Is your current financial filing system a shoebox stuffed with receipts?

Are manual account records driving you bonkers?

Starting to realize your favorite part of childhood was not paying bills?

You’re in luck. You’re about to discover the holy grail of budgeting and money management software to take your troubles away and get your money matters on track.

In this post, we share 11 of the best online personal finance software solutions with the sexiest value propositions. In fact, survey results from one of our picks showed new budgeters saved $600 by month two and $6,000 within their first year!

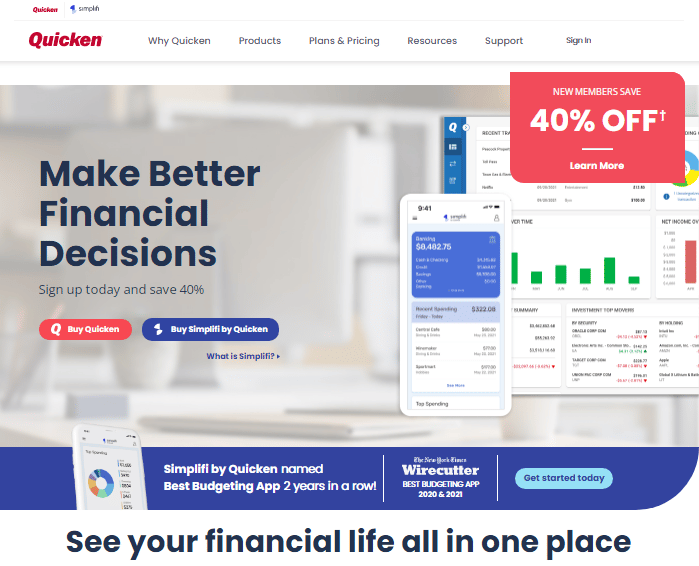

Thanks to its robust finance, planning, and investment tools, Quicken has quickly become the best all-round personal finance software available today.

Available on MacOS, Windows, Android, and iOS, this secure, intuitive, and user-friendly software lets customers aggregate accounts, track transactions, budget smartly, pay bills, track and manage loans and investments, plan for retirement, and more.

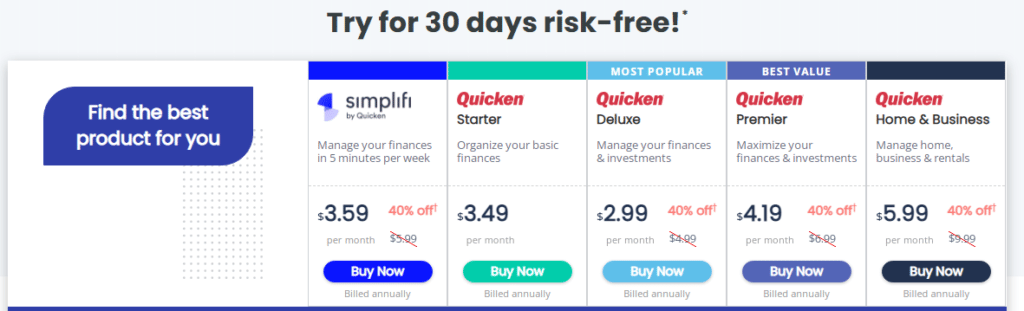

Quicken offers four pricing tiers to suit every user’s software needs and budget.

Their Starter tier provides basic personal finance tools for $41.88 per year, while their most popular Deluxe tier offers additional budgeting customization and goal-setting tools for just $59.88 per year.

For users wanting to simplify taxes and maximize investments, Quicken’s Premier tier costs $83.88 annually. Their Home & Business tier, which provides access to special business features, is $119.88 yearly.

Quicken is ideal for individuals wanting to take control of their finances, as well as small business owners whose business activities are integrated with their personal credit cards and bank accounts.

If you’re unsure whether you need so many features in the best personal finance management software, Quicken offers a 30-day money-back guarantee on all pricing tiers so that you can try it risk-free!

YNAB is an award-winning, zero-based budgeting program that aims to change poor money management habits and break the paycheck-to-paycheck cycle.

Following a proven, four-step method, users assign every dollar earnt to a spending category or savings goal, essentially giving each dollar a “job.” YNAB also encourages saving, helping users build a multi-month emergency fund. On average, customers save $6,000 in the first year.

YNAB is supported on Windows, MacOS, Android, iOS, iPad, Apple Watch, and Alexa.

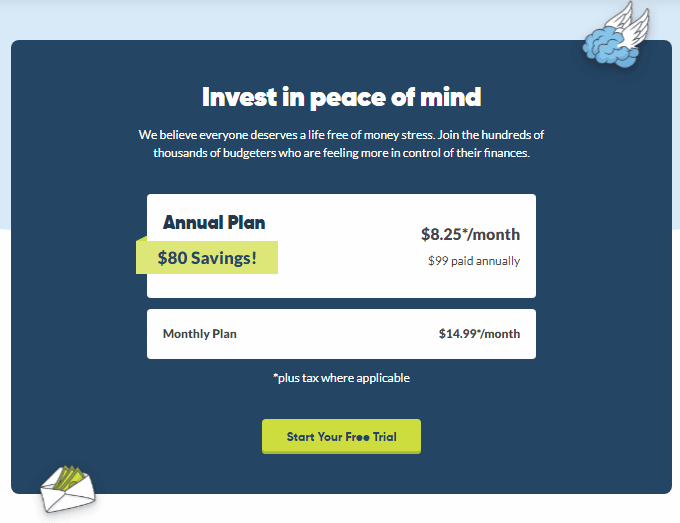

YNAB’s pricing options are simple:

Either pay $14.99 on their month-to-month plan or save $80 by paying $99 for the entire year.

You can cancel at any time.

Taxes may apply.

Perfect for budgeting beginners, financially flippant spenders, or personal finance powerhouse users, YNAB’s features make getting out of debt and saving money simple. This budgeting software company offers a generous risk-free 34-day trial period with no upfront commitment, so you’ve got nothing to lose by giving it a try!

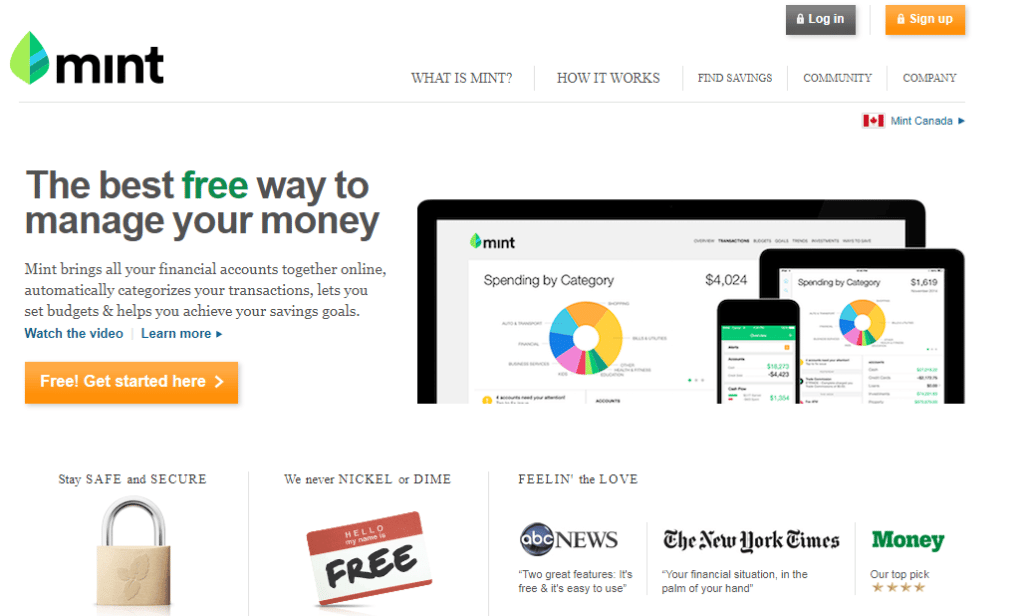

A trailblazer in the personal finance industry, Mint is a money management and financial tracker that helps users get ahead of spending, manage debt, and grow their net worth by providing customizable budgets, personalized insights, and subscription monitoring, among other things.

According to Mint’s parent company, Intuit, it’s the No.1 most downloaded app in this space and acquired 20 million users in its first decade alone. Platforms include Android and iOS.

You can’t get simpler or cheaper pricing than FREE! And no, there are no features secretly locked behind paywalls.

Mint is an excellent spending tracker for the everyday consumer who wants to monitor daily activity to see where their cash goes and where they can save. Since it’s totally free, test it out to see how you can budget effectively and squeeze all you can out of every penny.

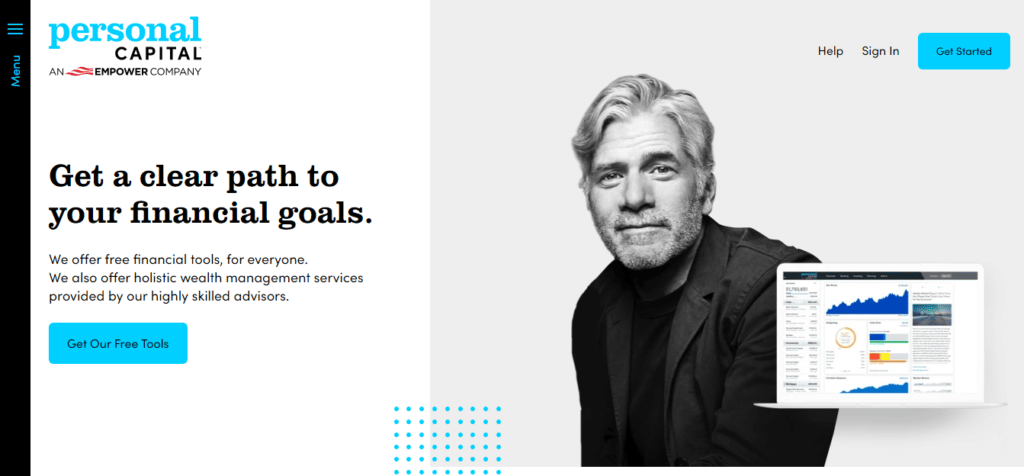

Although Personal Capital is primarily a wealth management and investment tracking tool, it also offers top-notch budgeting and savings tools for the not-so-wealthy user. Features include cash flow tracking, budgeting, savings planning, real-time net worth tracking, education cost planning, retirement planning, and more.

For users with a balance of $100,000 or more, Personal Capital offers portfolio management services that include personalized advice from financial experts. The software is available on desktop, Android, and iOS.

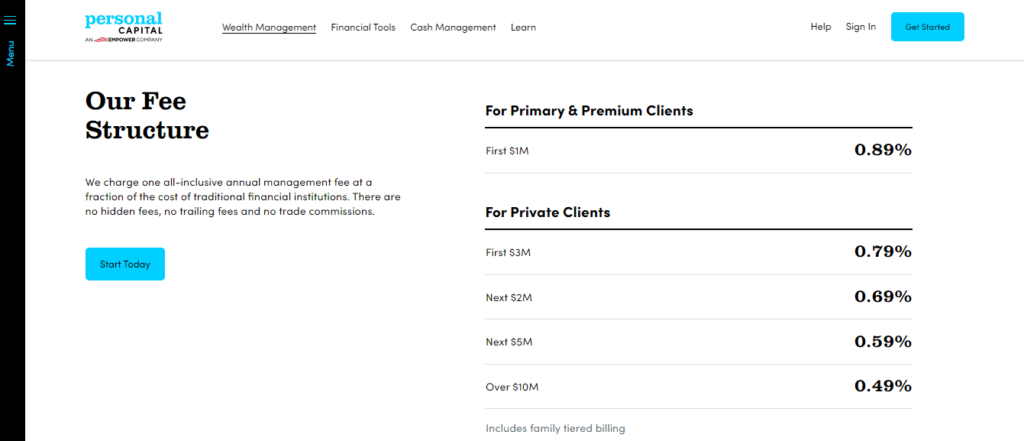

Personal Capital’s core financial tools are FREE to use. However, high-end users pay a tiered fee depending on their account balance.

The all-inclusive annual management fee works as follows:

Tier 1: 0.89% for $100,000 - $1,000,000

Tier 2: 0.79% for $1,000,000 - $3,000,000

Tier 3: 0.69% for $3,000,000 - $5,000,000

Tier 4: 0.59% for $5,000,000 - $10,000,000

Tier 5: 0.49% for $10,000,000+

For users who want an awesome suite of financial tools and a clear path to their financial goals, Personal Capital earns its reputation as one of the best personal finance apps around. Although asset and investment-rich clients will need to pay for exclusive personalized services provided by actual humans, the company’s financial planning and analytics tools are on the house and waiting for you to give them a go!

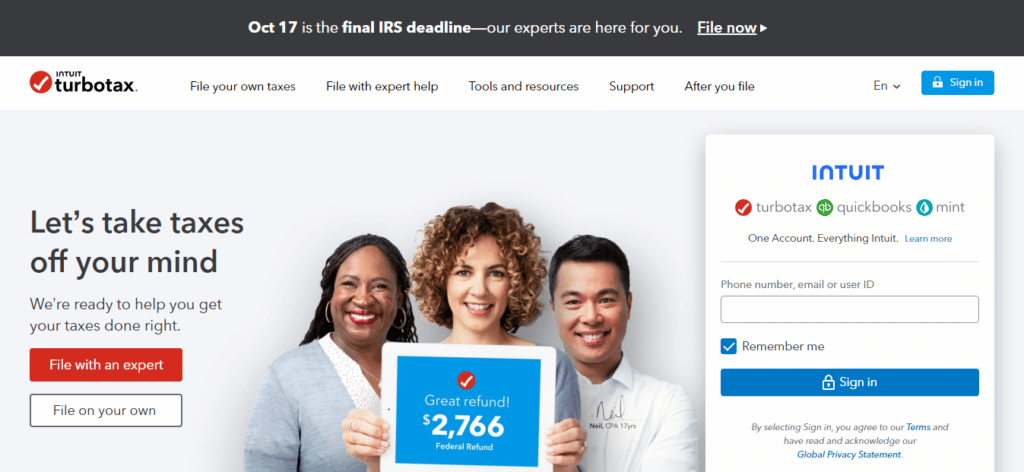

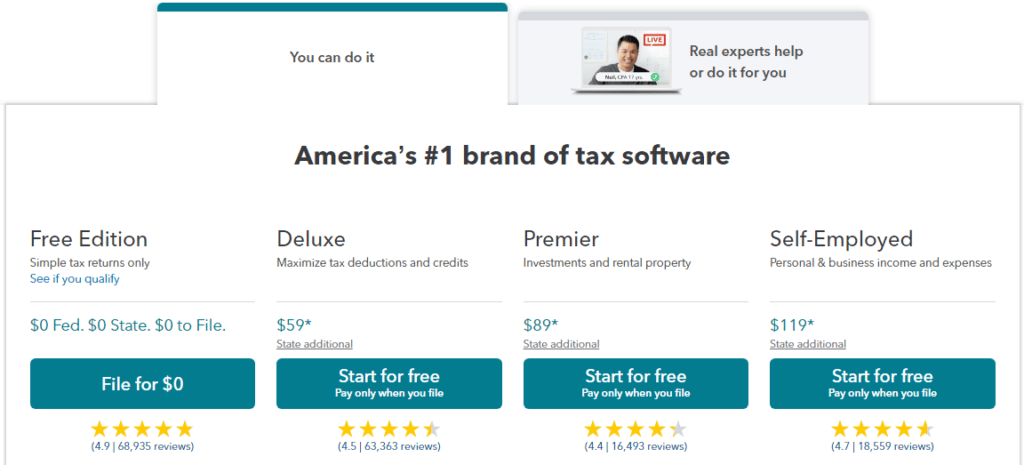

No one likes dealing with Uncle Sam, so it’s no surprise TurboTax makes the cut for the best personal finance software specific to tax preparation. Although it’s slightly pricier than other options, this handy software takes the headache out of tax season by helping you correctly fill out and file your return.

Whether complex or simple, TurboTax has a solution for every tax situation. Simply access the software on Windows, MacOS, Android, or iOS.

TurboTax has four pricing tiers and two filing options: 1) with help and 2) without it.

Their Free Edition tier costs nothing if you prefer a DIY approach. With expert help, this tier is called Basic and costs $79.

The Deluxe tier is $59 if you file. It’s $119 with expert assistance.

The Premier tier is $89 without help and $169 with it.

The Self-Employed tier is $119 for DIY and $199 with support.

TurboTax is ideal for anyone who wants to save money by filing their own return but also wants the flexibility and security that comes with live advice and expert filing services. If you have a simple financial situation, try TurboTax’s Free Edition next time you need to file your return.

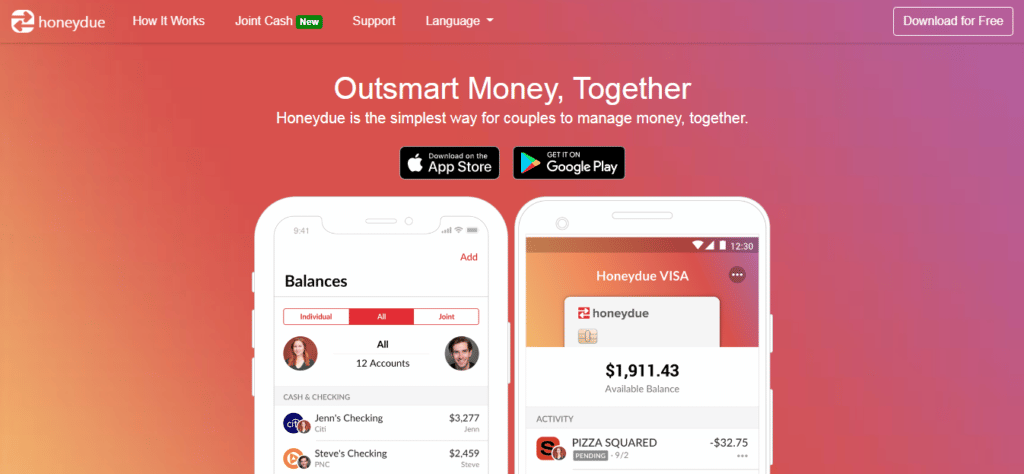

Specially designed for couples, Honeydue aims to create transparency and improve communication about finances between partners. While the software doesn’t come fully loaded with all the bells and whistles, it provides some nifty features like a joint bank account, support for multiple languages, and access to cash from Google Pay, Apple, and 55,000+ surcharge-free ATMs. You can download Honeydue on iOS or Android devices.

Simple pricing for a simple budgeting tool: Honeydue is completely FREE!

Beautiful in its simplicity, Honeydue is a great option for people who want to get out of debt, budget effectively, and save more with their soulmate. Since it’ll cost you nothing, try it out with your partner and bring harmony to your home.

EveryDollar is an easy-to-use budgeting app that takes the guesswork out of money management. Besides tracking spending, it lets you customize budget categories, line items, and expenses, create savings goals, and set due dates for bills.

With the app’s premium features, you can connect to your bank accounts for automatic transaction syncing, receive spending insights, access smart tracking recommendations, and more. Access the app on the web or on iOS and Android devices.

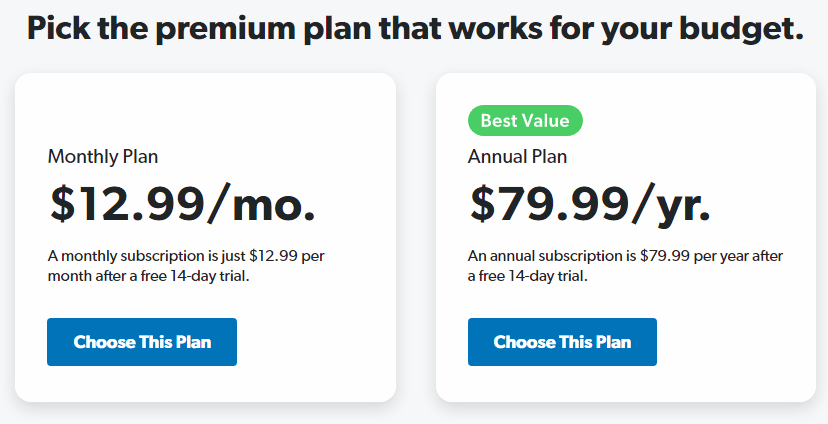

EveryDollar offers a FREE bare-bones version, but you have to enter your information manually. Plus, you won’t have access to premium features.

The paid version includes two pricing options. The monthly plan is $12.99 per month, while the annual subscription is just $79.99—a $75.98 saving!

Although EveryDollar is useful to anyone who wants to track their spending and create a monthly budget, it’s a particular favorite among those following Dave Ramsey’s highly effective baby steps for saving for emergencies, getting out of debt, and building wealth. Although you can start with the free option, consider testing out the paid version’s free 14-day trial.

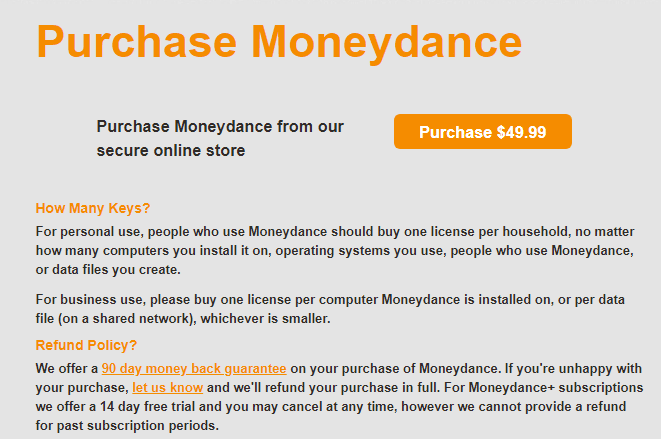

Moneydance is an advanced, full-featured personal finance app that’s often compared to Quicken’s Deluxe tier. While Moneydance has essential features like account management, online banking, bill payment, budgeting, and investment tracking, it also integrates with an array of extensions that add additional functionality to the software. The app is available on several major platforms, including Windows, Linux, MacOS, Android, iPhone, and iPad.

A Moneydance subscription costs $49.99 per household with unlimited use. This is a one-time fee.

For business purposes, users need to buy one license per computer.

As far as the best personal finance manager solutions go, Moneydance is an exceptional choice for anyone looking to get their finances in check, but the app really shines for investors. Fortunately, it has a 14-day free trial period and a 90-day money-back guarantee, so there’s no excuse not to give it a spin.

Kubera is a modern personal finance tracking app that provides in-depth wealth management tools usually reserved for billionaires. Now they’re available to everyone.

With Kubera’s user-friendly interface, you can easily track everything from bank and brokerage accounts, crypto wallets, stocks, bonds, and real estate to precious metals, art, NFTs, and digital assets. Kubera has a progressive web app supported by MacOS, Windows, Linux, and iOS. Android web browsers can access the app’s web version.

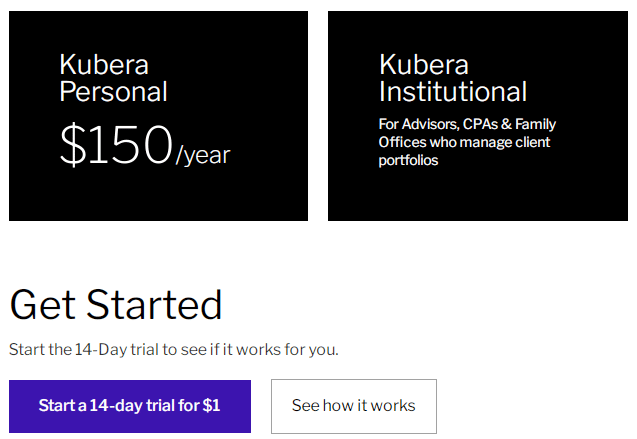

Kubera’s pricing is simple for personal use. The app costs $150 per year.

You can also start a 14-day trial for just $1.

For wealth management professionals, such as CPAs and Advisors, there’s a white label Kubera Institutional tier that comes with customized pricing depending on your needs.

While Kubera doesn’t have budgeting features or portfolio analysis, it’s perfect for users who want the simplicity and convenience of managing a complex asset portfolio on a single platform. If you’re not sure whether Kubera is right for you, the $1 trial period makes testing this app a no-brainer.

Leveraging the ever-popular envelope budgeting system in a digital world, Goodbudget offers a hands-on way to plan your finances. Rather than focus on previous transactions, the app lets you portion out your income each month toward expense and saving categories (i.e., envelopes).

Supported platforms include Android and iOS.

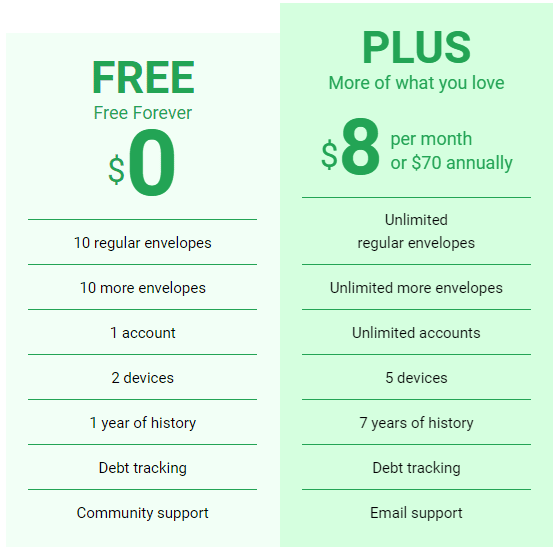

Goodbudget has two pricing plans: Free and Goodbudget Plus.

The free version is free forever while the plus version is $8 per month or $70 annually.

Goodbudget also offers a 30-day money-back guarantee.

Highly effective for monthly budgeting, Goodbudget is a strong choice for users who like the simplicity of the envelope system without minding the hassle of manual entries. Even though the free version has feature limits, it still makes our list of the best online personal finance software so give it a try!

Spendee is a collaborative budgeting app that lets couples, families, and roommates handle their shared expenses with ease. Besides tracking income and expenses to give users an overview of their cash flow, the app also makes saving simple and supports multiple currencies. You can access the app on Android or iOS.

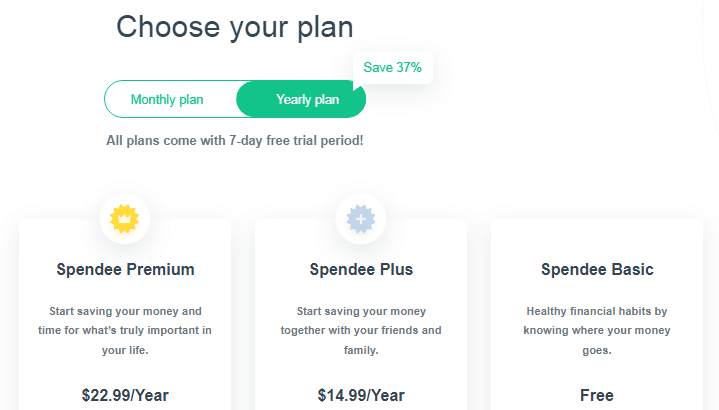

Spendee offers three subscription options:

Spendee is must-have software for anyone who wants to better understand their financial situation for better decision-making. With Spendee supporting multiple currencies, it’s also great for travelers. All plans offer a 7-day free trial period, so you can upgrade your experience and test out Spendee’s premium features risk-free!

Personal finance software is an application designed to help you manage all aspects of your financial affairs. While personal finance apps have different features and purposes, the best online personal finance software will let you track spending, create budgets, pay down debt, grow savings, monitor investments, and plan for retirement, all important aspects of proper money management.

One size doesn’t fit all when it comes to the best online personal finance software. Every user has different needs and expectations, so figure out what features and functionality matter to you most. Our top picks offer a great start, but the best personal finance program for you will be the one that motivates you to demolish debt, build wealth, and reach your financial goals in 2023 and beyond.