Your credit score is crucial for nearly every financial aspect of your life. It will determine whether you are approved for a mortgage, auto loan, or credit card. It can even affect your ability to rent an apartment or get a job. Because of its importance, it’s smart to stay on top of your score. You can do so using credit monitoring services to watch out for potential fraud. The right services will let you spot fraud immediately, so you can minimize the impact on your credit and immediately correct the problem.

The best credit monitoring services are those that explicitly look out for fraud. These services will prioritize potential identity theft threats. Top services also feature alerts, some even offering identity theft insurance.

As you choose the service that is right for you, consider the following:

With these factors in mind, the following are our picks for the best services to monitor your credit.

Credit Sesame offers one of the best free services for credit monitoring. You can also access your credit report or credit score for free via Credit Sesame with the same account. As a free solution, it doesn’t include any insurance, but you will get alerts and the ability to easily detect errors on your credit report. Keep in mind that Credit Sesame only checks TransUnion, not the other two bureaus.

This service from Credit Sesame is completely free. You will not even have to enter your credit card details or make any other commitments.

Credit Sesame is an excellent option for those who don’t want to pay for credit monitoring and are happy to monitor a single bureau only—TransUnion, in this case. The service is free and easy to use. It’s worth noting that there aren’t any paid upgrades available, so if you decide you want more information or features, you will have to sign up for another service.

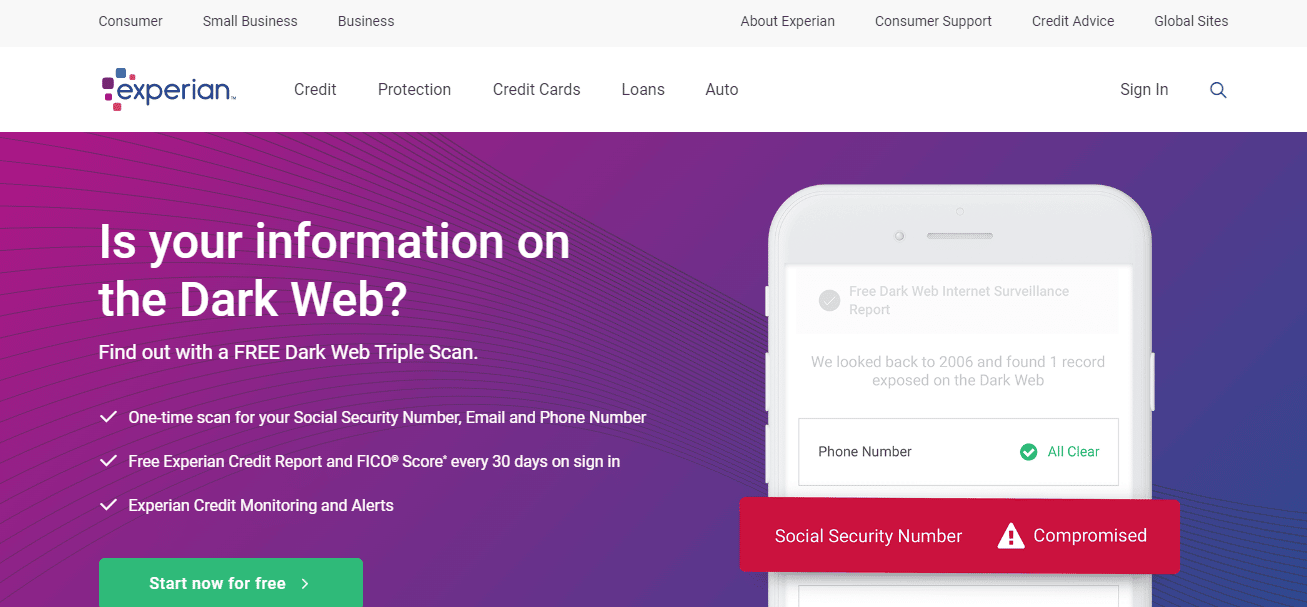

Experian offers both free and paid services. The free version requires you to use a few features separately, including the Credit Score, Credit Report, and Dark Web Scan. The Dark Web Triple Scan is especially important for credit monitoring, but you can only do this once for free. Because Experian is one of the three major credit bureaus, you can trust that the information is highly accurate.

There are several free services from Experian that you can combine, including the Dark Web Scan, Credit Report, and Credit Score. Conveniently, if you decide you need more frequent updates or monitoring, Experian offers the ability to upgrade to several paid plans, which are separately listed among our top picks.

The free services from Experian are appealing if you want credit monitoring that comes directly from one of the major credit bureaus. Just remember that it will be limited to your FICO score and report, not your Vantage Score from TransUnion. The ability to upgrade to a paid service with the same account is also convenient.

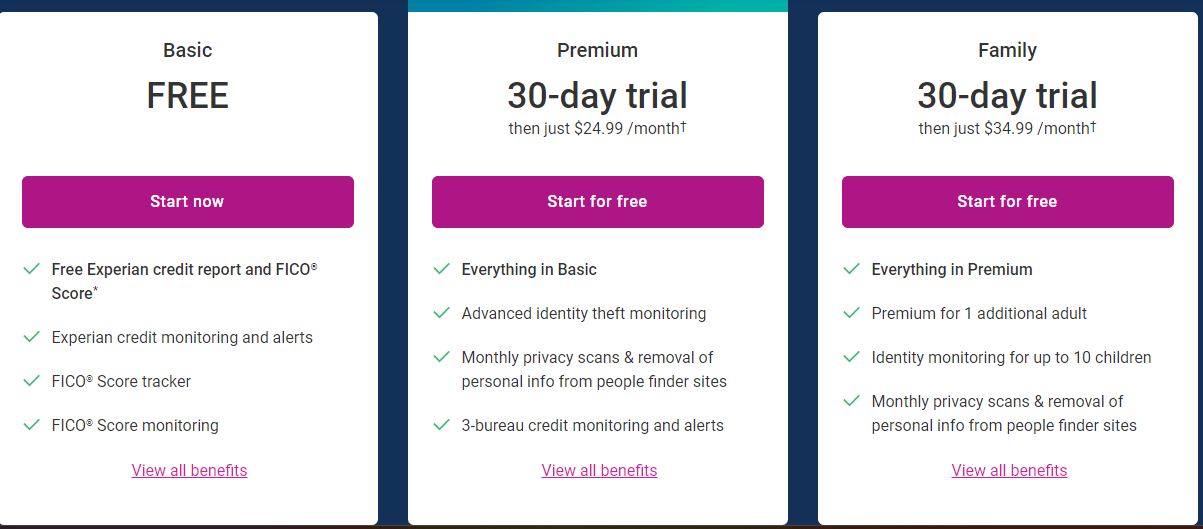

Experian IdentityWorks is the paid credit monitoring service from Experian. It gives you all the free features mentioned above, but you get identity theft monitoring and information from all three bureaus. If you are serious about protecting your identity and credit score online, this version of Experian is the one for you.

The Premium Plan comes with a free 30-day trial. After that, you pay $24.99 a month. The Family plan also has a free trial, followed by $34.99 a month. You will need to enter your credit card information to start the free trial.

Experian IdentityWorks is an excellent choice for those who want a paid credit monitoring plan from one of the major credit bureaus. The family plan is especially appealing, making this the go-to option for nearly any family wanting to prevent fraud from affecting several family members. As a bonus, the 30-day free trial for the Premium Plan gives you enough time to confirm you like the service’s features before paying.

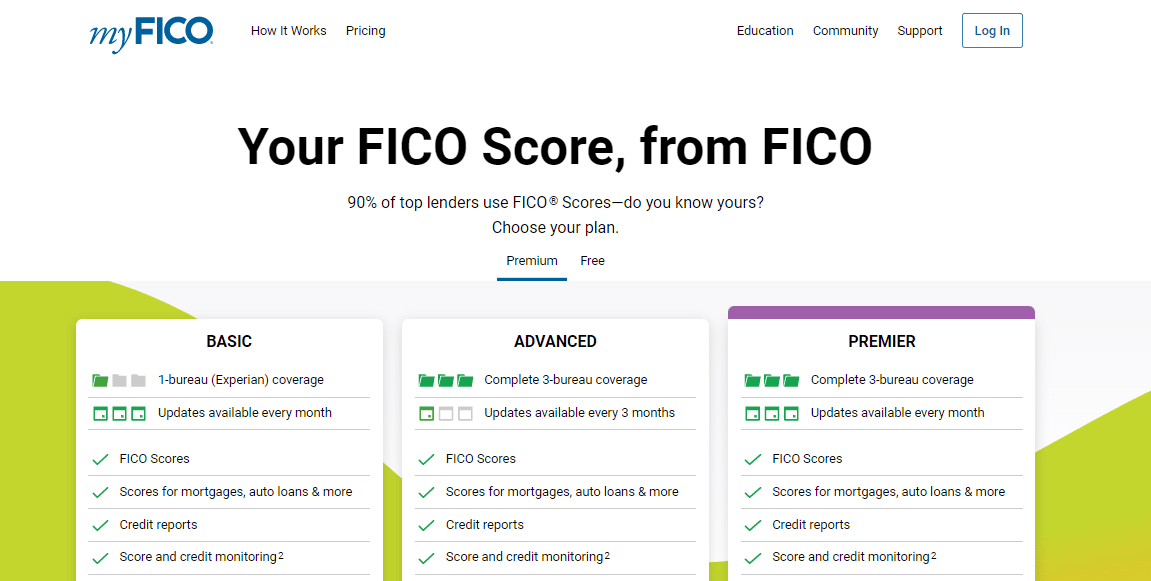

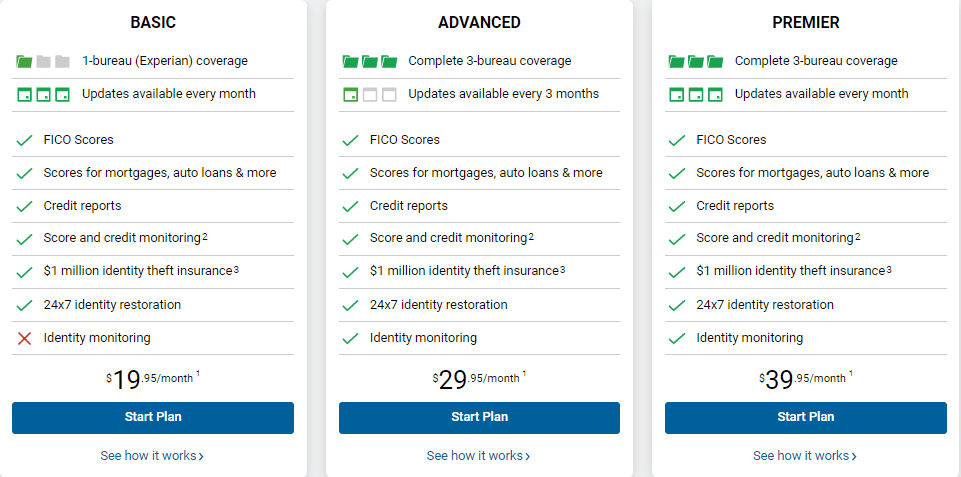

myFICO is another official option for credit monitoring, as it is connected directly to your FICO Score. This ensures that the information you get with a myFICO account is accurate and up-to-date. There are three plans to choose from, each including credit monitoring, identity restoration, and identity theft insurance. The differences are primarily in which bureaus are monitored and how frequently your reports and scores are updated.

You can choose from three plans for myFICO. The Basic Plan costs $19.95 a month. The Advanced Plan costs $29.95. The Premier Plan costs $39.95 a month.

With three plans to choose from, myFICO offers options for all budgets and preferences. The information is highly accurate as it comes right from FICO, giving you additional confidence. This credit monitoring service also has multiple useful features to help you build your credit and track your credit history, making it even more appealing.

Identity Force is a TransUnion brand, so it is connected to one of the major credit bureaus. As such, any credit scores that the service provides are your VantageScore. You can choose from two plans from Identity Force. One monitors your identity online to prevent fraud, while the other also includes credit score monitoring.

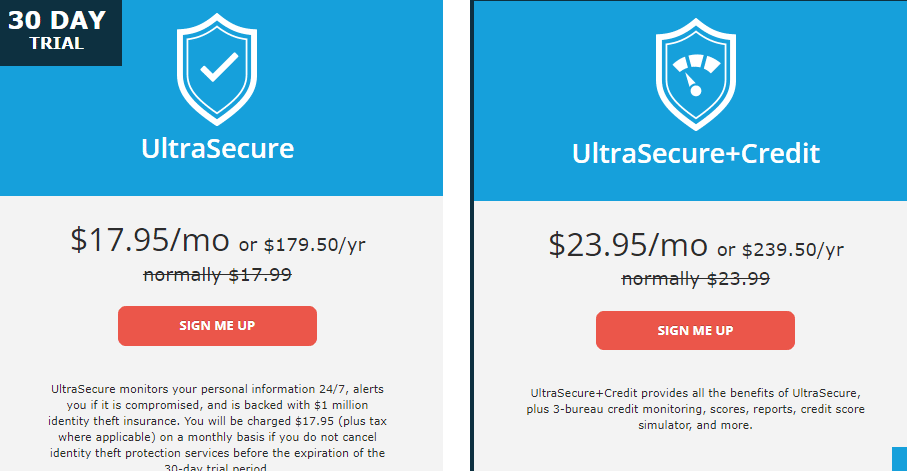

You can choose from two plans from Identity Force: UltraSecure and Ultrasecure+Credit. UltraSecure provides you with the identity monitoring services but not credit monitoring. It costs $17.95 a month or $179.50 a year. UltraSecure+Credit adds credit monitoring and related services. It costs $23.95 a month or $239.50 a year.

Identity Force also encourages potential customers to call to ask about family plans.

Identity Force appeals to those who prioritize thorough identity protection along with the various credit monitoring features. Between the variety of monitoring and restoration services, this is a good option for ensuring you can recover from identity theft. And the fact that it features credit information and monitoring from all three bureaus is a major bonus.

ID Watchdog comes from Equifax, making it another of the identity and credit monitoring services that come directly from one of the major credit bureaus. The service monitors for potential fraud on billions of data points. It includes monitoring of public records, high-risk transactions, the dark web, and credit reports, among other things.

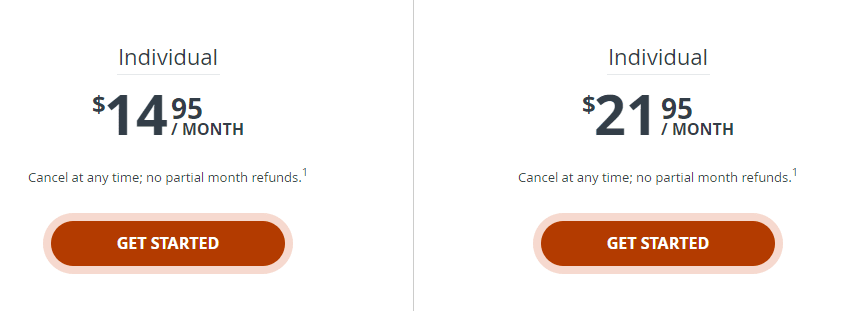

You can choose from the ID Watchdog Select or Premium plans. The Select Plan is $14.95 a month for individuals, while the Premium Plan is $21.95 a month. Paying annually drops the price per month slightly, with an overall price of $150 and $220 a year, respectively.

Family plans are also available. For Select Plans, the +Family plan is $23.95 a month or $240 a year. For Premium Plans, the +Family plan is $34.95 a month or $350 a year.

It’s worth noting that you can cancel any plan anytime but never get a partial month’s refund. Annual plans will, however, give you refunds on fully unused months.

ID Watchdog has a strong reputation because it is from Equifax, one of the major credit bureaus. This also helps ensure the accuracy of its information. The various types of monitoring you can get with ID Watchdog make it stand out from the crowd. The family plans are also a somewhat unique feature that few other services on our list offer.

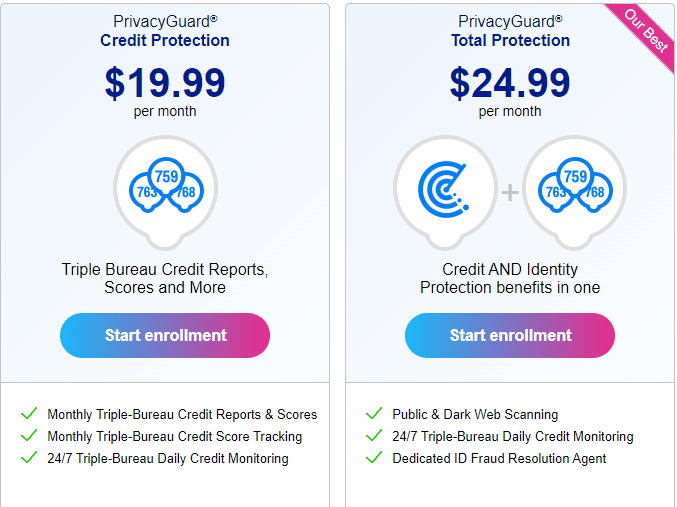

Privacy Guard is primarily an identity monitoring service designed to help you detect and prevent identity fraud, but it also offers credit monitoring. You can enjoy monthly triple-bureau reports and 24/7 triple-bureau credit monitoring, all in addition to identity protection via dark web scanning and public website scanning.

Privacy Guard offers three plans, one for Identity Protection, one for Credit Protection, and one for Total Protection. These plans cost $9.99, $19.99, and $24.99 a month, respectively.

These prices take effect after an initial price of $1 for the first 14 days. In the absence of a free trial, Privacy Guard offers this as an alternative.

Privacy Guard lets you choose whether you simply want to monitor your credit or identity or if you want to monitor both. It has competitive pricing and keeps you updated with reporting and monitoring from all three bureaus. You also get peace of mind from the identity theft insurance. While there isn’t a free trial, the first 14 days cost only $1, making it well worth trying Privacy Guard.

Credit monitoring services track your credit score and reports for unusual activity. They alert you if something occurs that may indicate identity theft, such as new hard inquiries or other major changes to your score. Most also offer identity monitoring services, such as scanning the dark web for your information. Many available paid plans even include identity theft insurance.

Using one of the top credit monitoring services is a smart way to protect yourself financially. These services will help you spot fraud quickly so you can take action immediately. Most paid services even offer support and insurance to help you correct fraud or other errors in your credit reports. At the same time, the best services enable you to track your credit score with regular reports and, as a bonus, provide you with helpful tools to plan your finances.