Most credit cards require a good credit score and at least some credit history. But you can also find cards designed for people with no credit.

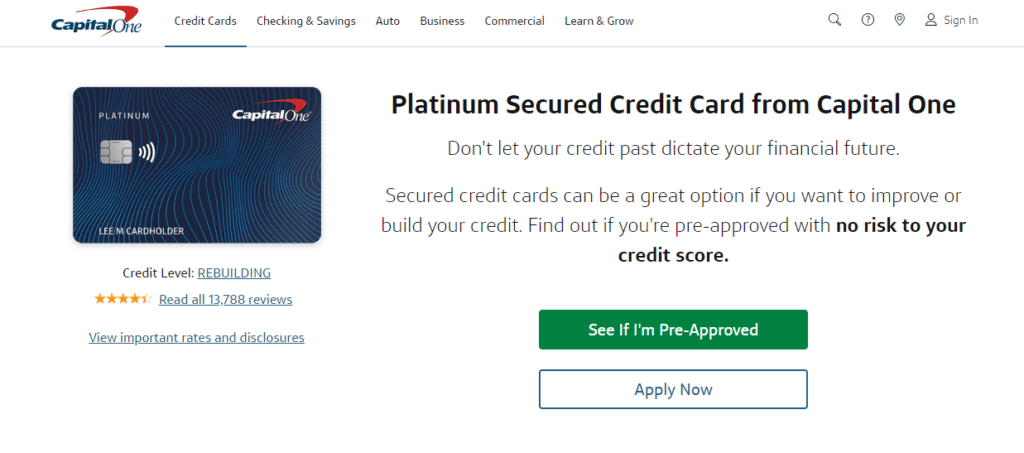

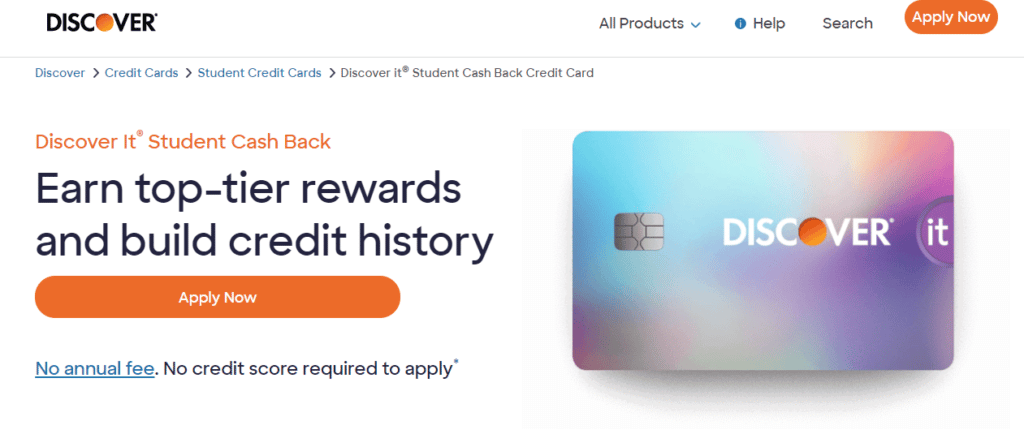

Most credit cards for people without credit are secured cards or those for students. However, there are a handful of unsecured options as well. Top options include the Capital One Platinum Secured Credit Card and the Discover It Student Cash Back card.

Take a closer look at these and other top credit cards for no or bad credit.

While most card issuers prefer you to have a credit history, you can get a credit card with no credit. You will be eligible for most secured credit cards on the market as well as various unsecured cards. We’ve gathered the best options for a credit card without credit. You’ll find options that give you cashback, have an upgrade path, and offer other useful features.

Before you can get a credit card with no credit, you will need to compare the various options. Use the same points of comparison we did when deciding on the best choices for a credit card without a credit score. These factors include:

With those factors in mind, it’s time to look at some of the best options for a first-time credit card with no credit history.

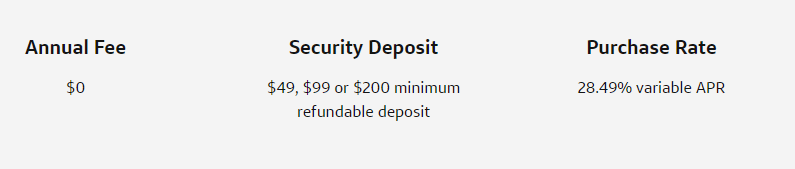

Since this is a secured credit card, you don’t need a credit history to be eligible. It stands out from other secured credit cards in a few ways, including the fact that you can deposit just $49 to receive a $200 credit limit. You also have a fast path to upgrades. As expected from a card for those with no or bad credit, the APR is high, so be aware of that.

The regular APR on this card is 28.49% variable, which is fairly high. You also won’t find an introductory APR offer from this card.

There are no foreign transaction fees when using this card. There are also no annual fees or hidden fees, such as replacement card fees or authorized user fees.

Balance transfers have a 3% fee on the amount transferred. Cash advances come with a fee of 3% or $10, whichever is larger. Late payment fees are up to $40.

The initial credit line is $200, which may require a deposit of $49, $99, or $200, depending on various factors.

If you are happy to get a secured credit card as your first card, then the Capital One Platinum Secured Card is an excellent option. You can upgrade to the unsecured Capital One Platinum Card after responsible use and avoid paying an annual fee.

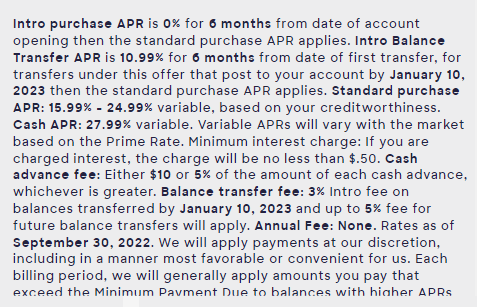

The Discover it Student Cash Back Card is an excellent choice for students, as it lets you earn cash back on all purchases, along with rotating categories of 5% cashback. There is no annual fee, and the APR can be competitive. You also get access to an introductory offer for a low APR and cashback match. There is even an introductory APR for balance transfers.

The Discover it Student Cash Back Card does not have any annual fees. The regular APR is 15.99% to 24.99% and variable. But there is an introductory APR of 0% on purchases for your first six months. There is also an introductory balance transfer APR of 10.99% for the same length of time. Balance transfers have a 3% introductory fee or a 5% fee after January 2023.

The cash advance APR is 27.99% variable. There is a cash advance fee of 5% of your cash advance or $10, whichever is larger. If you are charged interest, it will be at least $0.50.

Students looking to earn rewards on all of their purchases will want to consider the Discover it Student Cash Back Card. It has no annual fee and offers a reasonable everyday cashback rate with a very good cashback rate in rotating categories. Those who aren’t students may want to consider a similar Discover it card from Discover. Secured versions of this card are also available.

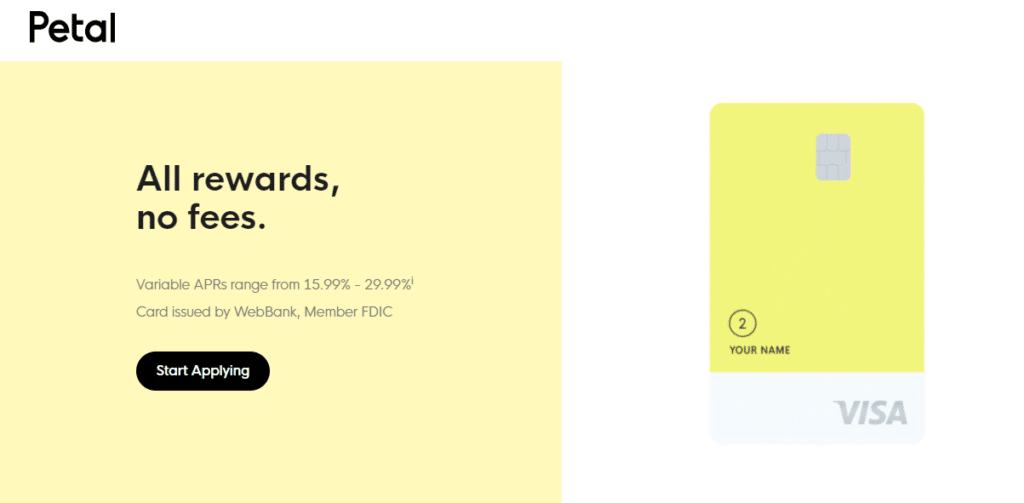

With no annual fee, the Petal 2 credit card is another good option for those looking for a credit card for no credit or bad credit. The card specifically doesn’t require you to have a credit history. The card also helps boost your credit score and build your credit history by reporting to the major bureaus. Just keep in mind that there are no introductory APR offers.

There is no annual fee for the Petal 2 credit card. The variable APR is 15.99% to 29.99%. The higher end of this is fairly high, so depending on your rate, make sure to pay your balance in full every month.

There are no foreign transaction fees. There are no returned payment fees or late fees either. You cannot do a balance transfer.

The Petal 2 credit card can be a good choice for those who need a credit card for no credit history, as it will also look at your bank statements and income. This is one of the few cards that offer cashback rewards without charging an annual fee, letting you make the most of the benefits.

This is another credit card for no credit score that is specifically designed for students. Conveniently, it is available to international students as well as those born in the United States, something few cards offer. This makes it especially useful for international students. You can also take advantage of 1% cashback.

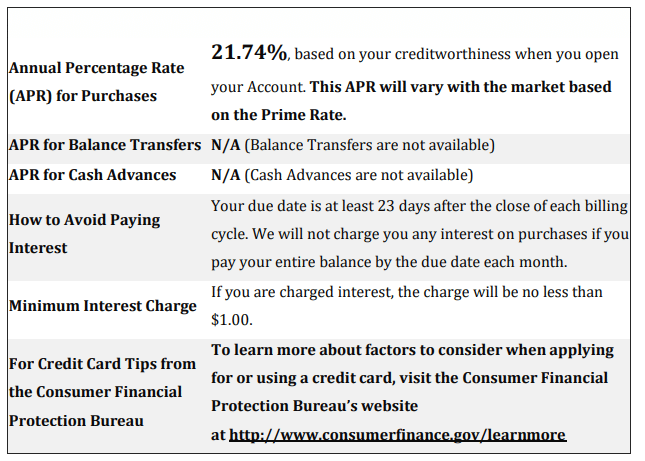

There is no annual fee with the Deserve EDU Mastercard for Students. The variable APR is 21.74%. International students and students studying abroad will appreciate the lack of a foreign transaction fee. Any interest payments will be at least $1.00.

Balance transfers and cash advances are not offered, so there are no fees for these. The late payment fee is up to $25 and the returned payment fee is up to $37.

The Deserve EDU Mastercard for Students is a great choice for international students who wonder, “How do I get a credit card with no credit?” It doesn’t require a social security number. Instead, the approval depends on other factors. It also stands out with its lack of annual fees combined with 1% cashback on purchases. This card also has some other unique benefits, such as a year of Amazon Prime Student and cell phone protection.

This is another secured card that answers the question of “Which bank gives a credit card with no credit history?” It does not have an annual fee and it offers reward points, an appealing combination. The APR is fairly high, so keep that in mind if you plan to carry a balance.

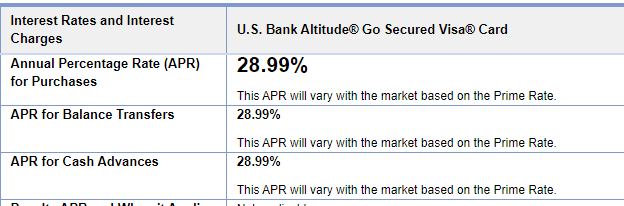

The variable APR for this credit card is 28.99%. That applies to purchases, balance transfers, and cash advances. There is no penalty APR. Interest will always be at least $1 if you are charged.

There is no annual fee. Late fees are up to $41 and returned payment fees are also up to $41. The fee for a balance transfer or convenience check cash advance is 3% or $5, whichever is larger. The fee for a cash advance (including at an ATM and a cash equivalent advance) is 5% or $10, whichever is larger. There are no foreign transaction fees.

The U.S. Bank Altitude Go Secured Credit Card is worth considering if you want a secured credit card that has an upgrade path and offers rewards. The ability to get the equivalent of 4% cashback in some categories is especially impressive, given the lack of annual fees.

Getting a credit card despite not having credit history is possible. You can start by looking at secured credit cards, as these do not usually have credit requirements. So, your lack of credit history or credit score won’t matter.

You will need to be at least 18 years old to apply for a credit card. You also need to show proof of income. Most credit cards also require your social security number, although there are some exceptions.

You can also look for a specific credit card without credit options designed for people in your situation. These tend to have higher interest rates than a card for someone with a credit history and good score would, but there are many options.

Many of the options that you discover in your search for “first-time credit card no credit history” even have paths to upgrade your card in the future. Some make it easy to transition from a secured to an unsecured card. Others make it easy to increase your credit limit.

Once you get your credit card, use it responsibly to build your credit history. The simple fact that you will have a history at all will help your credit score, as your credit history length affects it.

But you also want to pay your balance on time and try to keep your credit utilization rate low to maximize the improvement of your credit score. Ideally, your credit utilization ratio will be under 30%. So, if your credit limit is $300, you would not want to charge more than $90 per billing cycle. If your credit limit is $1,000, you will not want to charge more than $300 per billing cycle. This will become easier to do as your credit limit increases.

Improving your credit history and score will do more than just make it easier to get a good credit card in the future. It will also let you access traditional loans, including for a home or car. It can even help when renting an apartment or looking for a job.

To get a credit card with no credit history, just choose one of the options from our top picks. Decide whether you prefer a secured or unsecured card. If you are a student, consider one of the student-specific cards. If not, consider your priorities in terms of APR, fees, and rewards, and then apply for a credit card with no credit from our list.