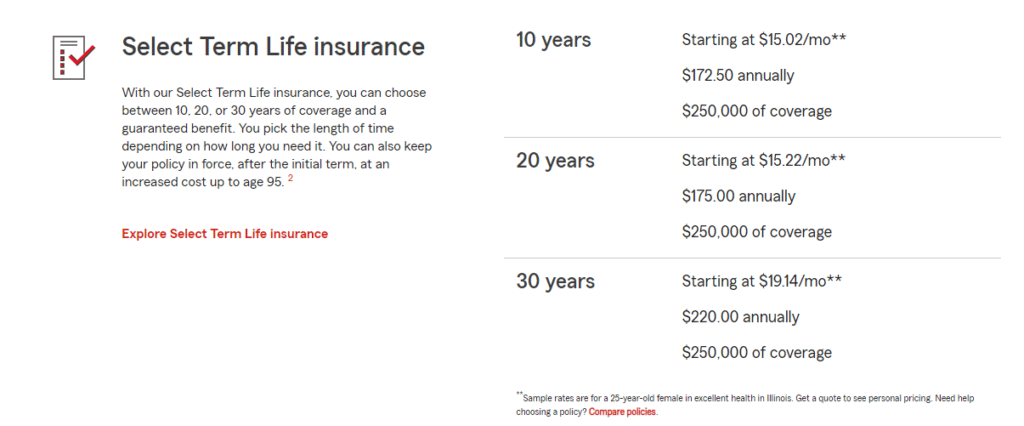

Term life is available for 10, 20, or 30 years.

Those 85 years and younger can get universal life insurance.

You can bundle life insurance with other types of insurance and save.

You can get only $50,000 coverage without a medical exam.

Prices are best for whole life and universal life insurance. Consider a different insurer for competitive term life pricing.

To get a quote for State Farm’s life insurance, you can fill out a simple online form. You will be asked if you are getting a quote for yourself or someone else. From there, you enter your birthdate and sex. You will also answer some questions about your tobacco usage, height and weight, health, and desired coverage (term length and coverage amount). In the end, you’ll have a quote in minutes, complete with a discount if you pay annually. While that quote isn’t binding, you can easily get a printer-friendly copy.

State Farm life insurance is particularly appealing if you want universal life or whole life insurance, although the company also offers term life insurance. State Farm stands out for its financial stability, customer support, and discounts when bundled with other types of insurance.

New York Life insurance is an appealing option for those who want whole life insurance. You can also opt for term, universal, or variable life insurance. You get the confidence that comes from a company that has been paying dividends for 169 years. New York Life also stands out with its variety of riders and offerings for those who are up to 90 years old.

New York Life is one of the few life insurance companies that sell policies to those up to 90 years old.

As of 2023, New York Life will have paid dividends for 169 years. The company itself is over 175 years old.

Choose from whole life, term, universal life, and variable life insurance policies.

You can convert a term life policy into a permanent policy.

Consider adding a rider for living benefits and Spouse’s Paid-Up Purchase Option (SPPO), the latter being incredibly rare.

Other riders include accidental death benefits and disability waiver of premiums.

High coverage amounts are available. The Million Plus Level Term 10 policy’s death benefit, for example, is at least $1 million.

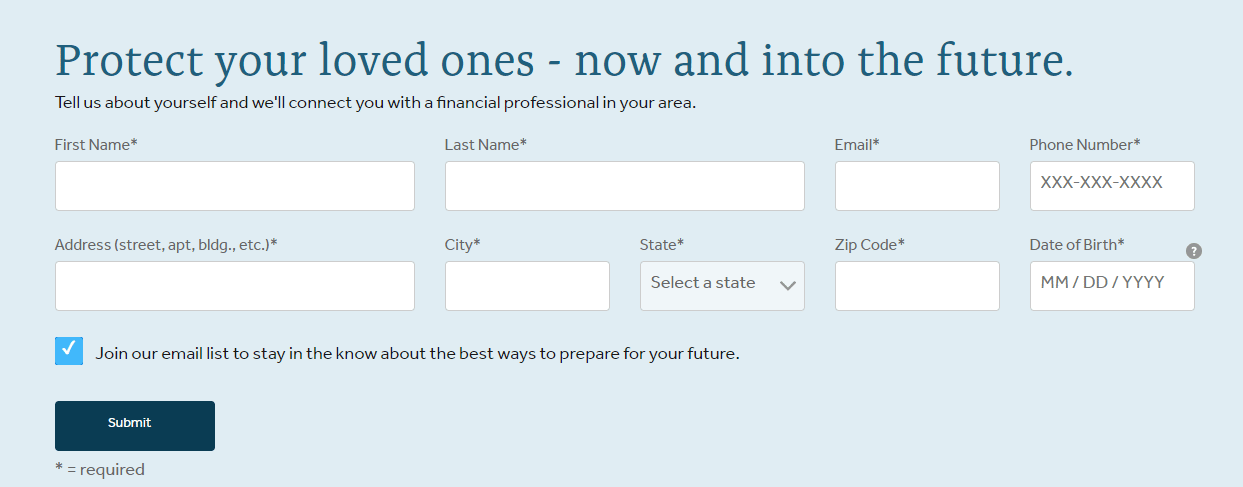

You will need to provide basic information and wait for an agent to contact you to get a quote.

With more than 12,000 agents, New York Life prides itself on individualized attention.

The company offers plenty of educational resources as well.

New York Life also offers investments, supplemental insurance, retirement income, estate planning, and wealth management.

As a mutual company, buying certain policies and earning dividends can entitle you to vote in the board elections.

Unfortunately, you have to contact an agent to get a quote on life insurance. There is no option to get an instant quote online or over the phone.

As long as you are willing to wait until an agent contacts you to get a quote, New York Life is a well-respected and strong option for life insurance. The company’s 175-year history gives you confidence, and if you get a whole life policy, you will benefit from its 169-year history of paying dividends. New York Life also stands out with its riders, including a few that you will be hard-pressed to find from another company.

Lincoln Financial is a strong choice if you want to be able to choose from various universal life insurance plans. It is especially popular among Boomers but also a strong choice for other generations. Conveniently, you can choose from term or permanent life insurance.

Those who want permanent life insurance can choose from universal, indexed universal, or variable universal coverage.

Survivorship life insurance is also available.

Those in search of term life insurance can choose from Lincoln TermAccel Level Terms for a fully automated process for those in good health.

Lincoln LifeElements Level Terms offer more coverage up to $1 million. You also get dedicated teams specializing in large cases.

Term life insurance policies have higher maximum ages at which you can convert to a permanent policy and for guaranteed renewability.

You can add a living benefit rider. There are also riders for accelerated benefits and waiver of premium, depending on your policy.

Cash value policies usually have low costs within the policy, so more of your premium goes to the cash value growth.

Lincoln Financial also offers annuities and long-term care planning (Lincoln MoneyGuard solutions). You can also get a lifetime protection VUL.

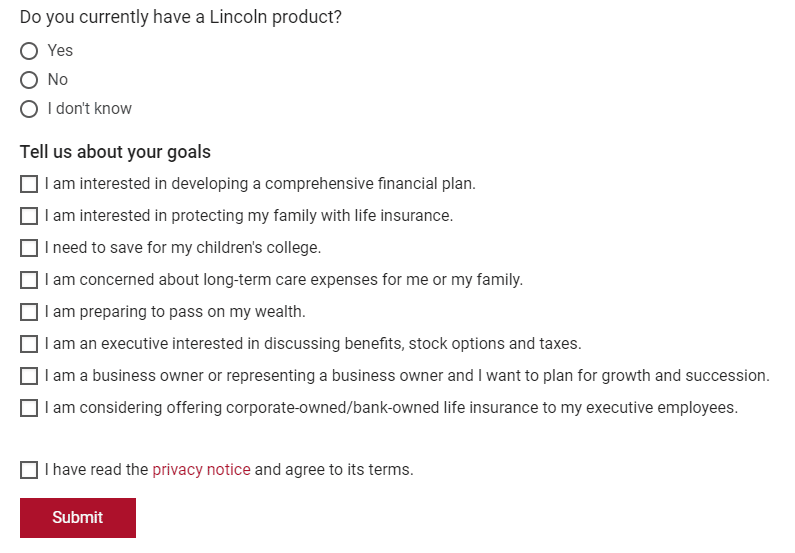

Like other life insurance companies on this list, you cannot get an online quote from Lincoln Financial. Instead, you have to fill out a form and wait for an agent to contact you. When filling out the form, you will indicate that you are interested in life insurance, as well as any other Lincoln Financial services you also want to learn about.

Despite not getting an instant quote, it is worth reaching out to Lincoln Financial, as their term policies tend to be priced competitively.

If you are interested in term or permanent life insurance, you should consider Lincoln Financial. While you can choose from various universal and variable policies, keep in mind that you will need to choose a different company if you want whole life insurance.

Nationwide is another highly rated life insurance company that nearly anyone should consider, especially Gen X and Millennials. As a bonus, if you get other insurance from Nationwide, you can get competitive bundling discounts. Nationwide also has excellent customer satisfaction ratings and is one of the few life insurance companies that accepts payment via credit card.

Nationwide has been in business for almost a century, so you can trust it to continue operating during your life.

Policies are available without a medical exam and with quick approval.

Permanent life insurance is available as variable, whole, or universal.

You can choose from multiple riders. Most policies already include three accelerated death benefit riders without additional costs for terminal, chronic, or critical illness.

Nationwide offers long-term care coverage.

Nationwide also offers dozens of other types of insurance, from home to cars to golf carts. You will find various investing, retirement, and banking services from them.

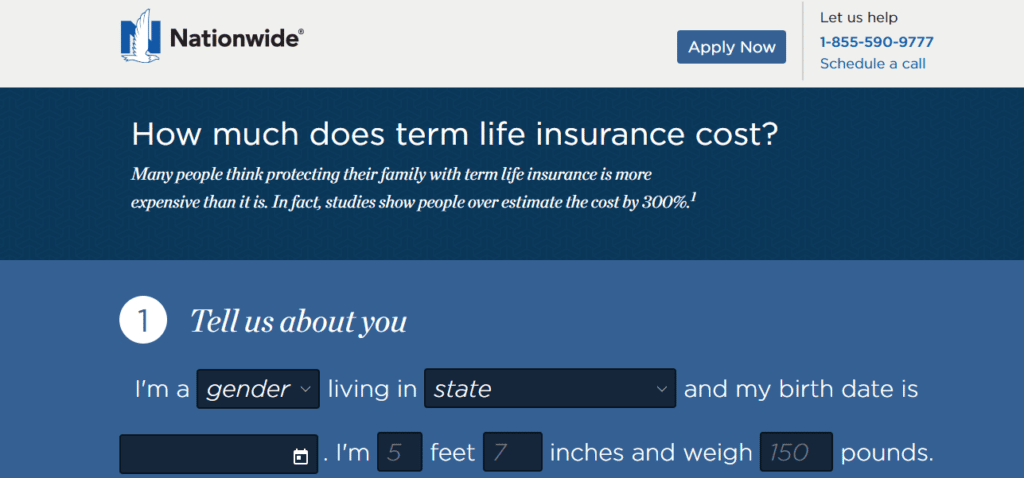

You can quickly and easily get an online quote from Nationwide for life insurance. As with most online quotes from companies on this list, you have to answer questions about your sex, state, birthdate, height, weight, health condition, and tobacco use. You will then see quotes for 10-, 20-, and 30-year coverage terms. The tool lets you choose a coverage amount between $100,000 and $1,000,000, automatically updating your monthly premium as you do so.

If you want life insurance that is not term coverage, you will need to contact an agent to get a quote.

Nationwide is another top insurance company for people who want the peace of mind that comes with a well-established insurer. While there are older companies on the list, Nationwide is almost 100 years old, giving you more confidence in their services. It is also one of the few insurers that accepts credit card payments and one of those that offer free, instant quotes for term life insurance.

Mutual of Omaha stands out with its living benefits for life insurance. This insurance company also leads the pack for indexed universal life insurance. You will also be able to choose from a range of riders and guaranteed issue options.

You can choose a plan with living benefits or one of several riders. Most policies include at least two riders for chronic, terminal, and critical illnesses. Some have all three.

You can choose to get a disability income rider.

Choose from term, whole, or universal life insurance.

Some insurance plans offer the cash value for withdrawals or loans.

Some policies let you change the death benefit amount.

You can opt for return of premium term life insurance. This returns up to 100% of your premiums if you live past the term. This is an incredibly rare offering.

An agent can help you customize a life insurance policy if none of the pre-set offers match your needs.

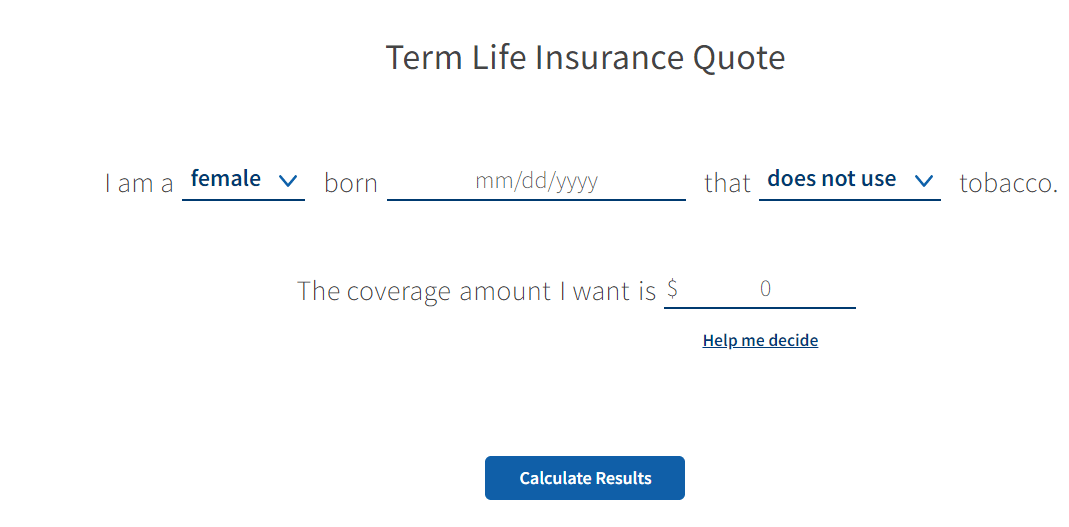

Like most other insurance companies on our list, Mutual of Omaha offers instant online quotes with some basic information. Select your sex, birth date, tobacco use, and desired coverage amount. The quote tool will also ask you some questions about your goals with life insurance.

The biggest stand-out feature of Mutual of Omaha is the option for a return of premium term life insurance policy, which only a handful of insurance companies offer. The fact that most policies include at least several living benefits riders is also a big draw. Mutual of Omaha is worth considering for whole, universal, and term life insurance, as it offers all three types.

Transamerica stands out with its high level of customization available for policies. It is also a very strong option for term life insurance, as well as other types of life insurance. There are also multiple choices for policies that don’t require a medical exam, and some policies have living benefits without additional costs.

Choose from term, index universal, whole, and final expense life insurance.

Term life insurance includes Trendsetter Super and Trendsetter LB. Coverage is $25k to $10m+. It is available for ages 18 to 80 with terms of 10, 15, 20, 25, or 30 years.

Transamerica offers life insurance for foreign nationals. These include Transamerica Financial Foundation IUL, Trendsetter Super, and Transamerica Lifetime Whole Life.

Choose from several policies that don’t require a medical exam.

Some policies already include living benefits. You can also choose from various other riders, including a unique disability income rider.

You can also get an income protection option, children’s benefit rider, accidental death benefit rider, term insurance rider, and other riders.

Transamerica has been in business since 1906, so it is one of the oldest insurance providers on this list.

Transamerica is one of the life insurance companies that requires you to talk to an agent to get a quote for coverage. You can use the company’s convenient agent-finder tool to do this.

If you want an insurance policy with living benefit riders for terminal, chronic, and/or critical illnesses, Transunion is a solid option, as these are already included on some policies. It is also one of the few insurance companies that offer a disability income rider.

The best online life insurance companies are those that specialize in selling life insurance, either as a standalone or in combination with other insurance plans and financial services.

Life insurance itself is a contract you make with your insurance company. You make premium payments while you are alive. When you pass on, your beneficiary receives a lump sum or the “death benefit.”

Many people get life insurance policies to cover their funeral costs. It is also very common for parents and grandparents to get life insurance policies to give their children or grandchildren an inheritance when they pass.

Another common reason to get life insurance is if you are a primary breadwinner and others depend on your income. This can include a spouse or children. People with outstanding debts may also consider life insurance, so their dependents don’t have increased financial burdens.

As you look at the reviews of our top picks for insurance companies, you will notice we mentioned several different types of life insurance. The biggest distinction is term or permanent.

Term life insurance policies have you choose the coverage length. It is usually between 10 and 30 years. Your beneficiary receives the death benefit only if you die during that term. If you outlive the policy, you will typically have the option to renew it at a higher cost.

This is a popular option for people with specific financial concerns. It is especially common for parents or families with single-income earners to cover potential lost wages during working years.

Permanent life insurance will always pay the beneficiary as the policy does not expire. These policies are usually more expensive than term life insurance. They also tend to include cash values that can accumulate tax-deferred money.

While term life insurance tends to be fairly straightforward and uniform, there are several types that differentiate this type of insurance.

With a whole life insurance policy, everything is fixed and guaranteed, including the rate at which the cash value grows, the premiums, and the death benefit amount. This feature makes these policies a good option if you want predictability.

Whole life insurance policies may pay dividends, but not all do. As such, you should always confirm whether your chosen policy does before applying.

Universal life insurance is more flexible than whole life insurance, as you can frequently adjust death benefits and premiums within a given range. The growth of the cash value depends on the investment assets that the insurer has underlying the policy, so they are not predictable.

There are also several types of universal life insurance, including indexed universal, variable universal, fixed-rate universal, and guaranteed universal.

Indexed universal life insurance (IUL): This policy lets you earn interest tied to index fund performance, although potentially with a limit on your rate of return.

Fixed-rate universal life insurance: This policy lets you earn all (or some) of your cash value within a fixed-rate account.

Variable universal life insurance (VUL): With this insurance policy, you choose how the cash value portion of the policy is invested. You can typically choose multiple accounts and divide the cash value among bonds, stocks, and mutual funds.

(No-lapse) guaranteed universal life insurance (GUL): With this universal policy, your death benefits and premiums remain the same throughout the policy. These policies typically have an end date.

Variable life insurance adds extra flexibility, unlike what you get with whole life insurance. At the same time, it prevents your death benefit from going below a certain point.

The biggest difference between a variable life insurance policy and a variable universal life insurance policy is that safety net. With a variable universal policy, the death benefit could theoretically drop further.

The other major difference between the two is that you can’t change your premiums with variable life insurance, but you can with variable universal.

Variable life policies also have cash values that you can use to a limited degree while alive. However, you must keep the cash value above a certain amount or risk your policy lapsing.

In addition to those main types of life insurance, you may also come across a few other types worth knowing.

As the name implies, this type of life insurance policy doesn’t require a medical exam, and it can overlap with one of the policies already mentioned. However, you may still have to answer questions about your health. There are three main types of no-exam life insurance policies.

Accelerated underwriting: With this type of policy, your rates mostly depend on third-party algorithms and sources. The company will look at factors like your driving record, criminal record, and prescription drug history.

Guaranteed issue: With guaranteed issue life insurance, you will always be approved. There are no health questions and no medical exams.

Simplified issue: This type of insurance will typically ask you a few questions about your health, but you won’t have to take a medical exam.

It is worth noting that no-exam life insurance, especially guaranteed issue, and simplified issue policies, tend to have higher premiums. That said, they are among the fastest options and the best choices for those with health problems.

This insurance typically has coverage of only up to $10,000. That money is designed to pay for your final expenses, such as burial and funeral. Expect these to be high-cost whole life insurance policies.

This insurance policy will pay off your mortgage lender if you pass on as the mortgage policyholder.

This policy delivers coverage for a husband-and-wife pair. The death benefit is only paid when both people on the policy pass away.

With the above information, you don’t have to worry about choosing the best online life insurance companies. Any of the companies on our list would be an excellent choice. You simply need to decide which one best fits your needs and budget. From there, the process of getting life insurance will be rather straightforward, and you will be able to continue to care for your family financially after you are no longer physically present.