While there is still room for improvement with a fair credit score, you still have your choice of credit cards. There are options from major card issuers, so you can choose to prioritize balance transfers, cashback, a low APR, or another feature. We’ve gathered the best credit cards for fair credit, saving you the hassle of researching them yourself.

As you look at our list, consider your goals for getting a credit card, and you should be on your way to choosing which one to apply for.

There is not necessarily a one-size-fits-all answer to the absolute best credit card, as it depends on your credit score, finances, and preferences. To figure out which of the credit cards for fair credit is best for you, you will want to consider a few crucial factors, including:

Any of the following credit card options for fair credit should be a good fit. You only have to decide which one you prefer.

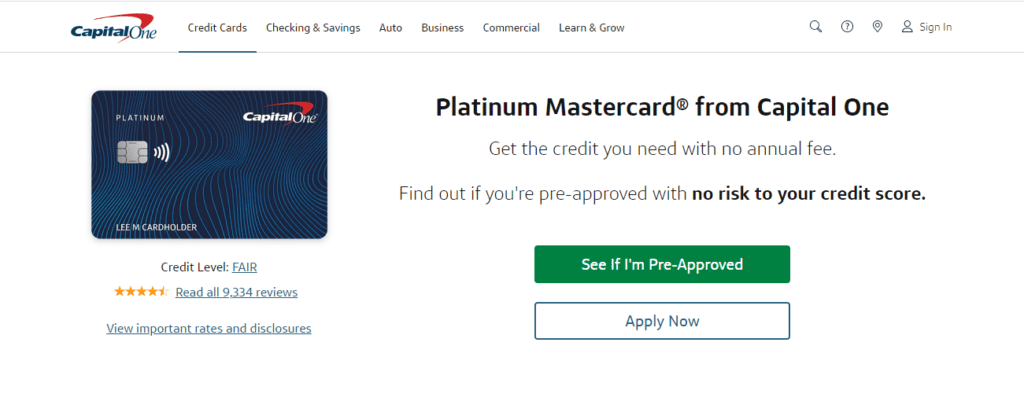

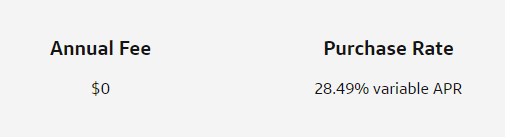

The Capital One Platinum Credit Card is an excellent option if you don’t want an annual fee and don’t need to accumulate rewards. And after six months of on-time payments, Capital One will automatically consider giving you a higher credit limit. Just be aware that the APR is fairly high, so avoid carrying a balance.

There is no annual fee at all for this credit card. However, the APR is high, with a variable rate of 28.49%. The same APR applies for cash advances in addition to purchases and balance transfers.

Transfers carry a 3% fee. Cash advances have a fee of 3% or $3, whichever is larger. Late payment fees are up to $40.

If you have a balance of less than $25, the minimum payment for a billing cycle is the same as the balance. If the balance is over $25, your minimum payment is 1% of your balance plus late payment fees and new interest or $25, whichever is larger.

The Capital One Platinum Credit Card is our pick for the best credit card for fair credit. Zero annual fees and instant approval make it highly appealing. The various protection measures, including from fraud and account alerts, are also incredibly useful. Just keep in mind that this card doesn’t have any rewards, and the APR is fairly high.

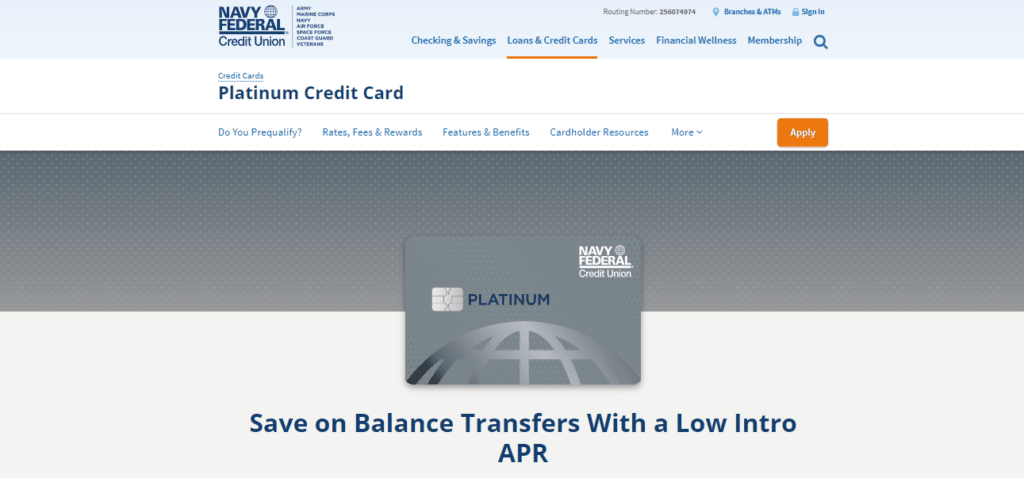

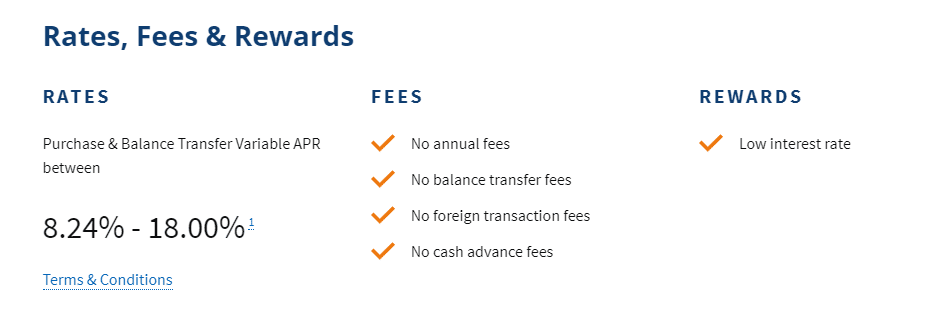

You usually have to be on the lookout for credit cards that let you take advantage of balance transfers, especially with fair credit. The Navy Federal Credit Union Platinum Credit Card doesn’t charge balance transfer fees and has an introductory offer on balance transfers. It also has no annual fee and a very competitive APR. Keep in mind that you must be part of an eligible military sector to apply for this card.

There are no annual fees. Also, enjoy no fees for balance transfers, foreign transactions, and cash advances. The only time you pay a fee on cash advances is if it is not done at a Navy Federal ATM or branch. In that case, the fee is a mere $0.50 domestically or $1.00 internationally.

The interest rate on this card is low, ranging from 8.24% to 18.00%. The introductory offer on balance transfers is 0.99% APR for the first 12 months. After that, the rate goes to your normal 8.24% to 18.00% rate. Cash advances come with a 2% APR above your variable APR.

The late fee is up to $20. The returned payment fee is also up to $20.

For those who are qualifying members of the military or dependents of someone in the military, the Navy Federal Platinum Credit Card is an excellent option. It is especially good for balance transfers with its 0.99% APR introductory rate. The card also has a highly competitive regular interest rate, making it worth considering if you are eligible. While you will not earn any rewards, the low-interest rate and zero fees will save you money.

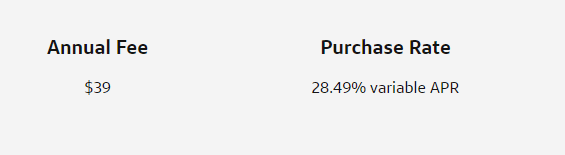

The Capital One QuicksilverOne Cash Rewards Credit Card is designed for those with fair credit, and it offers instant approval. While there is a small annual fee, most people who use the card regularly will easily earn more than that fee in the cashback rewards. That is especially true given that the cashback is unlimited and easy to redeem. However, you should be aware of the moderately high interest rate on this card.

The Capital One QuickSilverOne credit card comes with an annual fee of $39. You will also pay a 28.49% variable APR.

Transfers have a fee of 3% of the transferred balance. Cash advances have a fee of 3% of the amount of the advance or $10, whichever is higher. Late payment fees are up to $40. There are no foreign transaction fees.

The Capital One QuicksilverOne Credit Card is a good choice for those who want to take advantage of instant approval. You can even check if you are prequalified before applying, a process that will not affect your credit score. While the cashback rewards are good, keep in mind that there is an annual fee of $39. As such, you will need to spend at least $200 to $225 a month to earn enough rewards to pay for the fee.

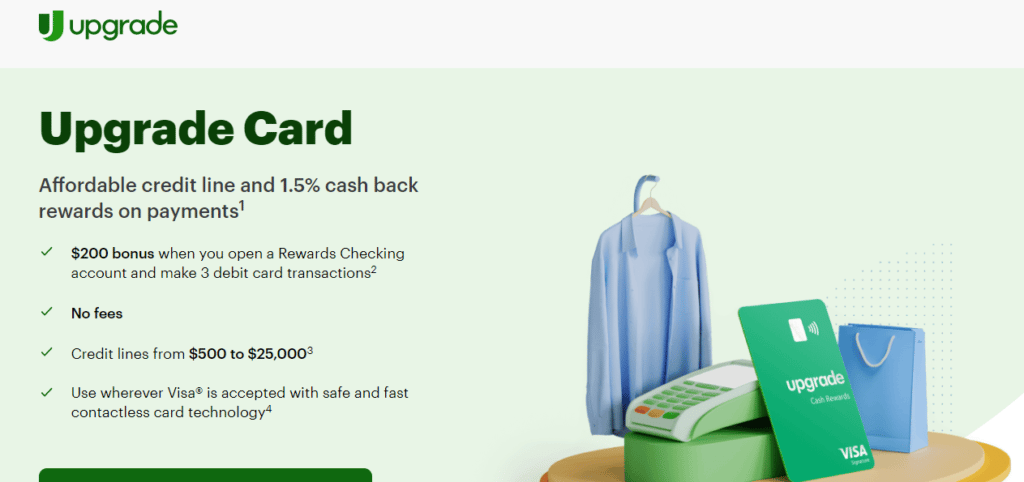

The Upgrade Cash Rewards Visa lets you earn 1.5% unlimited cashback without an annual fee, a rare combination, especially in a card for those with fair credit. There is a wide range of APR rates, so they may be competitive or very high. You can also get near-instant approval within a matter of minutes without any impact on your credit score.

There are no fees with the Upgrade Card, including no maintenance, activation, or annual fees. And you can get a $200 bonus if you also get a Rewards Checking account and make qualifying debits.

The Upgrade Card has a unique approach to balances, acting as a hybrid between a personal loan and a credit card. If you carry a balance, it automatically becomes a personal loan at a fixed interest rate equal to your APR. That APR can be 14.99% to 29.99%.

If you plan on occasionally carrying a balance, the Upgrade Cash Rewards Visa card can be a good option, depending on the interest rate that you qualify for. This is because any carried balance becomes a personal loan with a fixed rate, so your interest payments on it won’t increase in the future. The card also stands out with its unlimited 1.5% cash back and zero annual fees, as most cards with cashback charge a fee.

Petal 1 is a good option. If you are eligible for the Petal 2, though, it’s the better choice with its lower potential APR and the ability to earn cash back. This credit card for fair/average credit is a great choice if you want rewards while avoiding fees. Even better, shopping with some merchants gives you up to 10% cashback. The card is also good for building credit, and you will be approved quickly.

In addition to charging zero annual fees, the Petal 2 credit card doesn’t have any foreign transaction fees, late payment fees, or penalty APRs. The lack of late payment fees is noteworthy, as this is incredibly rare, especially among credit cards for fair credit. The APR is between 15.99% and 29.99%.

Those in search of a credit card that doesn’t have fees, including for late payments, will appreciate the Petal 2. It is one of the rare cards that offer cash back without an annual fee or high credit requirement. This card is also good for building credit, as it reports to the major credit bureaus. The important caveat to remember is that your credit limit may be as low as $300. If that’s your limit, you have to keep spending very low to maintain a good credit utilization ratio of under 30%.

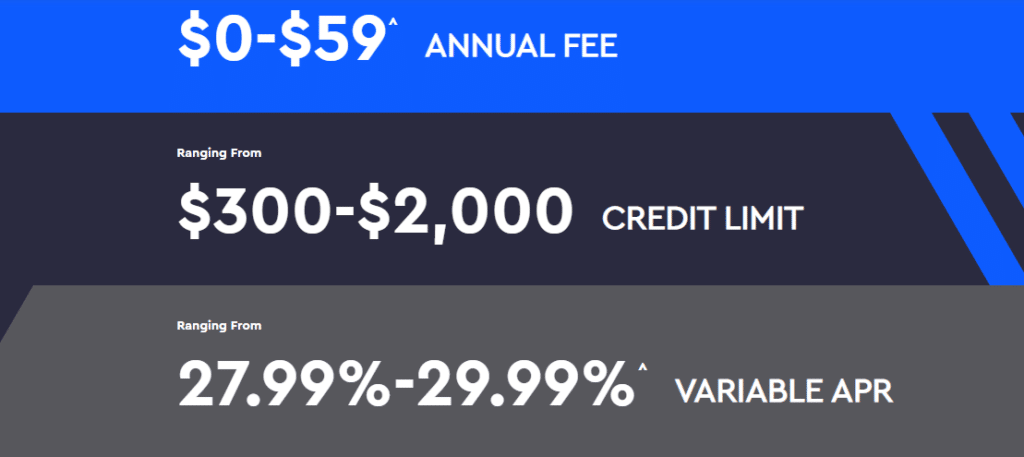

The Avant credit card is another good choice if you want a credit card for fair credit with instant approval. However, there is an annual fee of $59, and the APR is somewhat high. Note that there is no penalty APR and a required deposit. The lack of a deposit requirement makes it a good alternative to a secured credit card. It will also build your credit score with Avant reporting to all three major credit bureaus.

The variable APR on the Avant card is 25.74% to 29.99%, which is one of the higher rates on this list. So, be sure to always pay your balance in full. There is no penalty APR, so you don’t have to worry about the interest rate increasing beyond that. Keep in mind that whenever Avant charges interest, it will be at least $1.00. You should also be aware that the annual fee can be up to $59.

There is also a cash advance fee of 3%, with a minimum of $10. You cannot get a cash advance for more than 25% of your credit limit. There are no foreign transaction fees. The late payment fee is up to $39.

If you would typically only qualify for a secured card but want an unsecured one, the Avant credit card is a good alternative. It will appeal to people who don’t mind paying an annual fee to have a credit card and are okay without earning rewards. This is especially true if your goal is to build your credit score. Because the APR is fairly high, it is not ideal for those who plan to carry a balance.

The Indigo Platinum Mastercard is a strong choice if your fair credit score includes a past bankruptcy. While this card has a low credit limit, it can be a useful stepping stone following bankruptcy. You could prequalify with this card even if you filed for bankruptcy previously. There is no security deposit required. Plus, you can use the card to build your credit history and transition to a card with a higher limit.

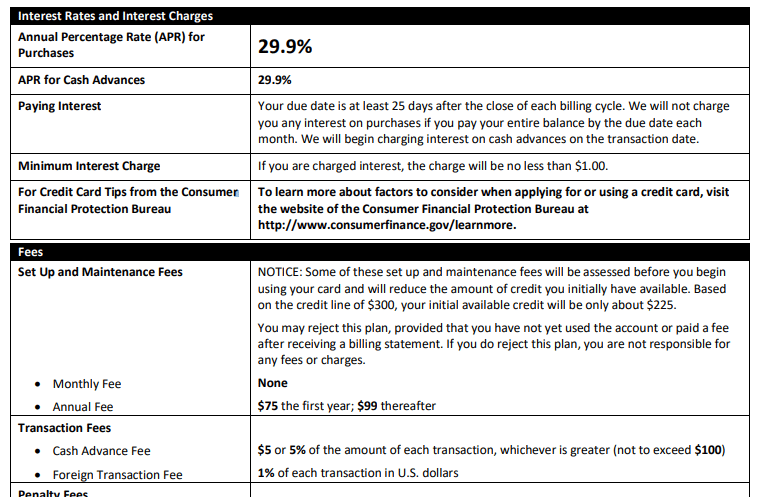

The annual fee of the Indigo Platinum Mastercard can be anywhere from $0 to $99, depending on your credit score and finances. The APR is 24.90%, which is fairly high. Keep in mind that this credit card has 21 different cardholder agreements listed on its website, each of which has slightly different annual fees and APRs.

The annual fee on most agreements is $75 for the first year and $99 in the following years. But your annual fee may be $0, $35, $49, $59, $60 (billed as $5 a month), or $125, including the first year. The APR can be 24.9% to 29.9%.

The penalty APR is 29.9%. Both late payments and returned payments come with a fee of $40. Expect the same fee for going over your limit. Cash advances cost $5 or 5% of your transaction, whichever is greater. Foreign transaction fees are 1% of the transaction.

It is also worth noting that the maximum credit limit is just $300. As such, this card is better for smaller purchases and building credit. That low limit also means you have to keep spending extremely low to maintain a “good” credit utilization ratio of less than 30%.

The Indigo Platinum Card will mostly appeal to people with a previous bankruptcy or a credit score on the lower side of fair. This is because there are no rewards, and the credit limit is only $300. You will also have to pay an annual fee of up to $125 and have a 29.9% APR, both of which are high in the industry. But if you don’t have other options for a secured credit card, this one is worth considering. And prequalifying does not affect your credit score. If you qualify for another option on this list, those will likely be a better fit.

Yes. You can easily apply for a credit card even if your credit score is fair or average. You just need to specifically look for credit cards for fair credit. For reference, fair/average credit refers to a FICO score of 580 to 669.

Keep in mind that credit card offers for fair credit will usually have higher interest rates and fewer rewards than those for people with better credit scores. That said, you can still easily find plenty of options.

The process when you apply for a credit card with fair credit is similar to anyone applying with a better (or worse) credit score. You will have to submit basic information, including your name, address, social security number, and income.

Luckily, there are numerous options, so you can apply for a credit card with fair credit that fits your preferences. Decide whether you would rather have some rewards and pay an annual fee or would prefer to forego rewards but not have an annual fee.

Because having a fair credit score means you will have fewer credit card options with higher fees and interest rates, you should do your best to build your credit score. The good news is that using your new credit card responsibly will help.

As you use your new credit card, keep the following tips in mind to get the most from its ability to improve your credit:

Once your credit score improves, consider applying for a credit card with better rewards or lower interest rates and transaction fees. You should keep your fair-credit-score credit card open as long as it does not have annual fees. This will help you maintain a longer credit history. However, if the credit card has annual fees, it’s better to cancel it when you upgrade, despite the potential impact on your credit score. You should also consider closing the old card if you cannot trust yourself not to use it or don’t think you will be able to pay off the balance.

There are plenty of options when it comes to credit cards for fair credit. First, think about your requirements and preferences. Then, look at factors like annual fees, interest rates, late fees, penalties, and rewards. Any of the credit cards with fair credit listed above is worthy of consideration.